A change in the desire to buy consumer durables is perhaps the most important indicator of an economy changing direction, explains Mahesh Vyas.

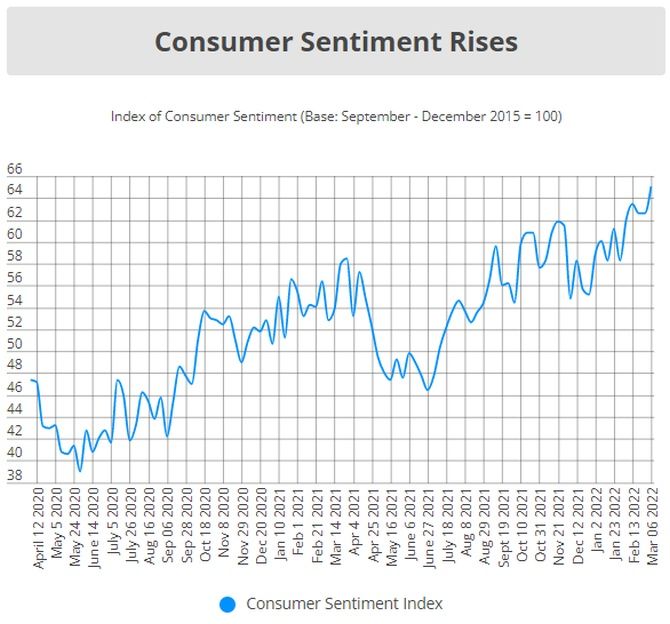

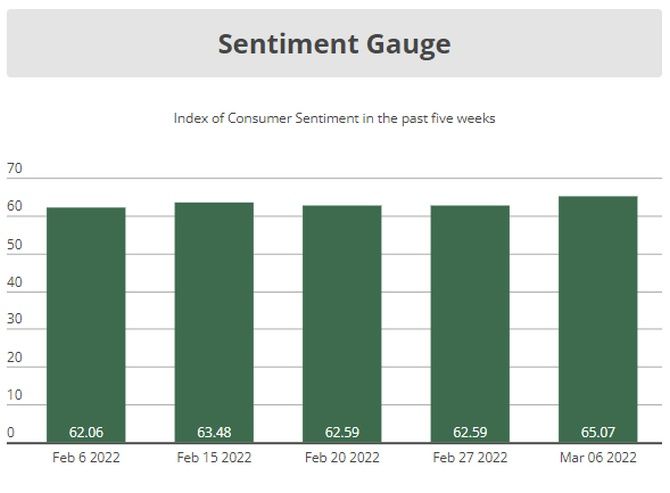

Consumer sentiments improved by a substantial five per cent during February 2022.

This came on top of a four per cent improvement that sentiments had registered in January 2022.

The cumulative growth in the Indian consumer sentiment during the first two months of 2022 was therefore a handsome 9.2 per cent.

Sentiments continued to improve into the early days of March 2022 as well.

The week ended March 6 saw the sentiments index rise by an extraordinary 4 per cent.

The 30-day moving average index of consumer sentiments as of March 6 was about 1.4 per cent higher than the average for February.

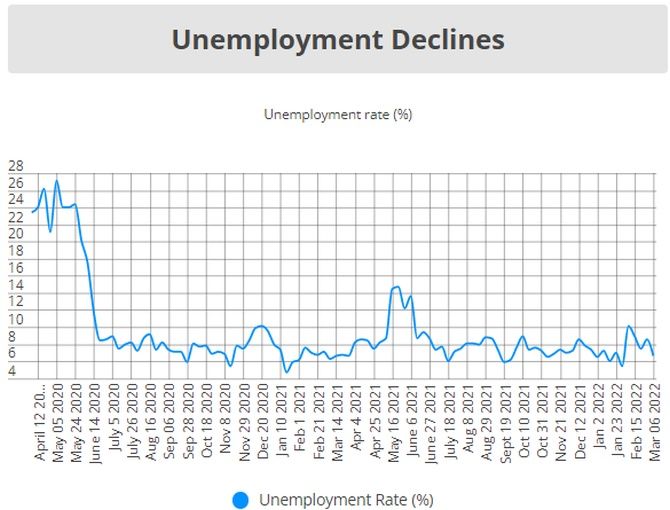

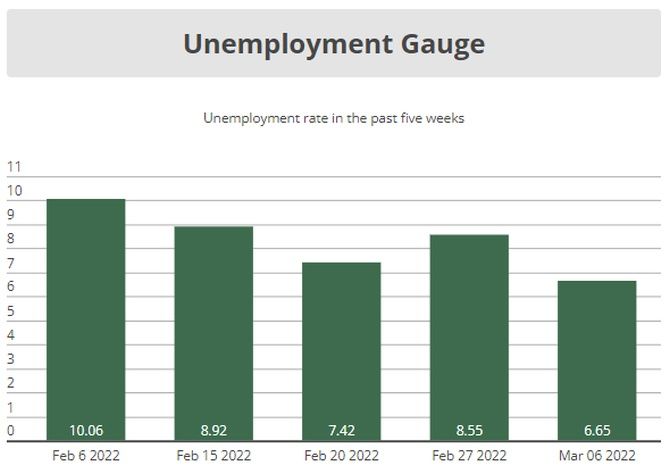

The improvement in sentiments during the early months of 2022 essentially reflects an increase in the proportion of households that believe that their current household incomes are better than they were a year ago.

In December 2021, 8.3 per cent of the households believed that their incomes were higher than they were a year ago.

This proportion was in single digits from April 2020 through December 2021.

In January 2022, the proportion jumped to 11.4 per cent and in February it rose further to 12.1 per cent.

In the first week that ended in March, 13.1 per cent of the households believed that their incomes were higher than they were a year ago.

Equally importantly, the proportion of households that believed that their incomes were lower than a year ago fell from 42.6 per cent in December 2021 to 35.6 per cent by February 2022 and to 31.5 per cent in the week ended March 6.

The proportion households reporting a fall in their income compared to a year ago was the lowest in February 2022 since April 2020.

Thus, there was simultaneous increase in the proportion of households reporting a rise in income and, a fall in the proportion of households reporting a decline in income.

There is a similar increase in the proportion of households who believe that their incomes would improve in the year ahead and a fall in those who believe that their incomes would worsen in a year.

The former increased from 8.1 per cent in December 2021 to 9.1 per cent in January 2022 and then further to 11.9 per cent in February.

The jump in February is particularly high and is perhaps, the best sign of consumer optimism.

The proportion of households that believe that their incomes would worsen has fallen from 42.3 per cent in December 2021 to 36.5 per cent in February 2022.

This change for the better in the perception of households regarding their current and prospective incomes is expected to play a significant role in the revival of the Indian economy.

It is expected to increase household spending and contribute towards an acceleration of the private final consumption expenditure component of the gross domestic product.

An improvement in the propensity of households to spend on non-essentials is already visible.

In February 2022, 9.1 per cent of the households said that it was a better time to buy consumer durables compared to a year ago.

This is big increase compared to the position in December 2021 when a mere 5.9 per cent of the households were positive on spending on consumer durables or, when in January 2022, when the proportion was 7.4 per cent.

A change in the propensity to buy consumer durables is perhaps, the most important indicator of an economy changing direction.

In the current context in India, the steady improvement in the proportion of households considering this to be a better time to buy consumer durables is an important sign of an economic turnaround being underway.

The proportion of households stating that this is a better time to buy consumer durables compared to a year ago has been rising steadily for eight months since June 2021.

This rising trend compares very well with the preceding eight months when this proportion was initially declining gradually and then sharply.

The recovery in the propensity to buy consumer durables has been sustained, which has been different from the smart but short-lived recovery from the first wave.

While households are optimistic regarding their own future and their willingness to indulge in non-essentials, they are not equally gung-ho on the economic and business prospects in the short or medium term.

This is somewhat surprising. It would be logical to expect first, an improvement in expectations of the economic environment and then an improvement in expectations of own wellbeing.

Only 8.8 per cent of the households expected the financial and business conditions in India to improve over the next 12 months.

And, a similar proportion expects the conditions to improve over the next five years.

There was a slight and partial improvement in the week that ended on March 6.

The proportion of households that expect the financial and business conditions to improve in the coming 12 months, increased to 9.8 per cent. But, the proportion that believes that the conditions will worsen is high and has risen.

In February, 41.4 per cent of the households believed that the conditions would worsen over a year. This is high.

In the first week of March, this proportion went up to 42.3 per cent.

Also, in the first week of March, the proportion of households that believe that the financial and business conditions would improve over the next five years dropped a bit, to 8.4 per cent.

A takeaway can be that the recent rise in consumer sentiments can be strengthened by policy interventions that could improve the prospects of a quicker economic recovery.

Feature Presentation: Rajesh Alva/Rediff.com