Vrishti Beniwal in New Delhi

After coming close to the target of providing banking facilities in 73,000 villages with population of more than 2,000, the next one for banks will be to cover 120,000 villages with population between 1,000 and 2,000.

In Budget 2010-11, the finance minister had asked banks to provide banking facilities to habitations with population of more than 2,000 by March 2012.

About 20,000 villages were covered in the financial year. In the next phase, the finance ministry is looking to provide a bouquet of financial services, including banking, insurance and pensions, under one roof.

Union Budget 2012-13: Complete coverage

...

Next phase of village banking likely to start

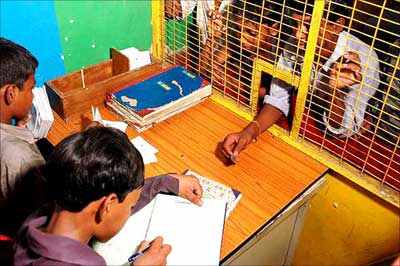

Image: Promoters explaining branchless banking to villagers.The new model of ultra small branches, which include services provided by banking correspondents (BCs) and regular visits by bank officials, will be used to provide a banking facility in most of these.

The Reserve Bank of India recently allowed interoperability of the BCs, to ease the accessing of banking services from any bank and any place in the country.

At the end of January 2012, banks had covered 62,000 villages with a population of over 2,000 each. Most of the remaining 11,000 villages are likely to be banked by the end of this month. Finance minister Pranab Mukherjee may announce new targets for financial inclusion in his Budget speech on Friday.

Union Budget 2012-13: Complete coverage...

Next phase of village banking likely to start

About 50,000 BCs have already been appointed to take banking to the doorstep of every villager. As the government wants to include smaller villages in the next round of inclusion, more BCs will be appointed. It may also look at assigning one BC to one or more gram panchayats. This may help cater to about 400,000 even smaller villages.

"Each BC will cover a population of 5,000-6,000. (But) the average population of a gram panchayat is 3,000-4,000. So, one BC may cover more than one panchayat," said a finance ministry official.

The ministry is banking upon integration of BCs to expand the reach of banking services. At present, a BC can only cater to clients of his bank and to people within his assigned region.

Union Budget 2012-13: Complete coverage...

Next phase of village banking likely to start

Under the new system, a BC will be able to perform banking transactions for customers of other banks, too. It will be similar to interoperability of ATMs, which allows customers to withdraw cash from any ATM. "It will lead to system integration and give rise to competition among Bcs, thereby improving their services. Procedures and technology will be standardised," added the official.

The system will also help the government better target payments under its social sector schemes. BCs will be able to do electronic transfer of money on a CBS platform.

The ultra-small branches, being set up to drive the financial inclusion initiative of the government, will be served by BCs, with regular follow-up visits by bank officers.

Union Budget 2012-13: Complete coverage...

Next phase of village banking likely to start

The designated officer will visit the village in his area on a pre-fixed date and time every week and the periodicity of the visits could be enhanced, depending upon the business volume in the village.

The finance ministry now also wants representatives of financial institutions to visit such branches to offer insurance and pension products.

Banks have been asked to request local bodies in these villages to provide them an area of 100-200 sq ft free of cost till the business grows to a viable level.

Union Budget 2012-13: Complete coverage

article