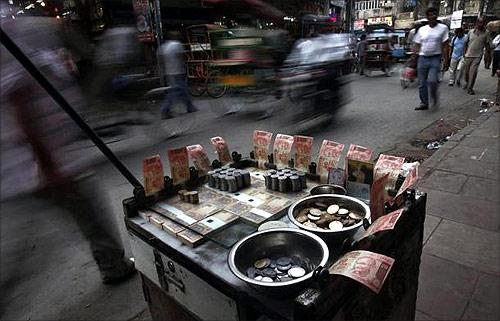

Photographs: Adnan Abidi/Reuters Shankar Acharya

Despite short-term economic weaknesses, India's long-term growth drivers of a youthful demography, technological 'catch-up' and demonstrated entrepreneurial talent remain in play, writes Shankar Acharya

By now everyone is familiar (unless they have been holidaying on Mars) with the litany of bad news on India's economic performance in the past year: growth sharply down, industry in the doldrums, inflation still uncomfortably high, fiscal deficits bloated by seemingly uncontrollable subsidies, external imbalances at record levels, investment climate gloomy, policy stasis continuing . . . and so on.

Nevertheless, looking ahead, future prospects are not necessarily of unrelieved gloom.

It is possible to construct plausible alternative scenarios: one moderately positive, another more relentlessly negative.

. . .

Indian economy: Half full or three-quarters empty?

Image: A woman sells drinking water near the Taj Mahal hotel in Mumbai.Photographs: Ahmad Masood/Reuters

Let us start with the positive first, the one that finds ready support from various senior government spokespersons. The ingredients include:

The US economy is still growing, even though slowly.

Europe seems to be coming to grips with her underlying problems and there is a real chance that, although growth will remain anaemic, a full-blown euro crisis will be avoided.

Lower oil and gold prices will help reduce India's external deficits.

. . .

Indian economy: Half full or three-quarters empty?

Image: A farmer ploughs his field to sow millet seeds against the backdrop of pre-monsoon clouds at Shapur village in Gujarat.Photographs: Amit Dave/Reuters

- Despite short-term economic weaknesses, India's long-term growth drivers of a youthful demography, technological "catch-up" and demonstrated entrepreneurial talent remain in play.

Further, the official national accounts still point to an aggregate investment rate of 35 per cent of gross domestic product in 2011-12.

This suggests that the current growth slowdown may be temporary, reflecting mainly global economic problems.

- The 20 per cent or so depreciation of the rupee in the past year should help correct current and capital account imbalances as time passes.

This substantial devaluation should also spur industrial and services activity for both exports and import substitution.

. . .

Indian economy: Half full or three-quarters empty?

Image: Employees affix a bonnet as they work on assembling a Mahindra Bolero vehicle at the company's manufacturing plant on the outskirts of Mumbai.Photographs: Vivek Prakash/Reuters

- Since the takeover of the finance portfolio by the prime minister a fortnight back, various senior government figures from the prime minister down have at last acknowledged the gravity of our economic problems and talked up a variety of likely policy changes/reforms including: dilution of General Anti-Avoidance Rules; some rollback of the retrospective tax measures adopted in the March Budget; significant increases in petroleum prices to reduce subsidies; revival of proposals for foreign direct investment in multi-brand retail and aviation; legislative progress on pension and insurance Bills; rapid progress on the goods and services tax; coordinated efforts to de-bottleneck major infrastructure projects; and other efforts to improve the investment climate.

Much of this is expected to happen after the presidential election is over.

. . .

Indian economy: Half full or three-quarters empty?

Photographs: Rupak De Chowdhuri/Reuters

. . .

Indian economy: Half full or three-quarters empty?

Image: A man walks in front of Hawa Mahal also known as 'Palace of Winds' in Jaipur.Photographs: Vijay Mathur/Reuters

So much for the positive story, which sees economic growth reviving to seven per cent this year and perhaps eight per cent in 2013-14.

The alternative, more negative view runs as follows:

- The global economic situation is still uncertain, with the European crisis far from resolved. Event shocks can still occur and, if they do, the damage to India could be significant.

- India's long-term growth drivers may be present, but their positive influence seems to have been outweighed by too many years of bad economic policies.

- It is unrealistic to expect a sudden resuscitation of good economic policies just because the prime minister has taken over the finance portfolio.

He may be able to dilute the damage inflicted by the March Budget. But the political feasibility of urgently needed administered price increases and the oft-listed raft of reform measures remain debatable.

There may be some progress but much less than the optimists expect.

After all, it was the same prime minister and the same United Progressive Alliance government presiding over the past eight years of non-reform.

. . .

Indian economy: Half full or three-quarters empty?

Image: The Taj Mahal.Photographs: Reuters

This is specially so when long overdue administrative reforms have not been implemented.

But when one considers some of the key sectors where states have primary responsibility, such as power distribution/pricing, agricultural research and extension, urban development, primary and secondary education and healthcare and overall governance, the performance is generally quite unsatisfactory, with very few good outliers.

So the states may not serve as major reform engines of the future.

The chances of that are now quite significant, given the massive rainfall deficiencies up through the first week of July.

. . .

Indian economy: Half full or three-quarters empty?

Photographs: Reuters

- As for the near future, the dismal performance of industry in the past year, coupled with signs of a slowdown in services, makes the prospects of a return to eight per cent-plus growth look increasingly dim.

- Quite apart from short-term growth prospects, the medium-term challenges of creating manufacturing jobs for the burgeoning labour force and providing viable structures of urban governance and finance to a rapidly urbanising population seem quite daunting, especially given the record of weak performance to date.

For example, significant chunks of labour-using manufacturing have been relocating out of East Asia as wages rise there.

But the preferred destinations continue to be countries like Bangladesh and Vietnam, not India.

Apparently, employment-friendly labour laws, basic skill endowments, infrastructure and investment climate offer a better package in those nations than we can.

So how does the glass look? You can take your pick.

On present trends, the three-quarters empty scenario looks more plausible to me.

Who knows, perhaps a strong burst of policy reform after the presidential election will confound my expectations.

The author is Honorary Professor at Icrier and former Chief Economic Adviser to the Government of India.

These views are personal

article