Portfolio management services (PMS), catering to higher networth individuals (HNIs), are facing tough competition from emerging alternative investment funds (AIFs), evident from their dwindling client base.

In May, the number of clients for the industry stood at 125,390, down 20,528 in two months, shows data from the Securities and Exchange Board of India (Sebi).

“PMS managers also have a high active ratio, which means their portfolios are quite differently positioned and more actively managed, compared to the benchmark, which is also a highlight for long-term investors.

"Last year was very challenging for PMS managers for generating alpha due to a variety of reasons and the complexity of index components driving it,” says Akhil Chaturvedi, chief business officer, Motilal Oswal Asset Management Company.

In the past five months, the assets under management for the PMS industry has ranged between Rs 26 trillion and Rs 28 trillion.

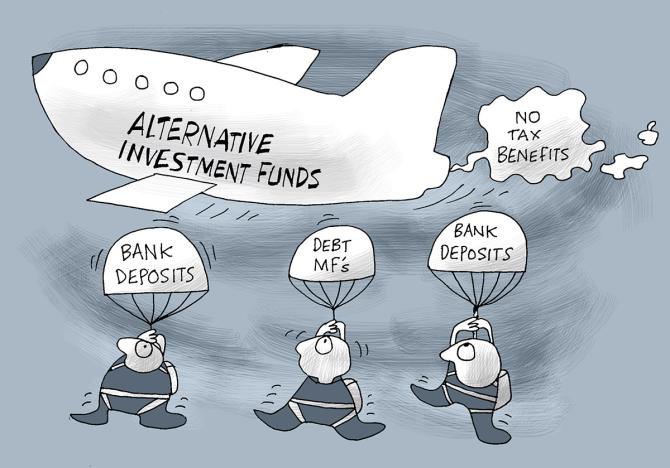

Although the returns in recent months for PMS have been improving, the competition now is with AIFs, for which the capital markets regulator has introduced trail-based fee structure and also mandated AIFs to launch direct plans.

“Increasingly, the preference of AIF as a vehicle has also increased, and we have seen a rebalancing of the portfolio from PMS to AIF in the past few years,” adds Chaturvedi.

While mandating direct plans for AIFs, Sebi had said these plans would not have any distribution or placement fee.

The regulator has also levelled the field for both by banning upfront commissions in AIFs.

However, one gap that remains is that of the relatively low entry barrier.

For the PMS industry, the minimum investment limit is Rs 50 lakh, against Rs 1 crore for AIFs.

Industry players believe that the recent move to keep debt funds out of indexation benefit has also affected the predisposition towards PMS, which manage a portfolio of assets like mutual funds (MFs), listed and unlisted equity, debt instruments, etc.

“One reason for the decline could be higher tax incidence with effect from April 1 on specified MFs in which PMS could be investing in the past.

"The other reason could be the more investor-friendly and flexible fee structure followed by AIFs,” says Punit Shah, partner, Dhruva Advisors.

Over the past year, the watchdog has announced a raft of measures to improve transparency, governance, and other such provisions for investor interest to provide these products with operational flexibility.

Data for Sebi shows that the total number of AIFs has risen to 1,114, of which 26 have come up between April and May 2023 and over 200 in the last financial year.

The investment commitments in AIFs, too, have seen a significant jump to Rs 8.33 trillion, while the total investments made stood at Rs 3.37 trillion as of March 2023.

However, the PMS industry is still hopeful with market sentiment improving and a higher number of people reaching HNI status in the coming year.

“Between the volume and value game, PMS strategies win over MFs in terms of per-customer value addition.

"As far as AIFs are concerned, the flexibility to take on higher risk is more in AIFs which might suit ultra-HNIs.

"But we believe PMS products with good performance to also grow since investing in complex asset classes is being made relatively easy using technology,” says Anil Rego, founder and fund manager, Right Horizons PMS.