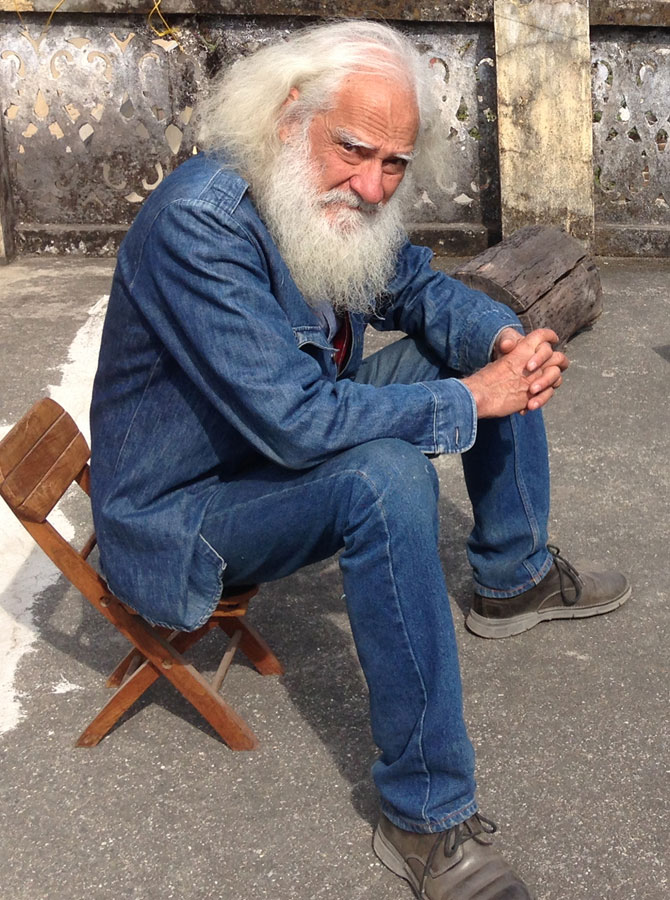

Former Union minister Salman Khurshid explains why the UPA government felt compelled to tax Vodafone and why the Modi-led NDA government is following in its footsteps in this matter.

Earlier this month, Vodafone International Holdings BV received a reminder from India's tax department, asking it to pay Rs 14,200 crore in retrospective taxes due, it says, after Vodafone acquired Hutchison Wampoa's telecom business in India for $11 billion in 2007.

In case of non-payment, the company was warned that its assets would be seized.

This notice comes soon after Prime Minister Narendra Modi, at the Make In India week, stated that his government would not resort to retrospective taxation.

When the tax notice was originally slapped on it, the British telecom major argued that no taxes were due -- the tax demand then was for Rs 7,990 crore -- since the transaction was conducted offshore. The Supreme Court had ruled in favour of Vodafone.

The UPA, which was then in power, carried out a retrospective amendment to the IT Act, as a result of which the Supreme Court verdict was bypassed and Vofadone was required to pay the tax amount.

Salman Khurshid, who was then part of the UPA government, and an eye-witness to what was happening, unveils what took place behind the scene.

The retrospective tax decision reversing the January 2012 Supreme Court verdict has often been cited as the reason for foreign investors losing confidence in India as an investment destination.

Vodafone -- a British telecommunications giant -- had been involved in a huge tax dispute with India's income tax department over the purchase of Hutchison Essar Telecom in 2007.

Although the transaction was centred upon a single share overseas in Cayman Islands (in the Caribbean Sea, known as a 'tax haven'), its sale gave Vodafone control of all assets in India.

India's Supreme Court, while overruling the earlier Bombay high court verdict of December 2008, came out in favour of Vodafone, stating that a transaction outside India between companies incorporated outside India did not fall within the taxing power of the income tax department.

In March 2012, the UPA II government chose to reverse the Supreme Court judgment and seek Rs 20,000 crore from Vodafone in recovery of tax plus penalties.

There may be some truth in that, but it is important that we do not overlook the fact that several other countries have implemented similar, though more limited, provisions of the law to correct fiscal aberrations and plug tax slippage.

One would have thought that if the Modi government really believed that to be a wrong decision, it would reverse it at the earliest opportunity. However, we saw nothing like that beyond Finance Minister Arun Jaitley touching on the issue in passing and promising not to resort to similar provisions in the future<./p>

I was personally opposed to the idea of reversing the Supreme Court decision right from the beginning and was encouraged by the immediate reactions of the then finance minister Pranab Mukherjee (who later became the President of India in July 2012) and P Chidambaram (then the Union home minister), who was to return to the North Block (in New Delhi, which houses the finance ministry) some months later.

But, ultimately, the die was cast in favour of retrospective taxation. The civil servants of the finance ministry were obviously concerned about tight liquidity as the Indian economy was subjected to aftershocks of the world economic slowdown resulting from the subprime crisis in the US in 2007-2008.

Chidambaram, a lawyer by profession, had himself found an out-of-court settlement in the Indian Tobacco Company matter in 1995. Unfortunately, Vodafone had not shown adequate interest in a negotiated resolution of the matter.

Furthermore, it is important that we do not overlook the fact that other jurisdictions like the UK and the USA have periodically resorted to retrospective tax provisions, albeit somewhat restricted in terms of the extent and the period.

There is a fine line between schemes to avoid tax and evade tax, the former being entirely legitimate. It is a fact of modern times and international taxation regimes that double taxation treaties and GAAR (General Anti-Avoidance Rule), at times, work somewhat unfairly as far as the state is concerned and therefore need permissible intervention.

Whatever be the view that one takes of the UPA decision, the subsequent reluctance or inability of the NDA government to reverse it indicates the urgency and necessity from the point of view of revenue.

But there is also a larger ideological position that a government can legitimately take. After all, the UK has a staggering succession tax or inheritance tax that has its fair share of its critics, but the government remains unmoved even as it clips income tax.

The British too have defended going against tax haven schemes that entail persons and entities not paying tax in either jurisdiction.

Seeking investment is an appropriate policy preference of any government but cannot be the sole consideration. But, of course, ensuring level playing fields and not reneging on publicly held positions that encourage investment is a must for responsible States.

When the issue of retrospective tax was on the anvil, I had spoken about it to Pranab Mukherjee as well as to P Chidambaram. I was certain they were both disinclined to take the retrospective route because of the adverse impact on investment sentiment.

Chidambaram even recalled the out-of-court settlement that had been accomplished with the ITC in 1995. (That agreement entailed the government giving up a claim of Rs 450 crore and, in return, the ITC gave up seeking a refund of Rs 350 crore).

But in the 2012 Budget proposals, Pranab Mukherjee, the finance minister, bit the bullet, ostensibly because of the very tight fiscal situation in the country.

When the finance portfolio came back to Chidambaram in July 2012, it seemed too late to reverse the position, but he did try to find an out-of-court settlement with Vodafone. After several false starts, the attempts were given up.

The Modi government did not do any better than to simply state its intent for the future without touching the existing retrospective tax provisions. Instead, it seems to have made peace with the industry in not appealing against the Rs 3,200 crore transfer tax judgment of the Bombay high court in the fresh Vodafone matter (January 2015). The court ruled that Vodafone was not liable to pay Rs 3,200 crore as tax demand.

Whilst it is true that such a rational and objective attitude towards the pronouncements of courts has been often suggested as a measure of enlightened governance, the fact remains that the concept of notional loss -- to the tune of Rs 176,000 crore -- propounded by the CAG in 2010 in the 2G matter is difficult to reconcile with this approach.

Would it just take a PIL and a zealous judge to upset the applecart for the present government as well? The incumbent ministers would be mistaken to believe that the demolition squad of activists will quietly return to the barracks.

In late March 2015, a PIL petition was filed against the Essar Group in the Supreme Court based on a whistleblower's disclosure. The apex court issued notices to the Essar Group and the Centre on the basis of this PIL seeking a court-monitored probe into an alleged nexus among the company and politicians, bureaucrats and journalists, involving, amongst others, Nitin Gadkari, the Union minister of road transport and highways.

If one digs deep enough, some relationship can easily be uncovered between political personalities and business houses. Unfortunately, in the climate of self-righteous, anti-corruption campaigns, ordinary civil relations are made suspect and doing the right thing by the law given an ugly twist of insinuation.

When times are bad, anything is believed about anyone. I am often reminded of the advice (politician, architect) Piloo Mody gave me, in the early 1980s, when I had returned from the UK to work as the officer on special duty to (then) Prime Minister Indira Gandhi: 'You can never tell when the truth is being told; so I follow a simple principle when someone tells me something about someone. Do I believe it? Is it something he would have done then I believe it even if he has not done it because he will one day do it anyway! On the other hand, if it is something he would not do I believe he has not (done it) even if he has because it must have been a mistake!'

The climate of a grand inquisition created during the second half of the UPA II's tenure (January 2012 to May 2014) was used to project the additional charge of policy paralysis against the incumbent government.

There certainly were some matters where lack of support from alliance partners made it virtually impossible to take on the obstructive Opposition, but most of the far-reaching next generation reforms were stalled by the BJP members consciously.

When we successfully outmanoeuvred them, as in the case of foreign direct investment in retail, they sought to spoil the game by threatening to reverse the decision upon coming to power.

Under the circumstances, investment was, not surprisingly, slow to flow in.

Excerpted from The Other Side Of The Mountain by Salman Khurshid, with the permission of the publishers, Hay House Publishers (India) Pvt Ltd.