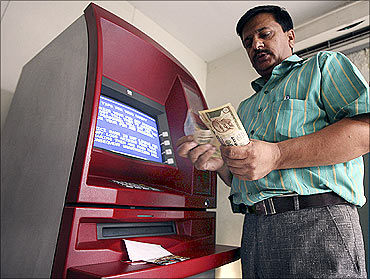

Here are a few things you should keep in mind when you're using an ATM.

ATMs might provide a nice blast of cool air in the summers, but if the money doesn't spit out of the machine, it can become quite a hassle. Remember, RBI has mandated that banks are supposed to pay you Rs 100 per day.

Using ATMs to withdraw money is often painful. You may get charged for using another bank's ATM. You may not receive the right amount of money. There can be unauthorised debits from your account. (Source: RBI).

Click NEXT for more

Courtesy:

Two main points to remember

You cannot be charged to use another bank's ATM according to the Free ATM Access Policy. But banks can limit the number of free transactions to five in a month. After this, the bank cannot charge more than Rs 20.

In cases of wrong debits, the bank has to return the amount within seven days. If there is a delay, the bank is liable to pay Rs 100 for each day's delay.

Recently, RBI reduced the period within which the bank is required to return the money from 12 days to seven days.

Click NEXT for more

Example number 1

Consider a few examples from the RBI Compendium of Cases Handled by the Banking Ombudsman Offices.

In complaint number 10, the complainant wasn't able to withdraw money because of a power supply failure. But Rs 600 was still debited from his account.

He contacted the bank but they did not respond.

As per the Ombudsman's judgment, the bank had to reimburse the amount.

Click NEXT for more

Example number 2

Complaint number 11 involved a debit of Rs 15,000 from the complainant's account by the bank. The complainant argued that this debit was unauthorised and that the amount should be re-credited into his account.

The Ombudsman found that the bank provided evidence for three transactions worth Rs 5,000 each. Since the card cannot be operated by anyone other than the card-holder, the complainant's argument was not accepted.

The bank was asked to explain the situation to the complainant and show him the evidence of the transactions.

Click NEXT for more

Example number 3

The last example is complaint number 33.

The complainant tried to withdraw Rs 5,000 from the ATM but he only got Rs 1,400. He didn't get a receipt either. He informed the security guard outside as well as the bank.

In the judgment, the bank was asked to credit the balance amount.