The focus of Union Budget 2014-15 on infrastructure development by addressing some of issues and giving an idea of directional approach along with boost for domestic manufacturing sector with clusters and tax incentives to have cascading effect on the capital goods industry.

The focus of Union Budget 2014-15 on infrastructure development by addressing some of issues and giving an idea of directional approach along with boost for domestic manufacturing sector with clusters and tax incentives to have cascading effect on the capital goods industry.

Budget Provisions

- PSUs will invest through capital investment a total sum of Rs 247941 crore in the current financial year.

- Propose to take up Ultra Mega Solar Power Projects in Rajasthan, Gujarat, Tamil Nadu, and Laddakh in J&K. A sum of Rs 500 crore is allocated for this purpose.

- Launching a scheme for solar power driven agricultural pump sets and water pumping stations for energizing one lakh pumps with a budget allocation of Rs 400 crore in 2013-14.

- A sum of Rs 100 crore is set aside for the development of 1 MW Solar Parks on the banks of canals.

- Implementation of the Green Energy Corridor Project will be accelerated in this financial year to facilitate evacuation of renewable energy across the country.

- Capital outlay of Defence for 2014-15 is increased by Rs 5000 crore over the amount provided for in the interim Budget.

- “Pradhan Mantri Krishi Sinchayee Yojana”, a programme to improve access to irrigation got budgetary allocation of Rs 1000 crore for 2014-15

- Programme (Deen Dayal Upadhyaya Gram Jyoti Yojana) for feeder separation to augment power supply to the rural area and for strengthening sub-transmission and distribution systems got a budgetary allocation of Rs 500 crore.

- Increased budgetary allocation for PMGSY at Rs 14389 crore for 2014-15.

- A sum of Rs 100 crore is allotted for preparatory work for ‘Ultra Modern Super Critical Coal Based Thermal Power Technology’.

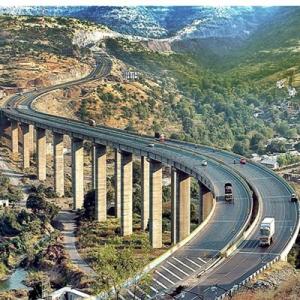

- Target NH construction of 8500 km will be achieved during CFY.

- Basic Customs Duty is being reduced from 10% to 5% on forged steel rings used in the manufacture of bearings of wind operated electricity generators.

- Full exemption from Special Additional Duty is being provided on parts and raw materials required for use in the manufacture of wind operated electricity generators.

- Full exemption from Basic Customs Duty is being provided on flat copper wire for use in the manufacture of PV ribbons (tinned copper interconnect) for solar PV cells or modules.

- Basic customs duty at a concessional rate of 5% is being provided on machinery, equipments, etc. required for initial setting up of compressed biogas plant (Bio-CNG).

- Basic customs duty and CVD on machinery, equipment, etc. required for initial setting up of solar energy production projects is being reduced to 5% and Nil respectively.

- Basic Customs Duty is being reduced from 5% to 2.5% on electrolysers and their parts/spares required by caustic soda or caustic potash units and membranes and their parts/spares required by industrial plants based on membrane cell technology. The BCD on other parts (other than membranes and parts thereof) is also being reduced from 7.5% to 2.5%.

- Plants & Equipment imported prior to year 2008 for use in projects financed by the UN or an international organization, which hitherto could not be transferred / sold / re-exported out of the project site, are now being allowed to be transferred / sold / re-exported from the project site subject to the conditions specified therein.

- Clarified that road construction machinery imported duty free can be sold within 5 years of importation subject to payment of customs duty on depreciated value and that individual constituents of the consortium whose names appear in the contract can import goods without payment of duty.

- Requirement of certification by Ministry of Road Transport (or NHAI) for availing of customs duty exemption on specified goods required for construction of roads is being done away with.

- Full exemption from excise duty is being provided on solar tempered glass used in the manufacture of solar photovoltaic cells or modules, solar power generating equipment or systems and flat plate solar collectors.

- Excise duty is being reduced from 12% to Nil on forged steel rings used in the manufacture of bearings of wind operated electricity generators.

- Excise duty on machinery for the preparation of meat, poultry, fruits, nuts or vegetables, and on presses, crushers and similar machinery used in the manufacture of wine, cider, fruit juices or similar beverages and on packaging machinery is being reduced from 10% to 6%.

- Full exemption from excise duty is being granted in respect of machinery, equipments, etc. required for initial setting up of solar energy production projects.

- Full exemption from excise duty is being provided on machinery, equipments, etc. required for initial setting up of compressed biogas plant (Bio-CNG).

- Full exemption from excise duty is being provided to reverse osmosis (RO) membrane element for water filtration or purification equipment (other than household type filter).

- Infrastructure Investment Trusts (InvITs), a modified REITS type structure for PPP and infrastructure projects will also have similar tax efficient pass through status. This brings in fresh equity by attracting long term finance from foreign and domestic sources including NRIs.

Industry expectations

Excise duty paid by the domestic manufacturers of power plant equipment be refunded as deemed export benefit so as to bridge the gap between the import duty structure and cost disadvantage suffered by the domestic industry.

Merit rate of 6% excise duty should be imposed on all products supplied to power generation, transmission & distribution projects till the time a uniform GST is implemented.

Import of CRGO electrical steel, which is a key raw material in manufacturing of transformers, be allowed at NIL duty till such time the country sets up indigenous manufacturing and achieves self-sufficiency in its production.

The sub-contractors supplying/catering to the projects covered under the notification (number 108/95-C.E dated 28.08.95) should also get the benefit of excise duty exemption.

Power generation, transmission & distribution related services should also be exempted from payment of service tax alike other infrastructure projects such as roads, airports, railways and transport terminals, bridges, tunnels and dams.

Reduce Corporate TDS rate for contractor from 2% to 1%. Contracting / Sub-contracting businesses do not have sufficient margin or cash flow to withstand a deduction of 2% from their fund flow.

Import of capital goods under 0% category for project imports and others should be removed so as to offset cost disadvantage faced by domestic manufacturer of such capital goods and encouraged domestic manufacturing.

Accelerated depreciation for Wind projects, which will bring back demand for WTG

Analyst Expectations

Central government programmes APDRP and AIBP, TUFs etc are likely to get greater allocation so as to improve efficiency of the domestic power/ textile industry. The renewable energy sector is also likely to get a renewed thrust with increased allocation of subsidy.

Stock to watch

BHEL, Thermax, ABB, Alstom T&D and Crompton Greaves

Summary

Budget announcement of a capital investment of Rs 247941 crore in the current financial year by PSUs is a positive for the capital goods sector as it accelerate the order finalization and execution. The budget by extending the sunset clause u/s 80IA for tax holidays for power projects up March 31, 2017 along with setting up of infrastructure investment thrust with tax pass through along with assurance in the budget speech for coal supply is to boost the investor confidence apart from accelerating development of ongoing projects. This will naturally have positive influence on power generation equipments industry. Similarly the feeder separation for rural power supply as well as accelerated implementation of green corridor will give boost to T&D EPC and equipments suppliers.

The confidence of completion of 8500km of national highway this fiscal along with increased budgetary allocation of PMGSY will boost the demand for road construction and earth moving equipment industry. Increased budgetary allocation more than interim budget for defence capital expenditure will augur well for players such as BEML/BEL.

Silence on reinstatement of accelerated depreciation which would have boosted the demand for WTG is a disappointment.

Please click here for the Complete Coverage of Budget 2014 -15