In FY23, Indian operations accounted for 41.6 per cent of the consolidated revenue of India's top five multinationals, up from 34 per cent in FY18 and 33.2 per cent and 34.2 per cent in FY21.

About 15 years ago, leading Indian companies, such as Tata Steel, Tata Motors, Hindalco, Bharti Airtel, and Motherson Sumi, embarked on an ambitious global expansion and this was achieved through multi-billion-dollar acquisitions in North America, Europe, Africa, and Southeast Asia.

Most of these acquisitions have proven financially successful, and the global operations of these Indian multinationals now overshadow their domestic business.

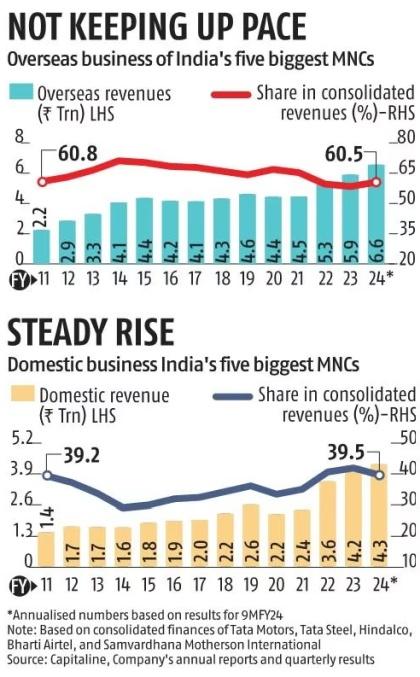

But over the past five years, these companies' revenues in India have grown at a faster pace than their overseas revenues.

As a result, the contribution of Indian business to consolidated revenues has steadily increased.

In FY23, Indian operations accounted for 41.6 per cent of the consolidated revenue of India's top five multinationals, up from 34 per cent in FY18 and 33.2 per cent and 34.2 per cent in FY21.

The combined revenue of the Indian businesses of these five companies rose from Rs 2.23 trillion in FY18 to Rs 4.22 trillion in FY23, growing at a compound annual rate of 13.6 per cent over the five-year period.

In the same period, the combined revenue of their overseas businesses grew at a CAGR of 6.4 per cent, from Rs 4.33 trillion in FY18 to Rs 5.92 trillion in FY23.

The overseas operations accounted for 58.4 per cent of the consolidated revenue of these companies in FY23, down from 66 per cent in FY18 and 65.2 per cent in FY21.

However, the results for FY24 suggest that the tide has now turned in favour of their overseas operations.

The combined overseas revenues of these companies increased by 11 per cent year-on-year during the April-December 2023 period (9MFY24), compared to a 1.3 per cent Y-o-Y growth reported by their Indian business during the period.

As a result, the share of overseas operations in their consolidated revenue grew to 60.5 per cent in 9MFY24, nearly 200 basis points higher than in FY23.

Based on their results for 9MFY24, their combined overseas revenue is expected to grow to Rs 6.56 trillion in FY24, from Rs 5.92 trillion in FY23.

In comparison, these companies' combined domestic revenue is expected to grow by 1.3 per cent Y-o-Y to Rs 4.28 trillion in FY24 from Rs 4.2 trillion a year ago.

Tata Steel has been an exception. There has been a sharp decline in the share of overseas business in the company's consolidated operations in favour of its domestic business.

Its overseas operations, including Tata Steel Europe (formerly Corus Group), which it acquired in 2007, accounted for only 43.4 per cent of its consolidated revenue in 9MFY24, down from 84.7 per cent in FY08.

The company has steadily divested a significant chunk of its assets in Europe, while it has grown its Indian business both through greenfield expansion and acquisitions.

Analysts attribute this to company-specific factors rather than macroeconomic factors or growth differentials between India and the rest of the world.

“Metals companies in India, such as Tata Steel and Hindalco, saw a big jump in their revenues in the past three years due to a boom in the metal cycle. At the same time, Tata Steel has shrunk its European operations,” said Dhananjay Sinha, co-head of research and equity strategy at Systematix Institutional Equity.

According to the IMF World Economic Outlook, India's gross domestic product at current prices in dollar terms has grown at a CAGR of 5 per cent in the past five years, compared to 4.3 per cent growth in the world GDP.

However, other companies in Business Standard's sample have seen a steady rise in the share of overseas business in their consolidated revenue. For example, in the past five years, Bharti Airtel Africa has grown at a faster pace (16 per cent CAGR) compared to its Indian mobile business (10.4 per cent CAGR). Its African operations are also more profitable than its Indian mobile operations.

Similarly, Novelis reported faster revenue growth during the FY18-23 period than Hindalco's other businesses.

Auto-component maker Samvardhana Motherson International is the most globalised company in Business Standard's sample and India only accounted for 17 per cent of its revenue in FY23, excluding the contribution from Motherson Sumi Wiring. The company made four more overseas acquisitions in FY24, further increasing its global footprint.

Feature Presentation: Rajesh Alva/Rediff.com