Edtech major Byju's is in process to raise Rs 600-700 crore to fund the company's operations till March by when it expects to realise money through the sale of Epic and partial stake sale in other subsidiaries, according to sources aware of the development.

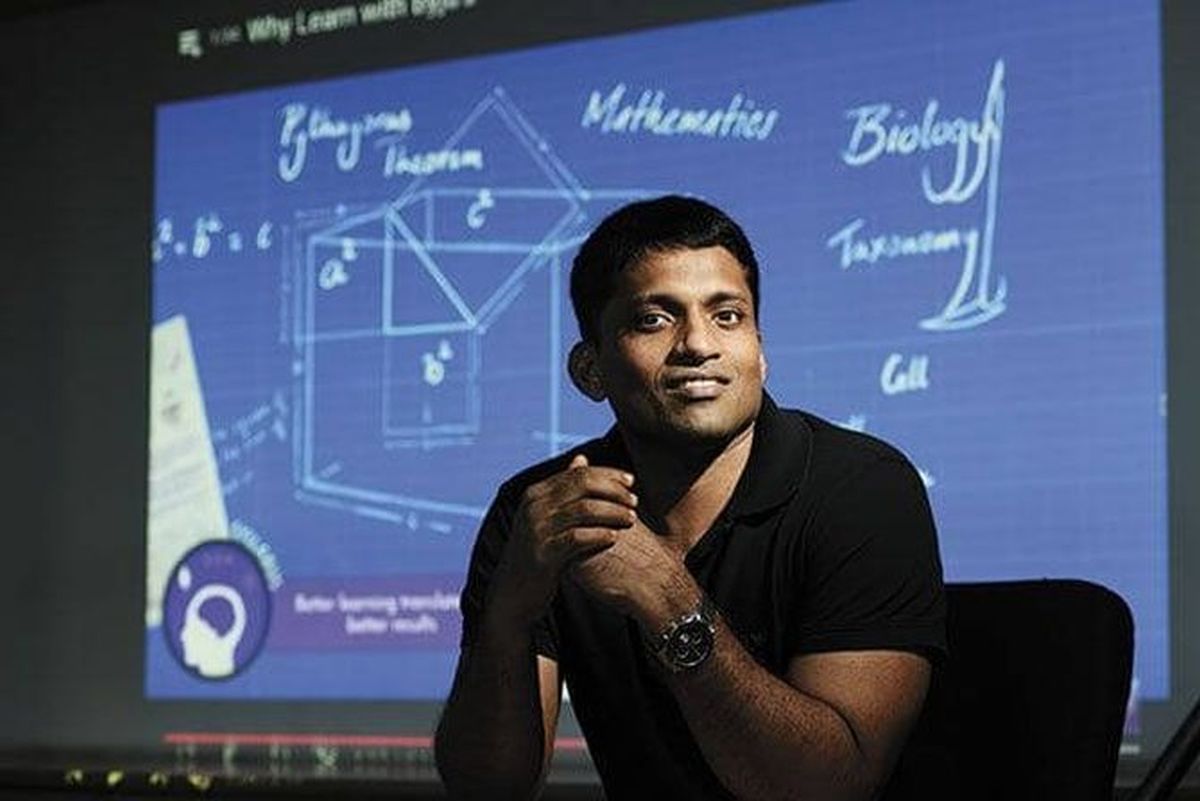

Byju's founder Byju Raveendran has recently raised money by mortgaging home and real estate assets owned by family members for paying salaries, sources said.

"There is about Rs 50 crore gap per month in operational expenses where a large component is salary.

"Promoters have pledged shares, home, and some other real estate assets of family members to bridge the gap," a source said.

"Promoters are also in the process of raising debt of Rs 600-700 crore to help operations till March.

"By March, the situation will ease with the sale of Epic and partial stake sale in some other subsidiaries," a source said.

Another source said Byju's has called an Annual General Meeting (AGM) on December 20 where the assets that have been pledged by the promoters will be brought to the notice of the company's board.

"The company is also in the process to submit a repayment schedule to the BCCI (Board of Control for Cricket in India) for Rs 160 crore sponsorship dues.

"Besides the sale of Epic, which is in advanced stages, existing investors are also expected to infuse funds into the company," the source said.

According to the AGM notice sent to shareholders, the company will also seek shareholders' approval for standalone and consolidated financial results for FY22.

An email query sent to Byju's elicited no reply.

Last month, Manipal Education and Medical Group chairman Ranjan Pai acquired a Rs 1,400 crore debt raised by edtech major Byju's from Davidson Kempner.

The settlement includes a penal amount claimed by Kempner against debt investment of $100 million, or about Rs 800 crore.

Pai is also in discussions to buy additional stakes in AESL shortly.

Ranjan Pai's proprietary fund, Aarin Capital, was the first institutional investor in Byju's in 2013.