Sale of stressed assets is gaining momentum this financial year after easing of certain rules by the central bank.

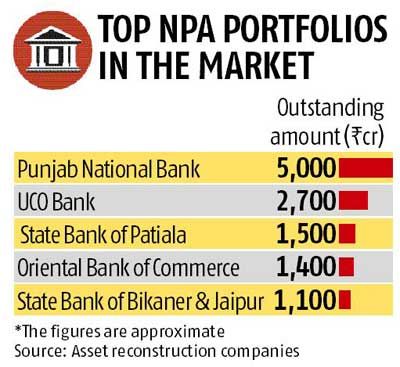

Public-sector banks have put Rs 14,000-crore (Rs 140-billion) worth of non-performing assets up for sale, to ease some pressure exerted by stressed loans on their balance sheets.

Public-sector banks have put Rs 14,000-crore (Rs 140-billion) worth of non-performing assets up for sale, to ease some pressure exerted by stressed loans on their balance sheets.

Delhi-based Punjab National Bank’s Rs 5,000-crore (Rs 50-billion) bad loans account for a large portion of the total offered for sale.

Top executives of PNB said many other lenders had earlier sold their NPAs to asset reconstruction companies but PNB was yet to offload its exposure.

“Some of the loan accounts PNB is putting on the block are new ones and the bank has made provisions in line with regulatory norms.

"Being a large bank, its exposure to stressed sectors like infrastructure, steel and construction is high; that is the cause for its bulging bad loans,” said a PNB executive.

Though banks are trying to get NPAs off their books, they still face several hurdles in making effective and meaningful transactions, analysts pointed out. Banks are expecting higher price on loans; they are averse to offering substantial discounts.

Saving banks' distressed assets

Saving banks' distressed assets

In a recent study, CRISIL had said only Rs 12,000-14,000 crore (Rs 120-140 billion) worth of NPAs were likely to be purchased by ARCs in 2015-16, hinting at a low systemic absorption capability.

Sale of stressed assets is gaining momentum this financial year after easing of certain rules by the central bank.

Amid a tough environment, ARCs had last year turned cautious about quality and valuation of assets they acquired.

This slowed down growth in their assets under management to 30 per cent in 2014-15, after a four-fold jump the previous year.

Capital constraints, mismatch in valuation expectations, low recovery rates and longer resolution timeframes were some of the reasons for ARCs’ inadequate absorption capacity, the CRISIL study had pointed out.

According to rating agency ICRA, despite lower stressed-asset formation, the Indian banking system’s gross non-performing assets increased from 3.9 per cent as of March 2014 to 4.4 per cent as of March this calendar year.

With an end to a regulatory forbearance on restructured assets, the GNPAs are likely to increase further. Stressed assets outstanding (gross NPAs plus standard restructured advances) had reached an all-time high of 10.6 per cent as of March 2015, it said.

The image is used for representational purpose only