Benchmark indices ended lower this Wednesday as concerns over weak macro-economic situation and inflationary pressure continued to weigh on the investor's sentiments.

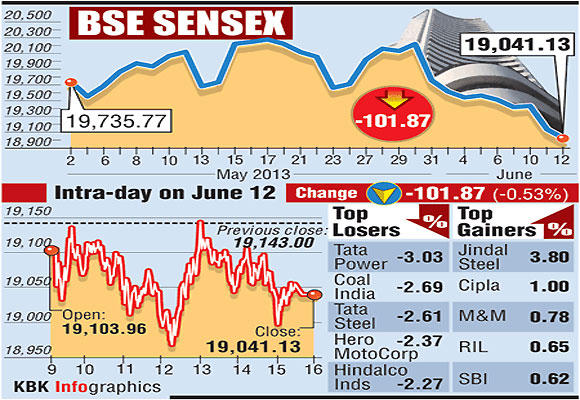

The 30-share Sensex ended lower 101.87 points at 19,041.13 and the 50-share Nifty shed 28.60 points at 5,760.20 levels.

Growth concerns continued to weigh after country's industrial production grew less than expected, at 2 per cent in April from a year earlier.

Meanwhile, Consumer Price Index- based inflation came down to 9.31% in May from 9.39% in April, government data showed on Wednesday.

Investors will now focus on Friday's wholesale price inflation data which is expected to remain in the central bank's comfort level of 5 per cent.

. . .

An easing inflation will provide RBI more elbow-room to reduce interest rates in the June 17 monetary policy review.

Rupee, however, added some respite after strengthening for the first time today during the last five trading sessions.

The local currency was trading at 57.98 on the Interbank Foreign Exchange Market.

On Tuesday, it closed at 58.39 after touching mark of almost Rs 59 per dollar prompting Reserve Bank of India to intervene in the market.

Asian stocks pared most of their morning losses but closed on a negative note amid looming fear over scale-back of US Federal Reserve bond-buying plan.

The Nikkei fell 0.2% to 13,289, Singapore Straits Times declined 0.6% to 3,152, Hong Kong's Hang Seng dropped 1.2% to 21,354 while China's Shangahi Composite index ended flat at 2,210.

. . .

European shares traded lower. France's CAC fell 0.1% to 3,808, Germany's DAX dropped 0.3% to 8,194 and UK's FTSE was down 0.2% to 6,325.

Back home, barring healthcare and bank sector, rest all declined with metal, banks, realty and consumer durables leading drop on the BSE.

The gainers included counters such as Jindal Steel gaining 3.8%, Cipla rose 1%, Reliance Industries gained 0.6% while Mahindra & Mahindra added 0.7% on the BSE.

The laggards included names like Tata Power falling 3%, Coal India fell 3%, Hero MotoCorp declined 2.7%, Tata Steel shed 2.6%, Bajaj Auto declined 2.2% while Hindalco Industries shed 2.3% on the BSE.

Shares of Tata Group companies have tumbled up to 20% in noon deals with Tata Coffee and Tata Teleservices (Maharashtra) or TTML seen no buyers on the counter.

. . .

Tata Coffee locked in lower circuit of 20% at Rs 1,100 on back of heavy volumes on the Bombay Stock Exchange.

A combined 771,051 shares representing about 10% of free-float equity of the company have changed hands on the counter so far and there are pending sell orders for 14,837 shares on BSE and NSE at 1415 hours.

TTML too, frozen down circuit of 20% at Rs 5.53, its decade low value on BSE. Earlier, in May 2003, the stock hit low of Rs 5.70.

The counter has seen a combined 11.4 million shares have changed hands and there are pending sell orders for 728,943 shares on BSE and NSE.

Titan Industries shed 13% to Rs 204.90 its lowest level since February 2012.

The stock has plunged 24% in two days after the company on Tuesday said that the Reserve Bank of India has clarified that all imports of gold for domestic consumption, either through banks, nominated agencies or directly can be made only with 100% cash margin.

The broader markets traded negative with mid-caps and small-caps falling 0.5 per cent on the BSE.

The market breadth was negative.

Out of 2,490 stocks traded so far, 1,398 stocks declined while 967 advanced on the BSE.