It is difficult to reconcile these numbers with other economic indicators.

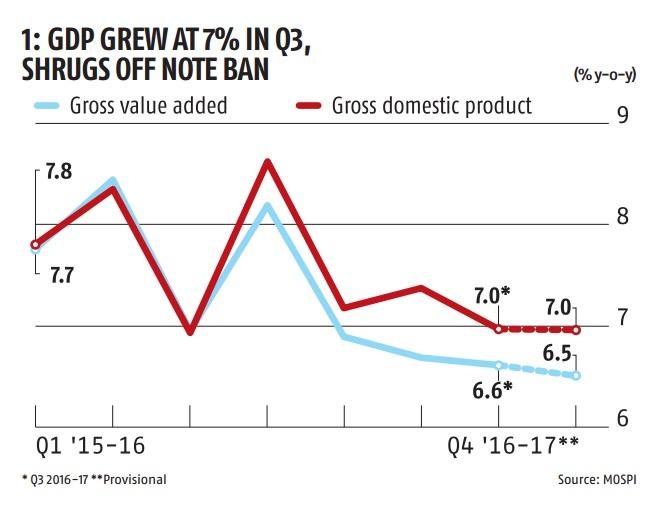

Withdrawing 86 per cent of the currency in circulation was widely expected to dent growth in the third quarter. Instead, estimates of gross domestic product (GDP) released by the Central Statistics Office (CSO), show an economy in the pink of health. As chart 1 (below) shows, GDP grew by a healthy seven per cent in the third quarter.

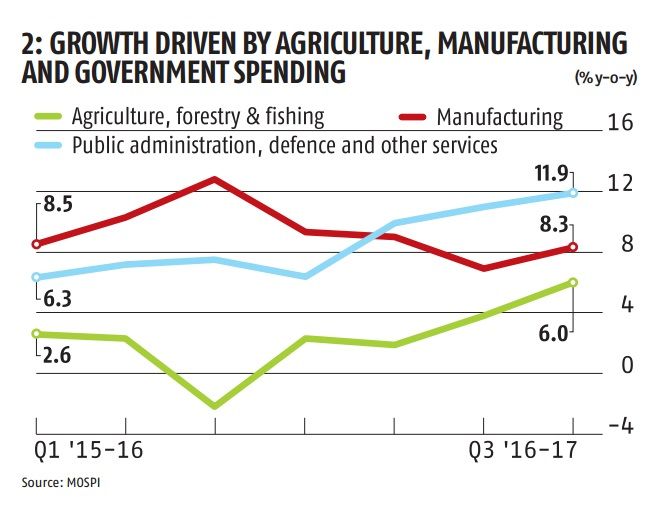

Some sectors like construction, and financial, real estate and professional services did witness a slowdown. But as shown in chart 2 (below), faster growth in agriculture, manufacturing and government spending more than compensated for the slack, pushing up growth.

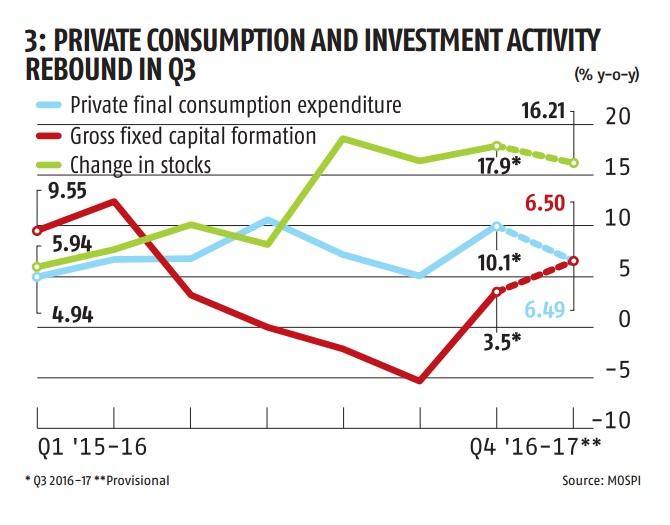

On the expenditure side, the numbers make an interesting read. As chart 3 (below) shows, private consumption grew by a staggering 10.1 per cent in the third quarter. Gross fixed capital formation, which connotes investments, expanded by 3.5 per cent in the third quarter, after contracting in the previous three quarters.

It is difficult to reconcile these numbers with other economic indicators.

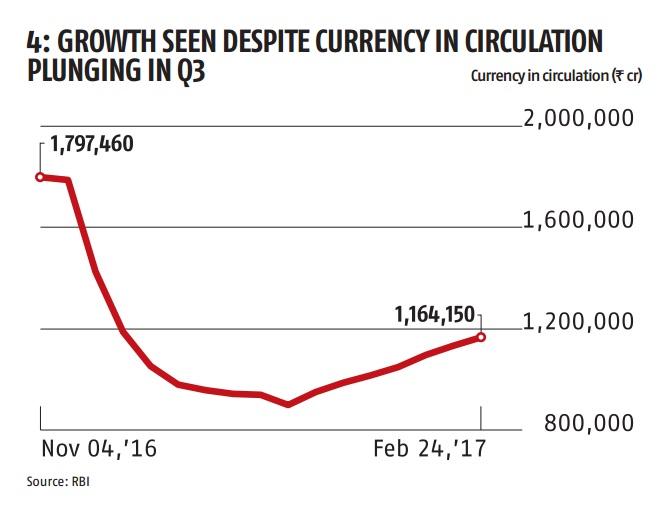

Could consumption have grown by 10 per cent, considering that during this period the currency in circulation (chart 4, below) actually plunged?

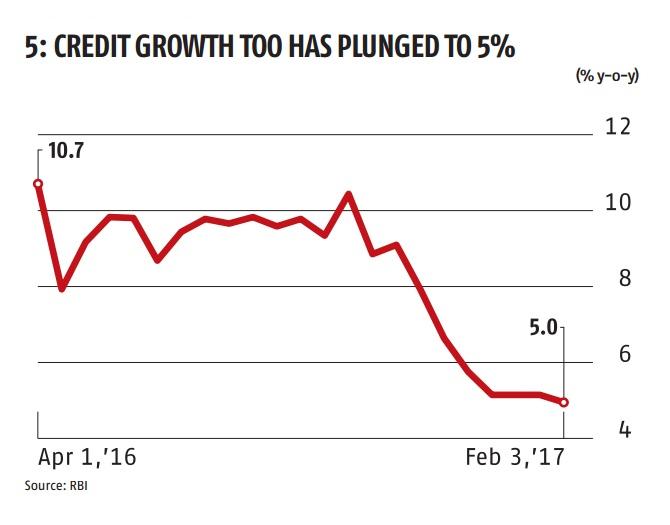

Could investments have taken off during a period when bank credit growth (chart 5, below) collapsed to five per cent?

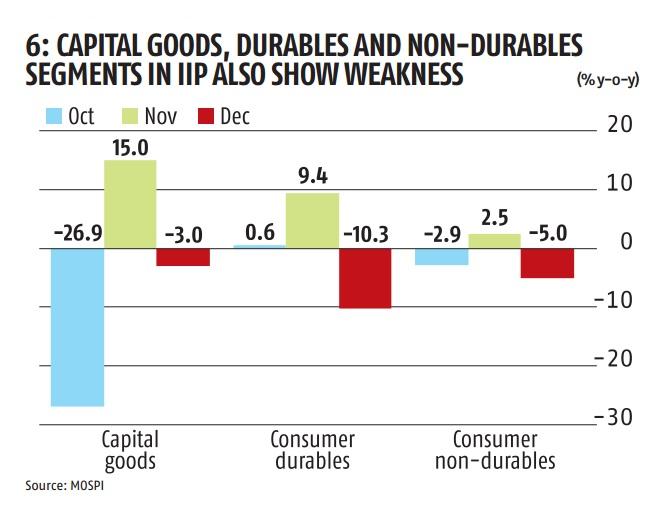

Other economic indicators also showed weaknesses during this period. The capital goods segment of the index of industrial production, an estimate of investment demand, contracted by 7.7 per cent in the third quarter as seen in chart 6 (below). Similarly, the consumer durables segment as well as the non-durables segment contracted by 0.3 per cent and 2.1 per cent, respectively.

Perhaps as some economists have said, these are preliminary estimates, which exclude the impact of the note ban on the informal economy.

Perhaps as some economists have said, these are preliminary estimates, which exclude the impact of the note ban on the informal economy.

Perhaps stocks held by distributors and wholesalers showed higher consumption.

For more robust estimates of economic activity after demonetisation one will have to wait.