Finance Minister Arun Jaitley on Saturday rejigged excise duty on petrol and diesel to make available an additional Rs 40,000 crore (Rs 400 billion) for road and highway development.

Finance Minister Arun Jaitley on Saturday rejigged excise duty on petrol and diesel to make available an additional Rs 40,000 crore (Rs 400 billion) for road and highway development.

Petrol attracts a total excise duty of Rs 17.46 per litre, including Rs 2 a litre road cess.

Similarly, diesel attracts Rs 10.26 a litre total excise duty, including Rs 2 per litre road cess.

The duty incidence on petrol is made up of Rs 8.95 per litre basic central excise or CENVAT, Rs 6 per litre special excise duty, Rs 2 per litre road cess and 3 per cent education cess.

This has now been changed to Rs 5.46 a litre CENVAT, Rs 6 per litre special excise and Rs 6 road cess.

Education cesses have been subsumed in the final duty.

On diesel, there is a CENVAT of Rs 7.96 a litre plus Rs 2 road cess and 3 per cent education cesses.

This will now change to Rs 4.26 a litre CENVAT and Rs 6 a litre road cess.

The total incidence of various duties of excise on petrol and diesel remains unchanged.

Announcing the changes in his Budget for 2015-16, Jaitley said existing excise duty on petrol and diesel is being converted ‘to the extent of Rs 4 per litre into Road Cess to fund investment in roads and other infrastructure.

‘An additional sum of Rs 40,000 crore will be made available through this measure for these sectors.’

Budget 2015: Complete Coverage

Also, specific rates are being revised only to the extent of subsuming the quantum of education cess presently levied on them, keeping the total incidence of excise duties unchanged, he said.

Apart from this, the oil and gas sector did not find any mention in the Budget. Naturally, the industry was disappointed.

Essar Oil managing director and chief executive officer L K Gupta said Jaitley ‘has not addressed many of our genuine expectations.’

The industry wanted the government to remove basic custom duty on imported natural gas, currently at 5 per cent as it is an inverted duty.

"There is shortage of domestic natural gas and imported LNG is very expensive, thus putting additional burden on us," he said.

Also, with petro products out of the ambit of GST currently, the industry wanted the government to reduce CST to 1 per cent from 2 per cent, in line with the proposed Constitutional Amendment bill on GST, before eventually making it zero with bringing the petro products under GST.

"Here too, refiners bear this burden which is neither reimbursed by the customer not is recoverable or can be offset," he said, adding that the government has also not provided relief to exploration and production companies for their demand of service tax credit.

Deepak Mahurkar of PricewaterhouseCoopers said the reduced oil price created a significant space for the government to evaluate macro-economic policy options.

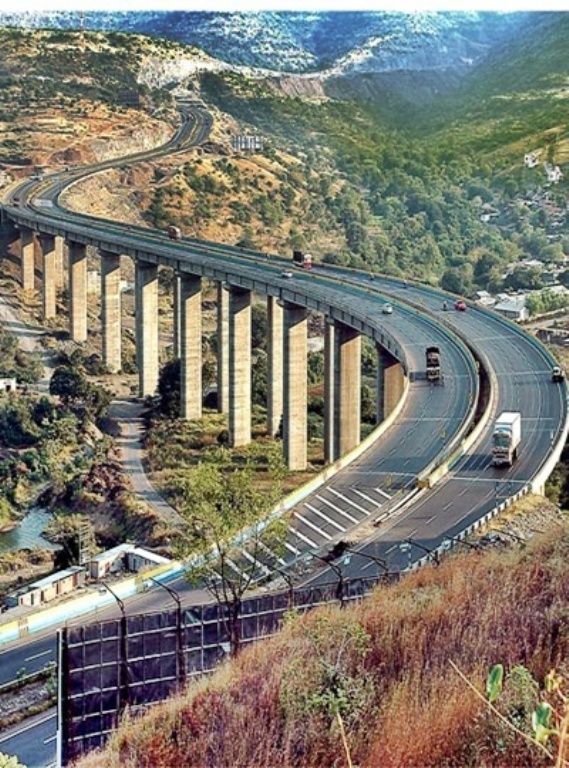

Photograph: Kind courtesy, NHAI