Equity Benchmarks Sensex and Nifty closed higher for a second straight session on Monday as buying in index majors Reliance Industries, HDFC Bank and ICICI Bank helped the indices rebound from early lows amid a mixed trend in global markets.

Besides, weakening Brent crude oil prices overseas also boosted investor confidence amid simmering tensions in the Middle East, traders said.

Recovering after a sharp sell-off in morning trade, the 30-share BSE Sensex jumped 329.85 points or 0.52 per cent to settle at 64,112.65.

During the day, it rallied 401.78 points or 0.62 per cent to 64,184.58.

The Nifty advanced 93.65 points or 0.49 per cent to 19,140.90.

Among the Sensex firms, UltraTech Cement, Reliance Industries, ICICI Bank, HDFC Bank, Bharti Airtel, IndusInd Bank, State Bank of India, Tata Consultancy Services, Larsen & Toubro, Kotak Mahindra Bank and State Bank of India were the major gainers.

In contrast, Tata Motors, Maruti, Axis Bank, Mahindra & Mahindra, ITC, NTPC, Tata Steel and Bajaj Finserv were the major laggards.

In Asian markets, Seoul, Shanghai and Hong Kong ended in the green, while Tokyo settled in the negative territory.

Global oil benchmark Brent crude declined 1.55 per cent to $89.18 a barrel.

"The domestic market mirrored the upbeat European and Asian markets, as geopolitical risk in West Asia continues.

"Equities are experiencing a short-term bounce after the heavy selling last week, as crude moderates and Q2 results provide some relief.

"But a full containment will depend on a radical fall in geopolitical risk and global bond yield," said Vinod Nair, head of research at Geojit Financial Services.

Foreign Institutional Investors (FIIs) offloaded equities worth Rs 1,500.13 crore on Friday, according to exchange data.

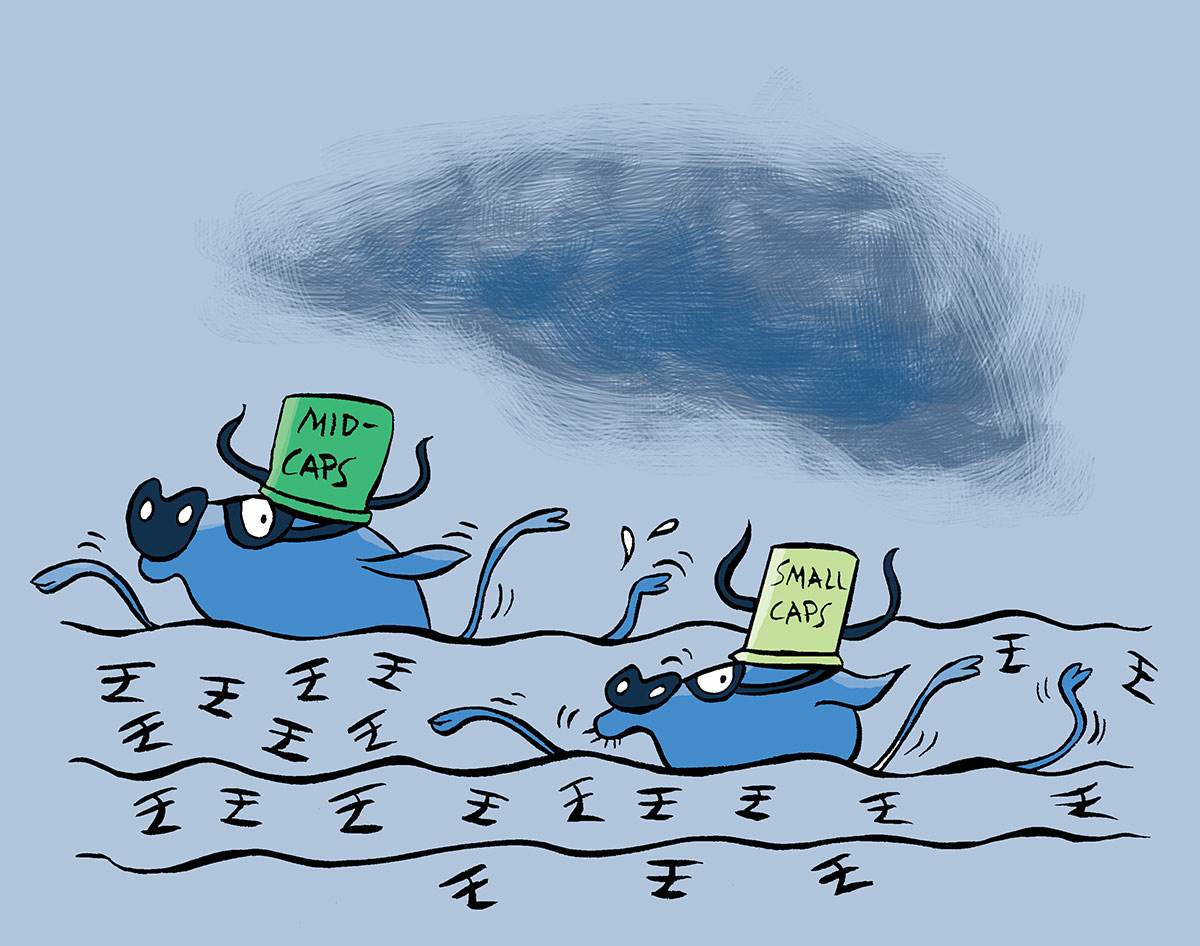

Foreign Portfolio Investors (FPIs) have pulled out over Rs 20,300 crore from Indian equities this month so far, primarily due to a sharp surge in the US treasury yield and the uncertain environment resulting from the Israel-Hamas conflict.