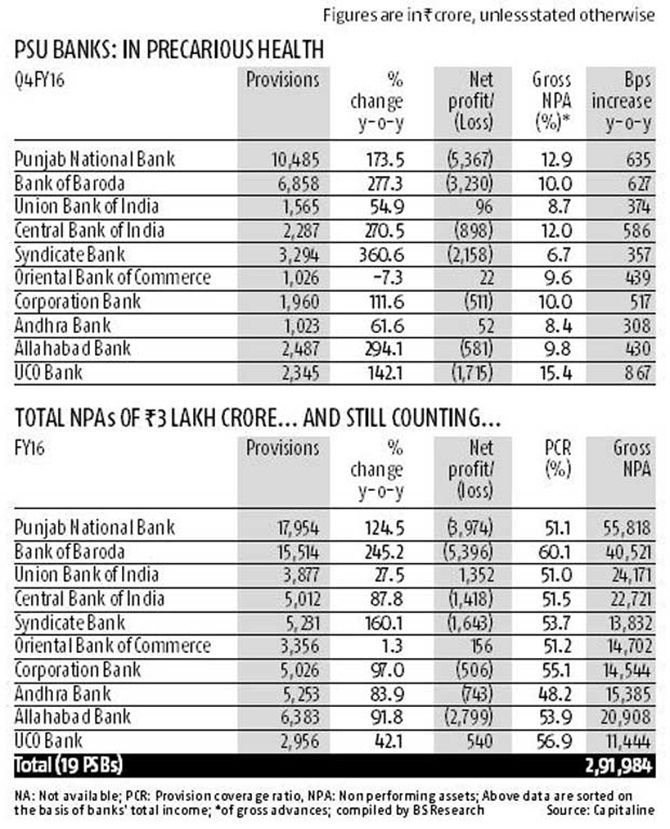

Rising bad loans continued to haunt public sector banks (PSBs) in the March 2016 quarter.

As they complied with the Reserve Bank of India's recent asset quality review, their provisioning for this surged sharply.

Nine of the 19 PSBs that have announced quarterly results so far witnessed a two-four times year-on-year jump in their provisioning.

Syndicate Bank, Allahabad Bank and Bank of Baroda occupied the top three slots on this front.

Of the rest, nine banks saw a one-two times rise in provisions.

Consequently, 10 banks reported a net loss versus a net profit in the March 2015 quarter, with Punjab National Bank posting the highest-ever loss by an Indian bank.

The combined gross non-performing assets of these banks now stands at Rs 2,91,984 crore.

With State Bank of India declaring results next week, this figure could rise.

The weak provision coverage ratio of these banks (between 48 and 62 per cent) reflects their inability to absorb any more stress.

Amid subdued credit offtake and possibility of further asset quality woes, the health of these banks is likely to remain critical.