India imports 1.2 billion barrels of oil, and oil prices are falling, falling...

Anup Roy reports.

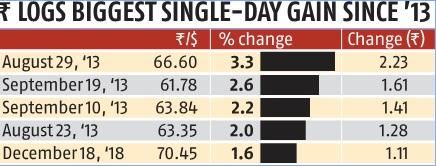

The Indian rupee gained the most in five years, aided by a sharp correction in crude prices.

The Indian rupee ended at 70.45 a dollar, gaining 1.57 per cent intra-day, its biggest one-day gain since September 19, 2013.

The rupee had closed at 71.55 a dollar on Monday, December 24. The present level though, is at a two-week high.

The gain was caused by a 4% fall in Brent crude prices to $57.20 a barrel.

The crude oil prices were at $86 a barrel even in September.

The sharp correction in oil prices may have saved about $30 billion in import cost for India, considering the country imports 1.2 billion barrels of oil.

"The rupee responded to oil prices, but there was also some heavy dollar inflow," said a senior dealer with a foreign bank.

Nationalised banks were seen buying dollars, and they may have bought dollars on behalf of the central bank as well.

As the oil bill falls, the chances of fiscal deficit widening reduce.

This is certainly reflected in the trade data for November, showing trade deficit narrowing to $16.7 billion, from $17.1 billion in October.

This would allow the government to stick to its borrowing plan.

Reflecting the change in the level of fiscal stress, the 10-year bond yields also fell 12 basis points to close at 7.35%, an eight-month low.

The chances of rate cuts have increased with the new Reserve Bank of India governor in place, and with favourable numbers.

Policy rate changes, though, impact short-term rates much more sharply than longer-term rates, showed an interesting staff study of the RBI.

'Policy rate is found to be a key driver of bond yields of short-term securities, and the impact on yields weakens as the tenure of the bonds increases,' said the study by Muneesh Kapur, Joice John and Pratik Mitra.

'Estimates in this study suggest that an increase of 100 bps in the policy rate could, over time, lead to an increase of around 95 bps in yields of 15 to 91 days residual maturity treasury bills and around 20 bps for 10-year government securities,' the researchers said in their paper.

The size of the government's borrowing programme, foreign portfolio investments in the domestic bond market, and foreign bond yields are also found to move domestic government bond yields, although the impact of these factors differs across maturities, the study said.