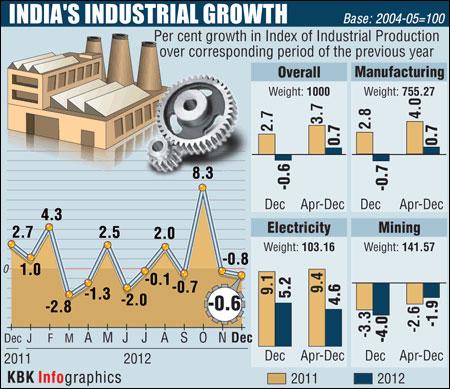

Indicating persistent sluggishness in the economy, industrial output contracted to 0.6 per cent in December due to poor performance of manufacturing and mining sectors and decline in production of capital as well as consumer goods.

The industrial output, as measured by the Index of Industrial Production (IIP) had grown by 2.7 per cent in December, 2011.

Industrial production growth stood at 0.7 per cent during April-December period of this fiscal, down from 3.7 per cent in the same period of 2011-12, according to official data released on Tuesday.

Meanwhile the decline in industrial output for November 2012 has been revised downwards to 0.84 per cent from a contraction of 0.1 per cent in the month as per the provisional estimates released last month.

...

The growth in industrial output for October last year has, however, been revised upward to 10.66 per cent from the first revision of 8.3 per cent released last month.

The manufacturing sector, which constitutes over 75 per cent of the index, registered a contraction of 0.7 per cent in December in 2012, as against a growth of 2.8 per cent in 2011.

The growth in the output of the key sector remained low at 0.7 per cent in April-December last year as against 4 per cent growth in the same period of 2011.

The mining output in December last year contracted by 4 per cent compared to a decline in production by 3.3 per cent in the same month in 2011.

In April-December, the production in the sector declined by 1.9 per cent, against a contraction of 2.6 per cent in the year-ago period.

Capital goods output declined by 0.9 per cent in December, as against a contraction of 16 per cent in same month of 2011.

Capital goods output also contracted in the April-December period by 10.1 per cent, as against a dip of 2.9 per cent in the same period of 2011-12.

Consumer goods output also saw a contraction of 4.2 per cent in December as against a growth in production by 10.1 per cent. In the April-December period of this fiscal, the growth in the segment was 2.6 per cent as compared to 5.7 per cent in the same period of 2011-12.

The dip in the output of consumer durables stood at 8.2 per cent in December, as compared to a growth of 5.1 per cent in the same month of 2011.

The growth in the output of these goods was at 3.7 per cent in April-December 2012, compared to 5.1 per cent in same period previous fiscal.

The consumer non-durables output dipped by 1.4 per cent in December, as against a growth of 13.8 per cent in the same month a year-ago. This segment grew by 1.7 per cent in the nine-month period of this fiscal, as against 6.1 per cent in the same period of 2011-12.

The intermediate goods production also contracted by 0.1 per cent in December, 2012 compared to a decline in output by 1.5 per cent in same month a year ago.

During the April-December period, this segment recorded a growth of 1.6 per cent, compared to a contraction of 0.7 per cent in the first nine months of last fiscal.

IIP figures for December are disappointing: CII

Stating that the IIP figures for December are disappointing Chandrajit Banerjee, Director General, CII, says "With the exception of October 2012, there is a secular trend developing, which is most disconcerting. What is extremely worrisome is the negative growth of the manufacturing sector driven by a sharp decline in demand conditions in the economy. This has happened especially at a time when the festive season was expected to boost consumption demand. The data indicates that upstream mining industries continues to show a contraction in output which, going forward, would lead to shortages of coal, ores and other industrial raw materials."

Chandrajit Banerjee further states, "Given the situation, under normal circumstances, it would have been natural for industry to ask for a stimulus package. However, given that the government's fiscal situation is quite serious, this could be an unreasonable demand. However, the least we expect is that the Union Budget would not consider raising any taxes or duties and would refrain from introducing new taxes. Sentiments are already reflected in the IIP figures and CII does not want to see any announcements which would hurt industry's confidence."

The CII hopes that the Union Budget would take bold decisions to rejuvenate demand and boost investor confidence which in turn would stem the slide in industrial production. CII has already suggested to the Ministry of Finance that the Union Budget should be aimed at reviving growth. This would imply taking measures such as containing fiscal deficit, moving towards GST, providing accelerated depreciation on plant and machinery, abolishing MAT on SEZ, etc. The reform agenda brooks no delay, he states.

"Some good has been done by the series of reform measures announced since September 2012 and now the RBI has indicated monetary easing. We hope the RBI would take note of the industrial situation and accelerate the reductions in interest rates. We hope that the calendar year would see at least a 150 bps cut in repo rate, he adds.