RBI's exercise will take into account standards of governance, the viability of the payment bank (PB) business model, and changes, if any, if needed.

The Reserve Bank of India (RBI) may undertake a comprehensive review of the architecture of payment banks (PBs).

This all-encompassing exercise, almost a decade after licensing terms were issued on November 27, 2014, is to take into account standards of governance, the viability of the payment bank (PB) business model, and changes, if any, if needed.

This will also impact PBs seeking to convert into small finance banks (SFBs), as a comprehensive review of the regulatory capital framework for the latter is also under consideration, as mentioned in the Report on Trend and Progress of Banking in India (2022-23).

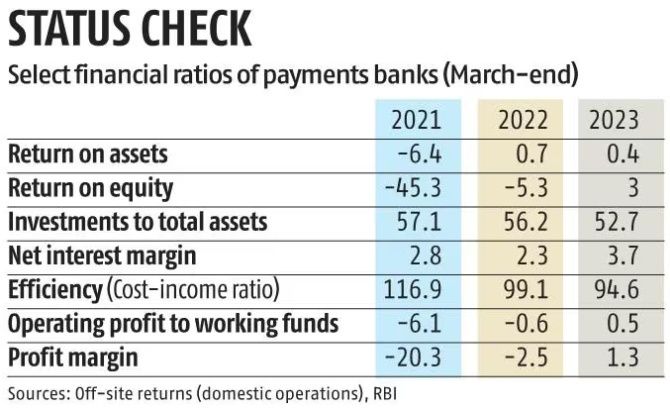

PBs turned profitable during FY23 for the first time since their inception nearly a decade ago.

Growth in interest income exceeded interest expenses, and key profitability indicators -- return on assets and return on equity -- were in the black in FY23.

Net interest margins increased to 3.7 per cent from 2.3 per cent in FY22 after declining for three consecutive financial years.

Over the years, PBs have argued with the banking regulator for a further increase in the end-of-day account balance limit from the current Rs 2 lakh.

This limit was last revised on April 7, 2021, from Rs 1 lakh set at the time of licensing these entities in 2014.

More significantly, they have also demanded that they be allowed to lend to the microfinance sector with the loan amount being appropriately capped to help them diversify their income streams.

If this last aspect is conceded, it will be a major departure from the licensing framework: PBs are to invest their funds only in government securities (G-Secs).

There is another detail playing in the background. While PBs can apply for an SFB licence five years after rolling out operations, so far, only FINO Payments Bank has made the effort.

However, it will be interesting to see the regulatory treatment if Airtel Payments Bank and Jio Payments Bank were to enter the SFB fray, as this will test Mint Road's stance on the entry of corporate houses into banking (even if it is into SFBs via conversion from PBs).

Corporates are not allowed into SFBs as fresh applicants. It must be remembered that the licensing of PBs preceded that of SFBs.

Back in 2014, around 40 applicants queued up at Mint Road for a PB licence.

These included Reliance Industries (with the State Bank of India), Aditya Birla Group (Idea), Bharti Airtel, and Vodafone, plus business correspondents (BCs) like Oxigen.

A retailer, Future Group, was also in the fray. Combined with the 70-odd who had sought an SFB licence (full-service, but to service very small ticket sizes), bottom-of-the-pyramid banking was seen as a lucrative business.

The idea of a PB is unique to India, even though Brazil (Law 12865) had created a new legal entity known as a “payments institution”, to be regulated by the Brazilian Central Bank.

In 2007, the South African Reserve Bank stated that non-bank payment service providers (PSPs) could play an important role in the payments system.

Globally, in the context of financial inclusion, Kenya's M-Pesa is a successful “nested” payments bank.

However, the Indian version is an “independent payments bank,” which is a direct participant in the payments system and, subject to preemptions --both cash reserve ratio and statutory liquidity ratio -- and can invest only in G-Secs.

Even back then, there were questions about the viability of the PB business.

For one, M-Pesa in Kenya had benefited from lower banking penetration (less than 15 per cent at the time of launch in 2007), a higher working migrant population, and regulatory patronage (telcos in the country do not require tie-ups with banks for cash-out).

Safaricom was able to navigate KYC concerns as Kenya has a national identification system. Here, the emergence of UPI, which was later made free, changed the entire payment topography.

The late RBI deputy governor, K C Chakrabarty, had been on record to a business channel stating that “my only question about payment banks is what will be their viability”. This even as then RBI Governor Raghuram Rajan was all for it.

A decade on, it is back to the drawing board for PBs.

Feature Presentation: Rajesh Alva/Rediff.com