Follow these simple rules to create wealth for your family and you

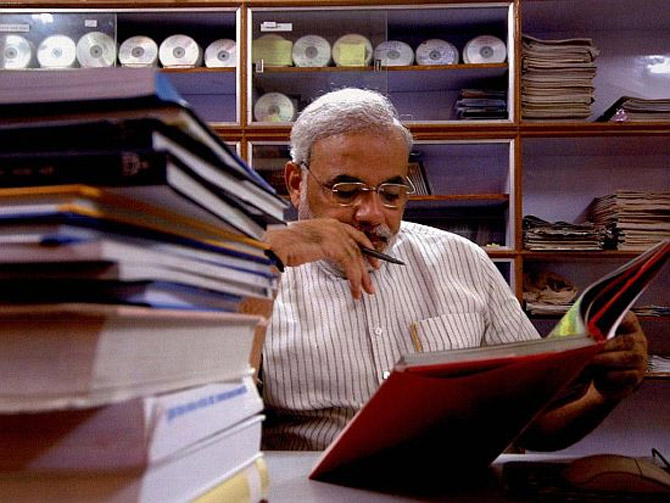

During the long drawn election campaign for the recently concluded 16th Lok Sabaha election, India witnessed a proficient orator and an excellent marketer in Narendra Modi, who made an impression on every voter in the country and created history by coming into power with a landslide victory.

Though the jury is still out on whether he can live up to the expectations of the countrymen at large, retail investors certainly stand to gain from him.

The gains so far have been tangible as the BSE Sensex, the 30 share benchmark index of the Bombay Stock Exchange (BSE), has already registered gains of 20 per cent in 2014 already as compared to gains of 9 per cent in the whole of 2013.

That apart, investors can take away a lesson or two about how to handle their finances from Prime Minister Narendra Modi as well.

Please click NEXT to continue reading

The author is a credit expert with 10 years of experience in personal finance and consumer banking industry and another 7 years in credit bureau sector. Rajiv was instrumental in setting up India's first credit bureau, Credit Information Bureau (India) Limited (CIBIL). He has also worked with Citibank, Canara Bank, HDFC Bank, IDBI Bank and Experian in various capacities.

If there is one thing that Narendra Modi lives by it is his discipline. Come what by he is known never to move away from his disciplined regimen.

This is a great thing to learn and emulate from our Prime Minister.

As an investor if you have a systematic and disciplined approach towards investing, your financial goals will seem much more achievable.

Chalk out an investment plan to meet the various financial goals you may have and invest accordingly.

One way to do it is investing in Systematic Investment Plans or SIPs that help you meet your investment objectives over the long term.

Please click NEXT to continue reading

As soon as Prime Minister Narendra Modi assumed office, he made it clear that he disliked clutter of any sort, and thus began the "cleaning drive" beginning with the babus.

The Prime Minister even made it clear that presentations had to be succinct to bring out important issues to the forefront.

Similarly, when it comes to your portfolio, take care to see that it is not a collection of unweildly investments that are causing clutter.

Ideally, there should not be more than 12-15 stocks in your portfolio.

If your portfolio is too large see whether you require diversification and distribute your investments among various asset classes.

Please click NEXT to continue reading

Modi has made it amply clear that he has zero tolerance for slack attitude.

Each member of his cabinet and the babus have to be on their toes and on the top of things, else heads will roll, as Modi has clearly communicated.

Similar should be your approach with underperformers in your portfolio.

Do not keep underperforming stocks in your portfolio forever.

The same holds true for mutual fund schemes.

If you find that a scheme is underperforming consistently as compared to its peers as well as the benchmark for over a year, use the first opportunity to sell out and deploy the funds elsewhere.

Please click NEXT to continue reading

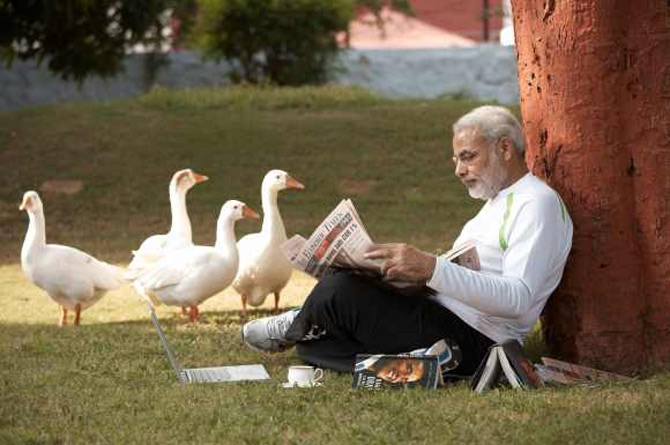

For the first time we have a Prime Minister in our nation who makes his opinion or action clear on any issue of national relevance on social media platforms. This shows that he is not just tech savvy, but likes to keep himself updated on every minor and major issue of national and international significance.

This is a lesson an investor can take from him as well.

As an investor, you should be cued in about what is happening across the markets and asset classes to ensure that you can take relevant action when need be.

Please click NEXT to continue reading

Modi is also known to be a leader who can take harsh decisions when need be, without worrying about criticism, whether it is from within his party or from the opposition.

This he can do because he believes he is in total control of the situation.

Similarly, if you have taken an investment decision after sound research, have the conviction to stand by it and do not get swayed by the noise around you.

Prime Minister Narendra Modi has displayed various traits that have come across as impressive in the first nine weeks that he has been in office.

Whether he can deliver on the great expectations India has from him remains to be seen, but small investors can certainly take lessons in money management from his personality traits in the meanwhile!