Not only were Urjit and Rajan outsiders, they also hired laterally, bypassing the existing talent, especially in the field of economics

With a former bureaucrat at the helm of affairs at the Reserve Bank of India (RBI), employees are expecting the return of the old times where everything worked to well-established traditions and norms.

For, the central bank is a tightly bureaucratic, conservative and closed organisation that doesn’t take departure from tradition lightly, particularly when it comes to outsiders not aware of the rule book.

That also explains why the central bank worked smoothly with the government when the governor was from the Indian Administrative Service (IAS).

In many ways, it is the culture that the past two governors, Urjit Patel and Raghuram Rajan, upset the most. Not only were they outsiders, they also hired laterally, bypassing the existing talent, especially in the field of economics, when RBI staffers pride themselves on their domain knowledge.

These lateral hires were uneasy arrangements, inviting resentment not easily ameliorated.

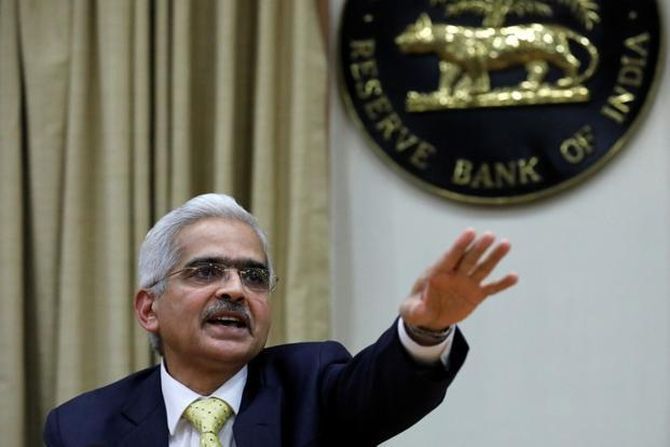

It is now for Shaktikanta Das (pictured) to restore that old culture at the RBI, something the central bank staffers want the most.

At least, some of the senior staffers say the past five years had been stressful at the central bank.

Lower-level employees, though, admired Rajan and Patel because both fought with the government on employee rights, especially on the pension issue.

Patel introduced a special medical scheme for retired employees to extend some benefits in lieu of the revised pension scheme.

Das’ initial days have been promising, say insiders. Last week, at the L K Jha memorial lecture (Jha was RBI governor and belonged to the Indian Civil Service), the new governor greeted the audience with folded hands. Dignitaries and the guests apart, most of the hall was filled with Reserve Bank employees of all ranks, who felt a connect with the gesture.

“It was an unprecedented gesture in recent memory,” said a mid-senior level employee present at the event.

Much of this was missing under Rajan and Patel. In the past five years, employees tried hard to adjust to the working styles of the celebrated global economists or “helicopter drops” as central bank staffers like to call them, implying that they were specialists brought in at a time of crisis.

Rajan came at a time when the rupee was undergoing a crisis of confidence, plunging every day to record low levels.

Rajan’s first-day press conference dramatically reversed the situation.

Patel’s rise to the top at the central bank followed a more natural choice, filling the post left vacant by Rajan’s non-renewal of contract.

But there was the challenging demonetisation planned for him.

Patel and Rajan were also very different in their personalities.

“Rajan loved to talk, and Patel liked being alone. What the central bank needed was a balanced approach,” said another senior staff member.

Both Rajan and Patel violated the cardinal principles through their open criticism of the government.

This is something Das is not expected to do even as he could be as much a defender of central bank autonomy as his illustrious predecessors.

In all probability, Das may not agree to transfer the Rs 3 trillion of RBI reserves to the government, even as there could be some increase in yearly pay-outs.

This happened even during Rajan’s tenure, when the annual dividend jumped from Rs 360 billion to Rs 57,000 crore under the recommendations of an RBI-appointed committee.

The dividend pay-out continues to remain high and increased every year till demonetisation dented much of it.

Senior RBI executives say all governments have been unreasonable in their demands, but they also know the central bank won’t be in a position to entertain those requests.

The whole process is that of an elaborate role play.

The RBI is expected to examine every demand carefully before it is communicated back in mild terms about it being untenable.

“It is never the culture that you go out in public and say that the government has been unreasonable. That sets in motion a number of factors that sends the situation out of control,” said a senior central banker.

A seasoned bureaucrat who is aware of the hierarchy and egos of various players involved, Das is unlikely to upset visitors.

“My experience of working with IAS officers is that they never do anything that disturbs the balance of the system,” said another senior official.

This official’s past working experience with Das, when he was in the ministry, says the new RBI governor is a level-headed, balanced person, but strictly his own man.

Das is expected to be consultative in his approach, expect the RBI staffers.

The culture of the central bank is not to make a noise but work tirelessly to a shared goal of economic stability, they say.

“It is important to have the communication channel open both internally and with the government. All the present issues have arisen because communication channels were tightly shut,” said a senior RBI executive.

Das is expected to open up those rusted channels and make the relations between the two warring parties smoother.

Photograph: Danish Siddiqui/Reuters