'There is a huge tax differential of 15% to 20% depending on income classification.'

Sachin P Mampatta reports.

The latest set of tax data shows a persistent oddity when it comes to short-term capital gains tax.

Around 97.8 per cent of them recorded zero short-term capital gains tax in 2016-2017.

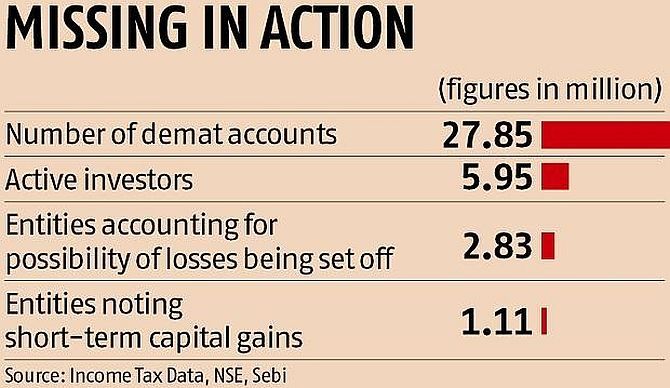

The 1.1 million who have recorded any short-term capital gains tax account for only around one-sixth of active clients.

Even after adjustments for the possibility of carry-forward losses, the possible number of those recording short-term gains is only one-tenth of the demat accounts in existence at the time.

This is in spite of rising markets in the year under question.

The stock market barometer, the S&P BSE Sensex, rose 16.9 per cent in 2016-2017.

Short-term capital gains tax extending to other investments including real estate and gold would mean the number of those with stock market trading would be lower than the headline figure suggests.

The tax data for 2016-2017 shows there are 49.9 million tax-filers in the country.

According to National Stock Exchange data, the number of active clients is 5.95 million.

The number of demat accounts in existence at the end of 2016-2017 was 27.9 million.

Investors can also set off earlier years' losses against the gains of the current year, which could contribute to reducing the number of people having to record short-term gains.

The number of entities who have set off losses in this fashion is 1.7 million.

The sum of these two figures (those recording short-term capital gains, and those with carry-forward losses) is still a fraction of the total accounts and active clients.

This is assuming that each of these managed to exactly set off their gains against past losses, which would be unusual.

Similar gaps were seen in previous years as well.

Another possibility could be that traders sometimes classify their stock market activity as business income.

However, experts feel this is an unlikely cause for the low number of filings because of the higher tax liability that this would entail.

"Generally individual taxpayers don't report the income from stock market investments as business income specially where such taxpayers have another primary occupation. In any case there is a huge tax differential of 15 to 20 per cent depending on income classification," says Rajesh H Gandhi, Partner-Tax, Deloitte Haskins & Sells LLP.

"I don't think people will be filing it as business income because reporting under capital gains is so much more beneficial..." says Suresh Surana, founder, RSM India.

Increasing mutual fund investments and a longer-term focus among investors, he adds, could be among the reasons for the low number of filings with capital gains reporting.

"It could also be that short-term capital gains are not being fully reported," he explains.

There may be some individuals who are using the income tax return form ITR-1 for filing their income though it is only supposed to be used by those with no capital gains.

People use it because of ease of filing, Surana added, though it is not allowed.

The possibility of the majority of demat account holders being long-term investors seems remote.

The average holding period for investors was only 24 days, according to the data compiled as part of a November 2011 paper entitled Behavioral Biases, Investor Performance, and Wealth Transfers between Investor Groups, from authors Sankar De of the Indian School of Business, Kellogg School of Management's Naveen R Gondhi and the Indira Gandhi Institute of Development Research's Subrata Sarkar.

Hitesh Gajaria, head of tax at KPMG in India, says the introduction of long-term capital gains tax of 10 per cent from 2018-2019 could have an impact on trends.

"Some long-term capital gains could move to the short term capital gains category if other reasons to sell are more compelling than the 5 per cent differential tax," Gajaria says.

The government, he adds, had been using technology to connect taxpayer information which would lead to better compliance and disclosure in the future.

Ilustration: Uttam Ghosh/Rediff.com