Governor says two-stage verification for card transactions might go; RBI in process of setting up IT arm

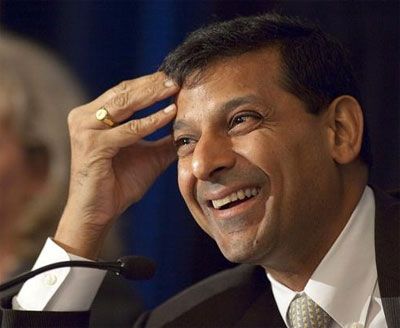

You might soon be able to order products on credit from online market platforms if the Reserve Bank of India (RBI) decides in favour of it. “There is a possibility... we are examining it; you could get credit from these internet marketing platforms,” RBI Governor Raghuram Rajan said on Friday.

You might soon be able to order products on credit from online market platforms if the Reserve Bank of India (RBI) decides in favour of it. “There is a possibility... we are examining it; you could get credit from these internet marketing platforms,” RBI Governor Raghuram Rajan said on Friday.

Speaking at an award function organised by the Institute for Development and Research in Banking Technologies in Hyderabad, Rajan complimented online market platforms for bringing tremendous choice to customers, even in rural areas.

“These platforms are bringing about a logistics revolution in the country; they create a lot of demand for rail, air and road logistics,” he said. The local kirana stores might become part of this whole logistics chain and perhaps find relevance in supplying products with less shelf life, Rajan added.

The RBI governor also hinted that you might be able to make small payments using your credit cards without the mandatory two-stage authentication. He said RBI could consider easing the process for small-value transactions if credit card providers were ready to take the risk.

“For small bank transactions, if banks or credit card providers are willing to take the risk, RBI may perhaps allow small-value payments based on direct usage of cards without a second level of protection.”

On the importance and scope of information technology, Rajan said IT had not penetrated the banking system the way it should have, and indicated that RBI was in the process of setting up an IT subsidiary.

“Banks are not yet fully integrated in terms of IT usage such that they can spin out, for example, the details of loans on a daily basis. It still takes time to put the stage together,” Rajan said.

“Before large loan data were put in place by RBI, banks didn’t know who they had lent to; there was no centralised information system. Even we found hiccups in getting the information from banks on time in the right formation with right details.”

The governor advocated a wider use of technology to bring down cost structure in the banking system and widening financial inclusion. “Despite use of all IT, the cost structure is still significantly high. Why are they not coming down faster? We should use more and more technology to bring down the cost faster,” he said.

“IT has to be the answer for inclusion. It is only by reducing the cost of transaction that we can reach everyone in the system, including those with low-value payment needs.”

Referring to banking security as a big area of challenge that all central bankers were concerned about, Rajan said RBI would set up an IT subsidiary to focus on cyber security, among other things.

On the way forward for the sector, the governor advised banks to make use of the information available about customers for offering them services and designing new products. He said the banks that were still using traditional systems and offering traditional products would face huge challenges in future from modern banks.

“There is tremendous amount of information about customers available through various platforms, including their social media habits and various kinds of products they use. All of that can be used to better formulate what the customer is likely to use or want,” Rajan said.

He also hoped that the Supreme Court would take a positive view on the wider use of Aadhaar. “It is a bit under a cloud right now, but hopefully the Supreme Court will see value in permitting wider usage of Aadhaar,” he said.

Rajan added that banks should be able to know on a daily basis what kind of business they were making. “Technology should help not only in doing better business but also in running the bank in a better way.”