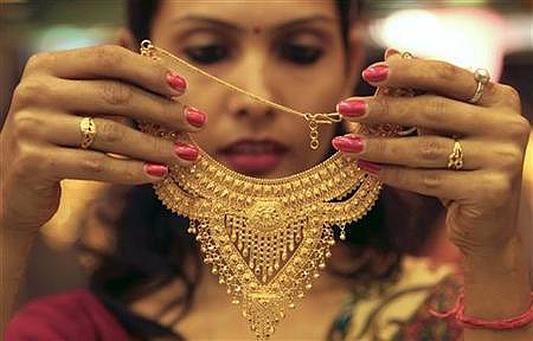

Photographs: Jayanta Shaw/Reuters Suvashree Dey Choudhury and Siddesh Mayenkar in Mumbai

The RBI plans to introduce three to four gold-linked products in the next few months, in an effort to bring 20,000 tonnes of gold held in households into the banking system, but the measure is unlikely to cut bullion imports sharply, a senior official said.

India is the largest importer of gold, which is its second biggest import item after oil and contributes around 10 percent to the total import bill.

Large gold imports are a worry for the government and the RBI, with the current account deficit shooting to a record high in the September-quarter, pressuring the rupee, and adding to inflationary pressures.

...

RBI to introduce gold-linked products to cut imports

Photographs: Siphiwe Sibeko/Reuters

The Reserve Bank of India (RBI) plans to mobilise the unused gold by lending it to importers and exporters of the yellow metal, in a move it hopes will bring down the demand for physical gold.

It wants banks to encourage products linked to accepting physical gold as deposits and investing public money in gold-related products, and extend loans against gold as collateral.

Indians own about 20,000 tonnes of gold, or three times the holdings of the US Federal Reserve, in jewellery, bars and coins.

"Overnight there won't be any reduction in imports, but people need to be made curious about new products," the RBI official with direct knowledge said.

...

RBI to introduce gold-linked products to cut imports

Photographs: Ajay Verma/Reuters

"The main conduits of gold imports are banks, forming 50-60 percent of the total imports and supplies to jewellers. The way banks are suffering from huge NPAs (non-performing assets), this is a good product to work on," said the official.

The RBI is likely to release its final report on issues related to gold imports and gold loans mid-next week, the official said.

The RBI is designing products that could replace physical gold demand to yield similar returns, with easy liquidity, and documentation.

Indian banks' total gold loans are worth Rs 1 trillion (Rs 100,000 crore). Manappuram Finance and Muthoot Finance, two of the top gold loan financing institutions, together have loan books of Rs 500 billion (Rs 50,000 crore ), the official said, indicating a large business opportunity.

...

RBI to introduce gold-linked products to cut imports

Photographs: Reuters

"The problem of gold imports can be solved only when the economy enjoys inflationary and macroeconomic stability," added the official.

Headline inflation has been above 7 percent in the last three years, prompting savers to invest in gold, stocks and real estate, which yielded higher returns compared with bank deposits.

The RBI estimates gold imports to fall by 25 percent in the current fiscal year ending March to 750 tonnes from a record of 1,079 tonnes in the previous year due to high import duty, a jump in prices, slowdown in economic growth, and a month-long jewellers' strike.

India's current account deficit would had been lower by $6 billion at 3.9 percent in 2011/12 instead of 4.2 percent, had imports grown by an average of 24 percent instead of 39 percent, the RBI said in a recent report.

article