Gold price surged to all-time high of Rs 21,000 per ten grams; while silver rate sets a new record of Rs 44,000 per kg in the Delhi bullion market on Wednesday on hectic buying from stockists triggered by sharp rise in the global market.

In New York, wary investors turned their attention to these metals as an alternative investment on mounting worries over a spreading debt crisis in Europe and news that Chinese authorities approved a fund to invest in gold overseas.

Gold for February delivery jumped by USD 18.60 to 1,386.10 an ounce on the Comex division of the New York Mercantile Exchange. Silver for March delivery jumped 3.8 per cent to USD 28.21 an ounce.

Silver gained 15 per cent in November. Turning to domestic market, standard gold (99.5 purity) resumed at Rs 20,715 from its previous close of Rs 20,540, revealing a rise of Rs 175 per 10 grams.

So why is the price of gold rising? Is this a good time to invest in gold?

. . .

Gold has continued to set new records and the prices have been rising over the years.

Gold prices touched at all-time record of over Rs 21,000-per ten gram on December 1, 2010 on the back of a strong marriage season demand, positive global cues and a weaker dollar.

Retail investment demand for gold has zoomed by 515.8 per cent to 109 tonnes. India consumes nearly 30 per cent of the world's annual gold production.

Here are the main reasons for the spurt in gold prices:

1. Tightening of gold supply

Gold mining is decreasing and the demand for gold is increasing. Gold supply has decreased by almost 40 per cent as the cost of mining, legal formalities and geographical problems have increased which has led to a fall in gold mining. Economics have taught us that lesser the supply, greater the demand and in turn greater the increase in price.

. . .

2. Inflation and interest rates

Gold has always been considered a good hedge against inflation. Rising inflation rates typically appreciates gold prices. It has an inverse relationship with interest rates. As gold is pegged to the US dollar, US interest rates affect gold prices. Whenever interest rates fall, gold prices increase. Lowering interest rates increases gold prices as gold becomes a better investment option vis-a-vis debt products that earn lower interest. Gold loses its shine in a rising interest rate scenario.

3. Low savings rate: With banks offering lower interest rates, fixed deposits make little sense. It is cheaper to even borrow money to invest in gold.

4. Festivals: Indians are among the largest consumers of gold. Gold has been used as ornaments and gifted during festivals and weddings. So there is a huge demand for gold during the festive season.

. . .

5. Currency fluctuation

As gold is pegged to the US dollar, it has an inverse relationship with the dollar. Right now with US being in great financial turmoil, the dollar has weakened against many other currencies.

Dollar is expected to weaken further and prices of gold are expected to rise further. Dollar is a de-facto currency of exchange around the world. But now with US on the brink of depression, gold is substituted as a safe haven for investments.

Though dollar seems to be getting stronger, it may be a temporary effect and very soon it can head southwards once again, in turn making gold an attractive and safe investment.

. . .

6. Geo-political concerns

Whenever there is geo-political strife, investors around the world rush to prevent erosion of their investments and gold as a safe haven attracts one and all.

For example after 9/11 terror strike in the United States the demand for gold had increased. With the recent events like tension between North Korea and South Korea, the ongoing war in the Af-Pak region, the tension between US and Iran coupled with recession have investors scrambling for gold.

7. Central bank demand

With the dollar losing its value, central banks of most of the developed countries have started to increase their share of gold. This explains the increasing market demand for gold.

. . .

8. Weakness in financial markets

General rule of thumb in the market is that gold is always attractive when all other investments are unattractive. Why is this? As gold is negatively co-related to stocks, bonds, and real estate, gold is considered to be a safe haven and hence during any crises, investors would like to sell off what they would term as risky investments and be invest the funds in gold.

So is gold a good investment. You bet, it is!

Here's why should you invest in gold:

High value and liquidity: It can be converted into cash and hence it is a highly liquid asset.

Good security: It is easy to get a loan banks since banks accept gold as security.

Investment in gold bonds: The other option is to invest in gold bonds or certificates issued by commercial banks. These bonds generally carry low interest rates and a lock-in period varying from three years to seven years. On maturity, depositors can take the delivery of gold or amount equivalent depending on their options.

. . .

No income tax: Since there is no regular income from investment in gold, the income will not be subjected to tax.

Stable investment: Gold pricing is not volatile so it remains stable. It is more stable than currencies.

Gold bars, coins: It is better to have 5-10 per cent of your net assets as gold. You can invest in gold bars and coins. You may not get a good price for jewellery because of making and processing charges involved in it. Smaller bars are more expensive than large bars but are easier to sell. Bars carry a higher price premium than coins.

Hallmark: Look for hallmark or BIS sign on gold bars and coins. It is a sign of quality and purity. Buy only from a known dealer or bank. It is better to buy gold coins and gold bars from banks like HDFC Bank, State Bank of Mysore, Bank of Baroda, Canara Bank, Corporation bank, ICICI Bank, etc.

. . .

Gold Deposit Scheme

You can deposit a minimum of 200 gm of gold with no upper limit, in exchange for gold bonds carrying a tax-free interest of 3 to 4 per cent depending upon the tenure of the bond ranging from 3 to 7 years. These bonds are free from wealth tax and capital gains tax. The principal can be collected back in gold or cash at the investor's option.

Gold ETFs

There has been a rise in the Gold Exchange Traded Funds (ETFs). ETFs are mutual funds that stock up gold and then issue units for the same value for investors to trade.

ETFs allow normal investors to hold gold electronically in paperless form. According to World Gold Council estimates, ETF demand for gold in the first half of 2010 stood at over 500 tonnes, three times their annual levels five years ago.

With the dollar losing its value, central banks of most of the developed countries have started to increase their share of gold. So there is a huge demand for gold.

The bulk of this growth will come from Asia led by China, India and the Middle East and is likely to have an immense impact on global precious metals demand. A high gold price is an indicator that all is not well with the global economy.

Here's how emerging nations like India, China countries are triggering a demand for gold.

. . .

The India factor

Gold has always been a popular investment both jewellery and bullion in countries like India and China.

India is the world's largest consumer of gold. With a population of 1.1 billion people, gold has a great future in India.

The Indian wedding season from December to May adds to the demand in gold. Any festive occasion is India sees a spurt in the demand. People even mortgage their properties to buy gold in India.

The China factor

Gold is a symbol of prosperity in China. China has also started investing more in gold. China has established gold exchanges. The Shanghai Gold Exchange has authorised the China Bank, China Industrial & Commercial Bank, China Constructional Bank and China Agricultural Bank as the banks for settling gold accounts.

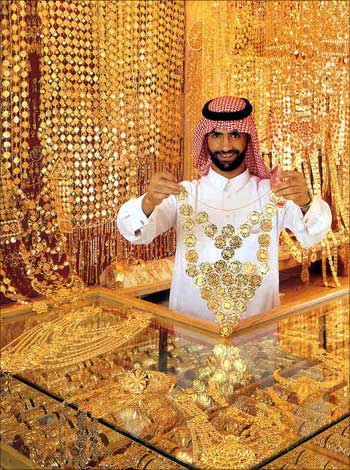

Middle East

Oil rich nations in the Middle East are investing more money in gold. Gold imports have risen steadily. Many OPEC countries have openly expressed their interest to move out of US dollar denominated assets.