Players such as Kidaara, True North, and Multiples Alternate Asset Management move outside the confines of just being a family-style financial office and become a true PE heavyweight.

Illustration: Uttam Ghosh/Rediff.com

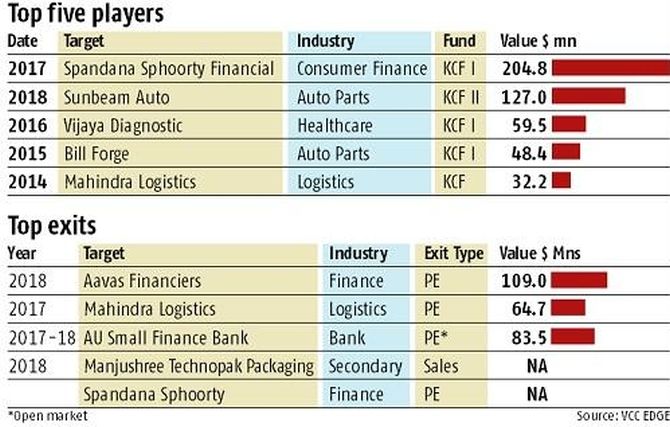

When Kedaara Capital recently divested its entire stake in packaging company Manjushree Technopack to US-based Advent International, financial details of the deal were not known.

However, it's not a stretch to assume that Kedaara managed to pull off at least two times the return on investment, given that the firm named after the Hindu temple Kedarnath in Uttarakhand, has delivered past exits in a similar vein, sources in the industry say.

Examples include the Mahindra Logistics IPO in which Kedaara invested Rs 2 billion and generated a 3.5 x return and AU Small Finance Bank, which saw a partial IPO exit by the PE firm after it made 5.5 times on capital.

Then there's BillForge, which saw an investment by Kedaara in 2015 for $48 million and a complete exit in 2016 through sale to M&M CIE Auto for $200 million. Here, Kedaara netted a 2x return in a year.

While it isn't alone, Kedaara, founded in 2011 by Manish Kejriwal, Sunish Sharma and Nishant Sharma, is among the front-runners of home-grown private equity players such as True North, and Multiples Alternate Asset Management looking to move outside the confines of just being a family-style financial office and become a true PE heavyweight.

Kedaara's operational strategy is driven by co-founder Manish Kejriwal, a former Temasek Holdings professional, who spearheads fund-raising for the company which has been both substantial as well quick-paced.

He said, "Kedaara is an operationally-oriented private equity firm pursuing control and minority investment opportunities focused on India." It’s an approach that has helped the firm drive 2.5 x returns on its first fund.

Kedaara neither denied or confirmed that figure.

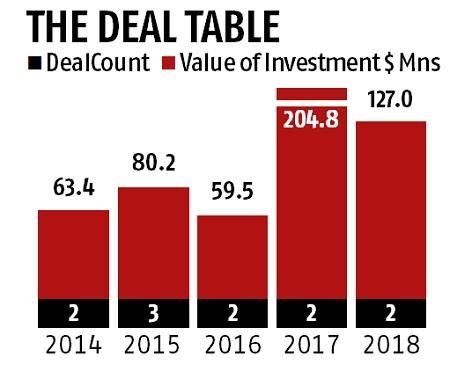

The firm's first fund closed at $560 million and the second one raised $790 million, Kedaara officials confirmed. The industry sees Kedaara's structure in this manner: Kejriwal is the impresario, while other co-founders Sunish Sharma and Nishant Sharma oversee potential opportunities, filter targets, lead the investments and manage the portfolio while partners such as PwC run audits diligence and tax strategies.

Kedaara has been able to do deals in restricted sectors such as retail very well, like Vishal Mega Mart, said Girish Vanvari, founder of boutique advisory firm Transaction Square. "It used the regulatory landscape to its advantage," he added.

Kedaara also swims in international circles where other Indian PE's are absent.

Riyadh in Saudi Arabia was the venue for 'Davos in The Desert' in October 2017 where a group of high-powered investors congregated, and the only fund from India was Kedaara.

That's not all. Kedaara is also unusual for being strategically tied-up with Clayton, Dubilier & Rice, a PE firm based out of Chicago.

Beyond Pedigree, Clayton is also long known for its proven ability to build stronger profitable ventures through its team of finance professionals and operating leaders with extensive experience in running global businesses.

Kedaara benefits from these global insights as Indian businesses strive to transform into professionally-managed platforms. Even so, the next few years will test Kedaara's mettle and if the firm can truly become a growth investor.

Co-founder and partner Nishant Sharma says, "It's early but we need to demonstrate consistency of returns over a couple of decades."