Clarity on Paradip refinery crucial for the stock, notes Ujjval Jauhari

Clarity on Paradip refinery crucial for the stock, notes Ujjval Jauhari

The US-Iran nuclear deal has again pushed crude oil prices into a bearish phase and, consequently, investor focus on domestic oil marketing companies.

Brent crude, which in May had rebounded to $70 a barrel after a six-year low of $45 in January, has again dropped to $57.

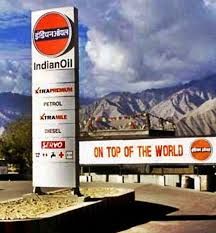

For the stocks, Hindustan Petroleum Corporation Limited and Indian Oil Corporation hit 52-week highs of Rs 872.55 and Rs 449, respectively, on Thursday, while Bharat Petroleum Corporation Limited at Rs 937, too, is trading close to its high of Rs 952.87 a few days ago.

The OMCs have been in a sweet spot since the oil and gas reforms started.

While petrol and diesel price deregulation accrued benefits on the subsidy front and resultant decline in working capital requirements (thus, lower interest outgo), the direct subsidy transfer is accruing more benefits.

The fall in crude prices has added to the gains.

And, if reforms on kerosene subsidy take place, there can be more.

However, the dynamics for all three public sector OMCs are different.

While BPCL is also into oil exploration and production and thus E&P upsides from Mozambique and Brazil are key medium-term

HPCL is the most sensitive to oil prices and reforms and has outperformed the other two OMCs.

Nevertheless, the stock has achieved most price targets set by brokerages as Rs 870 of IIFL or Rs 876 of Motilal Oswal, etc.

Therefore, a further upside will be driven by new developments, in the form of fresh reforms or further fall in crude prices.

For IOC, however, the valuation discount vis-à-vis HPCL and BPCL has widened in the current rally.

But, some catching up can take place. Analysts at Nomura, in their July 2 report, said ex-investments and E&P, BPCL (1.5x) and HPCL (1.3x) are currently trading at much higher multiples than IOC (0.9x).

Hence, they preferred IOC among the three, with target price of Rs 515.

For OMCs, profitability is led by their refining business, inventory changes and marketing margins.

While all the three have had a similar trajectory on inventory and marketing margins, in the refining segment the Street is awaiting clarity on profitability of IOC’s Paradip refinery.

Any positive news can drive stock prices further.