With strong governmental support, foreign direct investment has helped the Indian economy grow tremendously.

India has continually sought to attract FDI from the world's major investors.

In 1998 and 1999, the Indian government announced a number of reforms designed to encourage and promote a favourable business environment for investors.

FDIs in India are permitted through financial collaborations, private equity or preferential allotments, by way of capital markets through euro issues, and in joint ventures.

FDIs, however, are not permitted in the arms, nuclear, railway, coal or mining industries.

A Department of Industrial Policy and Promotion fact sheet mentioned 10 sectors attracting highest FDI equity inflows.

All the figures are for April 2010 to March 2011.

. . .

1. Services sector (Financial and non-financial)

FDI equity inflows: Rs 123,706 crore ($27,668 million)

The service industry forms the backbone of social and economic development of any region.

It has emerged as the largest and fastest-growing sectors in the world economy, making higher contributions to the global output and employment.

The contribution of the services sector to the Indian economy has been 55.2 per cent in gross domestic product and has been growing by 10 per cent annually.

An international comparison of the services sector shows that India compares well even with the developed countries in the top 12 countries with highest overall GDP.

The two broad services categories, namely trade, hotels, transport, and communication; and financing, insurance, real estate, and business services have performed well with growth of 11 per cent and 10.6 per cent, respectively in 2010-11.

Only community, social and personal services have registered a low growth of 5.7 per cent due to base effect of fiscal stimulus in the previous two years, thus contributing to the slight deceleration in growth of the sector.

. . .

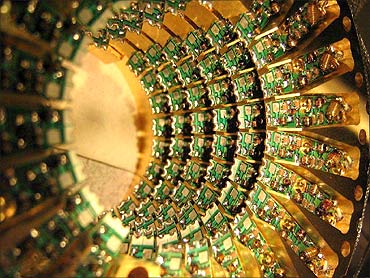

2. Computer (software & hardware)

FDI equity inflows: Rs 48,135 crore ($10,821 million)

Foreign direct investment Inflows to Computer Software and Hardware Industry in the first half of the fiscal year 2007-08 has been $0.3 billion.

Software Technology Parks, regulatory reforms by the Indian government, the growing Indian market and availability of skilled workforce have been important factors in boosting FDI inflows to computer software and hardware in India.

The computer software industry has witnessed a growth of 28 to 30 per cent CAGR in the past five years.

The computer hardware industry has occupied about $1.4 billion in the entire electronics hardware industry as has been accounted in the Financial Year 2005.

This includes personal computer, servers, and laptops.

Hundred per cent foreign direct investment is permitted under automatic route in the computer hardware industry.

. . .

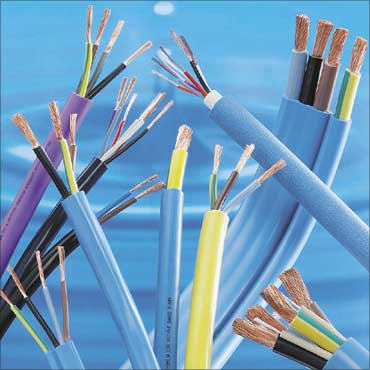

3. Telecommunications (radio paging, cellular mobile, basic telephone services)

FDI equity inflows: Rs 48,313 crore ($10,611 million)

The Indian Telecommunications network with 621 million connections (as on March 2010) is the third largest in the world.

The sector is growing at a speed of 45 per cent during the recent years.

This rapid growth is possible due to various proactive and positive decisions of the government and contribution of both by the public and the private sectors.

The rapid strides in the telecom sector have been facilitated by liberal policies of the government that provides easy market access for telecom equipment and a fair regulatory framework for offering telecom services to the Indian consumers at affordable prices.

Presently, all the telecom services have been opened for private participation.

. . .

4. Housing and real estate

FDI equity inflows: Rs 43,288 crore ($9,655 million)

The finance ministry recently called for tougher foreign direct investment norms in the housing and township sector.

It has also proposed stringent monitoring to ensure FDI rules are strictly followed in this 'sensitive' sector.

The ministry has said a more effective monitoring mechanism could be set up jointly with the ministries of commerce and urban development to ensure FDI does not "render policy objectives in a sensitive sector of the economy with limited practical significance".

At present, 100 per cent FDI is allowed in this sector, but with some riders.

However, there have been concerns over the lack of clarity of rules, the need to tighten these and the difficulty in monitoring these.

For instance, foreign companies willing to invest in this sector need to have a minimum capitalisation of $10 million for wholly-owned subsidiaries, and $ 5 million for joint ventures.

The funds have to be brought in six months of commencement of business. Also, the minimum area to be developed under each project is 10 hectres.

. . .

5. Construction (including roads & highways)

FDI equity inflows: Rs 42,160 crore ($9,491 million)

The evolution of Indian construction industry was almost similar to the construction industry evolution in other countries: founded by government and slowly taken over by enterprises.

After independence the need for industrial and infrastructural developments in India laid the foundation stone of construction, architectural and engineering services.

The period from 1950 to mid 60's witnessed the government playing an active role in the development of these services and most of construction activities during this period were carried out by state owned enterprises and supported by government departments.

In the first five-year plan, construction of civil works was allotted nearly 50 per cent of the total capital outlay.

It contributes more than 5 per cent to the nation's GDP and 78 per cent to the gross capital formation.

Total capital expenditure of state and central government will be touching Rs 8,02,087 crore (Rs 8,020,87 billion) in 2011-12.

. . .

6. Automobile industry

FDI equity inflows: Rs 28,037 crore ($6,199 million)

FDI Inflows to Automobile Industry have been at an increasing rate as India has witnessed a major economic liberalisation over the years in terms of various industries.

The automobile sector in India is growing by 18 per cent per year and is one of the high performing sectors.

This has contributed largely in making India a prime destination for many international players in the automobile industry who wish to set up their businesses in India.

. . .

7. Power

FDI equity inflows: Rs 27,848 crore ($6,156 million)

The huge size of the market in the power sector in India and high returns on investment are important factors in boosting FDI inflows to power.

Hundred per cnet FDI is permitted to this sector under automatic route in almost all the power sectors in India except the atomic energy.

There are huge opportunities of FDI in power sector in India.

The power sector in India has grown significantly and is an important part of infrastructure.

Investment potential in the power sector of India is huge due to the market size and returns on investment capital.

Past few years have witnessed an outstanding growth in the power sector especially the sectors based on renewable sources of energy.

The government of India aims at reaching 2, 00,000 MW of capacity by 2012.

. . .

8. Metallurgical Industries

FDI equity inflows: Rs 18,724 crore ($4,286 million)

The country's metallurgical sector garnered Rs 5,023.34 crore (Rs 50.23 billion) in foreign direct investment in the financial year 2010-11, a 150 per cent increase compared to the previous fiscal.

The sector, which also includes steel, had attracted over Rs 1,999 crore (Rs 19.99 billion) in FDI in FY'10.

According to statistics from the Department of Industrial Policy and Promotion, he added the metallurgical sector attracted Rs 4,152.56 crore (Rs 41.52 billion) in FDI in 2008-09.

. . .

9. Petroleum & Natural Gas

FDI equity inflows: Rs 13,763 crore ($3,159 million)

Hundred per cent FDI is permitted under automatic route in petroleum and natural gas. Petroleum and natural gas Industry accounts for 35 per cent share in the entire energy requirements in India.

Important initiatives have been taken by the Indian government to drive FDI inflows to this sector.

Petroleum and Natural Gas Industry accounts for 35 per cent share in the entire energy requirements in India.

Downstream industries like petrochemicals, fertilisers and energy play a vital role in the oil industry in India.

. . .

10. Chemicals (other than fertilisers)

FDI equity inflows: Rs 13,234 crore ($2,927 million)

FDI Inflows to chemicals industry has increased over the last few years, thanks to several incentives by the government of India.

The increased FDI Inflows to chemicals industry has helped in the growth and development of the sector.

Hundred per cent FDI is allowed in chemicals under the automatic route in India.

FDI policy in chemicals industry in India comprises:

1. Up to 100 per cent FDIis allowed through the automatic route for all the items in the chemical industry except for the chemicals that are of hazardous nature for which the approval of the government is required.