A client asked me, 'the dollar is nearing an all-time high against the euro. It will be good for technology stocks in the long run, right?'

A client asked me, 'the dollar is nearing an all-time high against the euro. It will be good for technology stocks in the long run, right?'

I simply said 'yes, sir'. What else could one say," asks Harish Vasudevan, a Mumbai-based stock broker.

The current stock market rally is seeing a very different kind of small investor, he says.

"They Google search. They give you more information about a company than even the promoter. They talk to five people before they buy 100 shares."

The e-commerce generation is learning to buy shares like they buy clothes and mobile phones - after thorough research.

This was not so when the country saw its previous bull market. Though the internet was around, people would trust their brokers and relationship managers for information. "In those days, even for buying 5,000 shares, people would not talk to more than one person," he recalls.

Brokers like Vasudevan are struggling to keep themselves in tune with this super-informed, new-generation retail investor.

True, an informed investor is just what the doctor ordered for a strong bull market. But it may still be too early to say if informed choices will necessarily turn out to be multibaggers.

Similar to the 2004 rally

Similar to the 2004 rally

The current one is an election year that saw a Narendra Modi-led National Democratic Alliance government taking charge at the Centre in May.

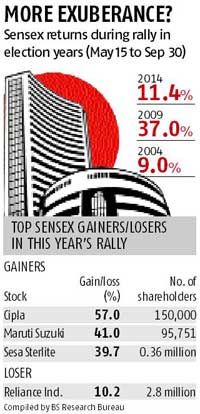

According to data compiled by Business Standard Research Bureau, the Sensex gained 11 per cent over the period between May 15 and September 30 this year.

This jump was less than a third of that seen during the same period in 2009, the previous election year which brought the United Progressive Alliance (UPA) under Manmohan Singh back to power.

That year, recovering from the post-Lehman Brothers crisis, the index had gained 37 per cent.

By comparison, in the corresponding period of 2004, the election year in which UPA had come to power for the first time, the Sensex had gained only nine per cent from its 5,000 level.

However, the index went on to rise four times over the following three years.

This year, the performance of smaller stocks has largely been proportionate with the blue-chip ones.

While the BSE Mid-cap and Small-cap indices have gained 24.74 per cent and 37.10 per cent, these had, respectively, clocked 63.5 per cent and 74.1 per cent in 2009.

In 2004, the gains for these indices were 17.5 per cent and 28.5 per cent, respectively. Besides the range of returns, there are several other parellels that people are drawing between now and 2004.

Ambit Investment Advisors Chief Executive Andrew Holland says: "In 2004, first there were expectations of high GDP (gross domestic product) growth, then earnings growth began accelerating. And, in turn, markets started to play catch-up. I think, at present, we are in a phase similar to the 2003-2006 period." The Sensex can double from its current level over the next three years, he says. Not everyone, though, seems to share Holland's optimism.

A sagging Reliance

In 2009, while all 30 Sensex stocks were in the green in the first few months of a new government taking charge, there is no such luck this time.

At least three big stocks have given negative returns since Modi was voted to power.

While Reliance Industries Ltd's (RIL's) stock has lost the most (10 per cent), Bharat Heavy Electricals and Tata Power have also been losers. With 2.8 million small shareholders and hundreds of funds holding the stock in big chunks, RIL is a key sentiment driver.

By comparison, Cipla, which has been the biggest gainer in this rally, has only 0.15 million small shareholders. Maruti Suzuki, the second-best performer, has only 95,751 small shareholders.

In its core area, RIL faces uncertainty over gas pricing. Also, its merger with Network18, which brings key synergies to its 4G telecom venture, is still awaiting regulatory approval.

In 2004, though RIL was not among top gainers, it was not among top five losers, either.

"When Reliance is down, the broader sentiment gets affected, as a large number of people are yet to see money despite a Sensex rally.

RIL has taken big bets, investing billions of dollars in retail and 4G - not its core areas. These stories take time to play out.

The stock will pick up when clarity emerges," said a fund manager marketing a new fund offer.

The e-commerce theme

One sure and present threat to the retail sector, where Reliance Industries has spent significantly, comes from e-commerce.

According to the fund manager quoted earlier, each big bull market has a defining theme, and every time this tends to be new.

"In 1994-96, it was financial services; in 2004-07, it was real estate and infrastructure; my gut feeling is, it will be internet and e-commerce businesses this time." He points out, though there are few options for investors in the listed space, new companies will list and become key drivers of the bull market as it matures. "When a rally started in 2004, were there any listed real estate companies?

Had you heard of a Purvankara? Still, see what happened by 2007," he says.

Vasudevan agrees that e-commerce is the next big thing. "It has picked up exceedingly well even in the Tier-II and -III centres.

Entire stocks of cellphones vanish in seconds. It is a dream market for manufacturers. Once the speed increases with launch of 4G, there will be a big fundamental shift," he predicts.

Goldman Sachs analysts had said in a recent report, 'India's digital dividend': "India currently has about 25 million online buyers.

That is only a 10th of the country's total internet user base of about of 252 million.

We believe that lower broadband penetration and limited access to electronic payment systems are primarily responsible for such low internet buyers-to-user conversion rate. We believe the government's initiatives to expand the broadband connectivity and improvements in the retail ordering/distribution technologies would help improve this ratio.

Given that e-commerce models like "marketplace" provide scale and reach for small businesses with very little investment, we believe investments in retail technology solutions could boost the productivity of the retail economy."

This report also said that the impact of internet and communication technology (ICT) on India was growing at an exponential rate.

"There are already 900 million mobile phones and 250 million internet users in India, according to the Telecom Regulatory Authority of India. This is enabling a rapid flow of information, bringing people closer together, and allowing consumers to purchase virtually anything at any time. ICT is spurring innovation and entrepreneurship, and boosting productivity in all areas it touches."

'Corrections will be short-lived'

The Reserve Bank of India's decision to hold rates, amid fears of the US Federal Reserve raising those in the near future, has left the Street nonplussed. But expectation of quicker decisions and clearances from a tech-savvy Modi government has fuelled hopes of faster economic growth.

This is key to higher corporate earnings growth, which would push up valuations.

S Naganath, president & chief investment officer, DSP BlackRock, expects India's annual GDP growth to accelerate to seven per cent in 2015, 2016 and beyond - even as many other emerging-market economies are expected to slow.

"The growth is driven by implementing half-finished projects. Equity valuations are reasonable, earnings momentum looks set to take off and domestic investors are buying."

Naganath believes the Sensex has material upside over the next three years. "Any correction (a five per cent to 10 per cent decline is a possibility) are likely to be short-lived," he says.

Ambit's Holland says: "When the Nifty moved from the 7,600 level to around 8,200, I did not really want to chase the markets, because it was more driven by global liquidity than fundamentals.

However, the market has retracted a bit from that level and may correct a bit more due to global factors. So, what we will see now is more of stock-picking than index-picking.

That is how people will make money over the next two-three years."

Vasudevan, meanwhile, is busy reading reviews of different smartphones; he wants to replace his BlackBerry to keep in touch with his clients on popular chat application WhatsApp.