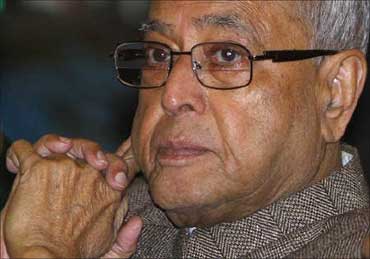

Admitting that the situation has not changed much during the past one year, Finance Minister Pranab Mukherjee on Wednesday said that he will have to address the slippages in economic parameters in the upcoming Budget.

Admitting that the situation has not changed much during the past one year, Finance Minister Pranab Mukherjee on Wednesday said that he will have to address the slippages in economic parameters in the upcoming Budget.

"I must confess, at this point in the year, I find myself in much the same situation," he said 84th annual general meeting of Federation of Indian Chambers of Commerce and Industry in New Delhi.

As I set about preparing the Union Budget for the next year, I have to take stock of the developments in the past months and find ways to address the slippages, the gaps and building on outcomes that need to be consolidated in the ensuing years," he said.

Warning that the months ahead are difficult, he said the growth rate could fall below 7.5 per cent in the current financial year from 8.5 per cent a year ago.

"We have difficult last quarter ahead of us in this fiscal year.

"Our growth for 2011-12 may be around 7.5 per cent or less," he said.

Click here for Rediff Realtime News!

There are also concerns on the central government finances for the current fiscal, he said, adding, performance during the first half on the fiscal front poses some risks in both receipts as well as expenditure estimates.

"Adhering to the fiscal deficit target of 4.6 per cent of gross domestic product in 2011-12 is a major challenge," he said.

The government proposes to bring down the fiscal deficit in the current fiscal to 4.6 per cent of the gross domestic product from 4.7 per cent a year ago.

However, the surge in subsidy bill and poor realisation from disinvestment has made the task difficult.

According to official estimates, the subsidy bill of the government is likely to exceed Budget projections by about Rs 1 lakh crore (Rs 1 trillion) during 2011-12.

As far as disinvestment is concerned, the government has been able to mop up just around Rs 1,100 crore (Rs 11 billion), against a target of Rs 40,000 crore (Rs 400 billion).

Claiming that India's growth fundamentals are strong, Mukherjee said they look more attractive in a world challenged by problems of confidence and lack of growth.

"India's robust performance in difficult times shows that we could actually come out stronger from the crisis," he said.

There are some clear signs of inflation moderating in the coming months, he said, adding, "I expect it to be in the range of 6-7 per cent in end-March, 2012."

Industrial production is also showing signs of a pick-up.

While the services sector has retained its growth momentum, agriculture sector expansion despite high base year production is likely to provide a buffer for the moderation in growth rate in the current fiscal year, he added.

He, however, said, "We have to be alert to shape the required policy responses, reform systems, improve the regulatory framework of our institutions to make the most of the opportunities coming our ways."

There have been a host of policy measures, including incremental changes in easing capital controls, making available a framework for pooling of debt finances for infrastructure and various other measures which lend credence to the commitment to economic reforms, he added.

Acknowledging that the process of reforms sometimes gets events, the Finance Minister said, "This is in the very nature of our democracy and its polity."

"High income country growth is now expected to come in at 1.4 per cent in 2012 (-0.3 per cent for euro area countries, and 2.1 per cent for the remainder) and 2 per cent in 2013, versus a June forecast of 2.7 per cent and 2.6 per cent for 2012 and 2013, respectively," it said.

The report further added: "Developing country growth has been revised down to 5.4 per cent and 6 per cent versus 6.2 per cent and 6.3 per cent in June."

Global trade is projected to grow by only 4.7 per cent this year, compared to 6.6 per cent in 2011.

However, trade is likely to bounce back in 2013 with an annual growth of 6.8 per cent.

The fall in trade is on account of a reduction in trade financing by banks.

The report said in the event of a major crisis, the global downturn might last longer than the 2008-09 slowdown as high income countries do not have the fiscal or monetary resources to bail out the banking system or stimulate demand to the same extent as four years back.

"Although developing countries have some manoeuverability on the monetary side, they could be forced to pro-cyclically cut spending -- especially if financing for fiscal deficits dries up," the World Bank said.

It also said that developing countries are more vulnerable now than they were in 2008.

According to the report, even though fiscal conditions in developing countries are better than in high income countries, government balances have deteriorated by 2 per cent or more of the GDP in almost 44 per cent of developing countries.

". . . and some 27 developing countries have government deficits of 5 or more per cent of GDP in 2012.

"As a result, developing countries have much less fiscal space available to respond to a new crisis," it said.

Image: Pranab Mukherjee