There are loans to salaried people where the borrower is employed, but has failed to make repayment.

Such loans would be identified and sold in a pool to ARCs.

State Bank of India, the country's largest lender, is changing its strategy to recover bad loans up to Rs 500 crore (Rs 5 billion).

This financial year, it will look at doing 'pool' sales of mid-size units, small and medium enterprises (SMEs), and retail bad loans.

To date it has been engaging in account-by-account sales.

There are two strands in selling bad loans.

One is big-ticket accounts, which will move to the newly formed National Asset Reconstruction Company Ltd (NARCL), and the second is the non-NARCL portfolio, where the bank intends to sell loans totalling Rs 3,500- Rs 4,000 crore (Rs 35 billion to Rs 40 billion).

The realisation expected for non-NARCL sales is 35-40 per cent, a senior SBI executive said.

NPAs in personal loans, SMEs, and agriculture stood at Rs 57,857 crore (Rs 578.57 billion) at the end of March 2022.

Some asset reconstruction companies and special situation funds are looking to buy -- on a portfolio basis -- loans of retail customers and micro, small, and medium enterprises.

The bank has not been active in this (pool sale). Other banks and finance companies are active offloading NPAs by bundling small-value loans.

The bank will not sell education loans (NPAs).

There are loans to salaried people where the borrower is employed, but has failed to make repayment. Such loans would be identified and sold in a pool to ARCs.

The exercise will involve bundling 10,000-20,000 retail or SME loans.

ARCs and funds will do due diligence and valuations and acquire that from the bank.

They would then engage in the recovery process.

The bank is careful about practices that the ARC or funds follow in making recoveries, another official said.

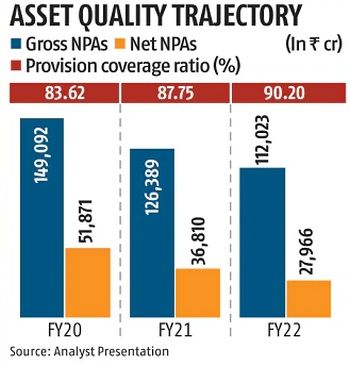

SBI's asset quality profile improved with gross NPAs declining to 3.97 per cent as of March 31, 2022, from 4.98 per cent in March 2021.

Its net NPAs declined to 1.02 per cent in March 2022, down from 1.5 per cent a year ago.

Loan loss provisions fell sharply by 67.10 per cent to Rs 3,262 crore in Q4FY22 from Rs 9,914 crore (Rs 99.14 billion) in Q4FY21.

However, the provision coverage ratio (PCR) improved to 90.2 per cent in March 2022 from 87.75 per cent a year ago.

The bank's recoveries and upgrades from NPAs were higher at Rs 21,437 crore (Rs 214.37 billion) in FY22 from Rs 17,632 crore (Rs 176.32 billion) in FY21, the year when the pandemic hit in a major way.

The recoveries and upgrades were Rs 25,781 crore (Rs 257.81 billion) in FY20.

Besides NPAs, the bank has restructured loans worth Rs 30,960 crore (Rs 309.60 billion).

They are a blend of loans to retail customers, SMEs, and companies (the last group has a small share).

The bank has created sufficient contingency provisions against restructured loans to insulate its balance sheet from any future shocks, SBI Chairman Dinesh Khara had said after announcing the results for FY22.

Feature Presentation: Rajesh Alva/Rediff.com