Kushal Pal Singh, chairman, DLF, said that the launch of the company's initial public offering is a significant landmark in its corporate history.

Kushal Pal Singh, chairman, DLF, said that the launch of the company's initial public offering is a significant landmark in its corporate history.

Real estate major DLF Ltd on Tuesday came out with a public issue of 175,000,000 shares of Rs 2 each, having a price band of Rs 500-550 per share.

The issue will constitute 10.26 per cent of the fully diluted post-issue capital of the company.

While around Rs 3,500 crore (Rs 35 billion) of the issue proceeds will be pumped in for acquisition of land in 62 cities across the country, Rs 3,493.4 crore (Rs 34.934 billion) will be put in for the expenditure of existing projects and the remaining for loan prepayments, said DLF vice chairman Rajiv Singh.

Sixty per cent of the issue has been alloted to qualified institutional buyers (QIBs),10 per cent to non-institutional bidders and 30 per cent to retail individual bidders.

DLF has also plans to foray into hospitality sector, special economic zones (SEZs), infrastructure and Insurance business, said Singh.

The company has tied-up with Hilton group and US-based prudential insurance and has kept an eye for more joint- ventures in domestic market.

"The company has a strong balance sheet and has a total asset strength of Rs 18,170.8 crore (Rs 181.708 billion) as on March 31," Singh said.

DLF currently handles residential projects in an area of 7 million square feet, while the commercial and retail project is being done in an area of 27 million square feet and 10 million square feet, respectively.

The company has land reserves of 10,255 acres with an estimated developable area of approximately 574 million square feet.

The issue will open for subscriptions on June 11 and will close by June 14.

DLF's mega issue will raise Rs 9,625 crore, at the upper band, from the market.

Post-listing, real estate major DLF will find a place among the top-10 companies in terms of market capitalisation.

The Delhi-based company's total enterprise value stands at Rs 85,221 crore (Rs 852.21 billion) on the lower side of the price band of Rs 500 a share on the total equity capital of Rs 340.88 crore (Rs 3.408 billion) of Rs 2 paid-up equity share.

On the higher side, DLF's current enterprise value stands at Rs 93,743 crore (Rs 937.43 billion). DLF will occupy the eighth position in terms of market capitalisation ranking, after Reliance Communications (Rs 1,03,110 crore or Rs 1,031.10 billion) and before ICICI Bank (Rs 82,119 crore or Rs 821.19 billion).

The company's enterprise value of Rs 85,221 crore (Rs 852.21 billion) constitutes 50 per cent of the total market capitalisation of real estate stocks listed on the Bombay Stock Exchange (BSE). It is almost 100 per cent of the total market value of real estate stocks.

The real estate sector will cross the market capitalisation of Rs 170,000 crore (Rs 1,700 billion) after the DLF listing. The sector will be among the top-ten sectors after telecommunication, oil exploration and power and ahead of pharmaceuticals, steel and engineering sectors.

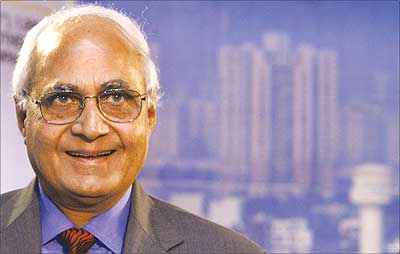

DLF chairman K P Singh.

Photograph: Sajjad Hussain/AFP/Getty Images