Photographs: Raj Patidar/Reuters

The mid-quarter statement of the RBI in March was seen as a hawkish stance. The sentiment was also evident in the bond market, as yields rose. What changed in the past month that prompted a more-than-expected rate cut?

Expectations don't influence our decision. What changed between March 15 and April 17 is that, first, we had the IIP numbers that showed industrial production had gone down much more than expected earlier and the growth for last year would have been 6.9 per cent, as projected by the CSO.

Inflation numbers that came yesterday showed headline inflation has gone down but core inflation has gone down much more (below five per cent - for the first time in two years). These were the two main dimensions that influenced the policy decision.

Click on NEXT for more...

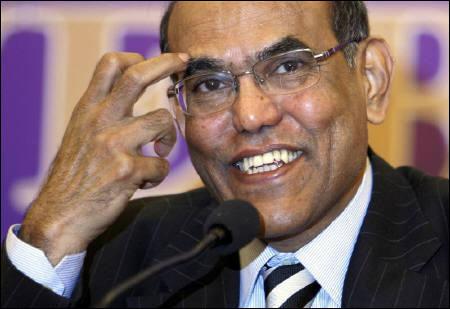

Rate cuts will revive India's growth: D Subbarao

Photographs: Reuters

In the macroeconomic and monetary development report released on Monday, it was said the policy stance was neutral. With today's rate cut, can we say the policy stance is accommodative?

No. I believe today's rate action reflects today's growth-inflation dynamics. You cannot say we are in an accommodative stance now.

We are at the appropriate stance as required by the growth-inflation numbers, as we expect these to roll out in the next one year.

You have said there is limited scope for a further rate cut. Does that mean there is still scope for a rate cut?

Yes, of course. It does mean that. These are not cast in stone. We said the probability for further action is limited because the economy will be growing at 7.3 per cent this year, just short of the trend rate of growth.

So, the output gap might be closed. But, if these numbers change, there will be scope for further rate cuts.

Click on NEXT for more...

Rate cuts will revive India's growth: D Subbarao

Photographs: Reuters

If the inflation forecast for March-end is 6.5 per cent, then why is the scope limited?

Our projections for growth and inflation have been factored in our action today. So, if we do have to do further easing, we necessarily have to reckon with inflationary expectations.

What is your corridor or comfort on real policy rates?

We don't have a corridor or a comfort. But, real policy rates were negative until recently and just about became positive. While we don't have a target, we look at it as one of the variables that go into our policy analysis.

In case inflation moves up during the course of the year, will the RBI change its inflation forecast and tighten monetary policy?

It depends on what the drivers of inflation are and how we see them rolling out. If the drivers are one-off shocks, then there is no need for a policy response.

But if it is a persistent shock, then of course the headline will translate into generalised inflation and then we will have to respond.

Click on NEXT for more...

Rate cuts will revive India's growth: D Subbarao

Photographs: Reuters

How confident are you that the rate cut will support growth?

Quite confident, because one of the motivations for easing monetary policy is to revive investments. We had said that monetary tightening was not the only factor behind an investment or growth downturn.

There were other factors like domestic policy and governance issues, but in as much as the monetary policy is one of the factors, we hope our easing will encourage investment and generate a supply-side response, both to raise growth and keep inflation down.

What are the possible tools the RBI can employ if global capital inflows dry up?

I can't really speculate what we might do but we will try our best to mitigate the risk factors and to bring in comfort or reduce the discomfort.

But, ultimately, balance of payment (BoP) pressures cannot be mitigated by fixes but fundamental changes have to take place to make exports competitive, make imports price-elastic and get capital flows of more durable variety like FDI.

Ultimately the BoP issues will have to be addressed by deep-rooted reforms.

Click on NEXT for more...

Rate cuts will revive India's growth: D Subbarao

Photographs: Ajay Verma/Reuters

How credible was the road map on fiscal consolidation presented in the Budget?

We have to take them at face value. The finance minister said he would bring in new FRBM, he would cap subsidies at two per cent of GDP, and that they are working on DTC and GST, which are going to be game-changers in many ways. So, I think if all these things are carried through, the road map will be credible.

Deposit growth in the banking system came down sharply last financial year, except for the last week. What was the reason for that?

When we spoke to banks today, they said they had been crowded out, with competitive instruments like small savings and by tax saving bonds came to the market, where the post-tax yields are much more attractive than banks.

So, as we have reduced rates, banks might respond with reducing their deposit rates and we hope other instruments in the market should respond likewise. It cannot be the case that one segment of the market is fixed and the other segment is flexible. The entire market has to be flexible.

Are you confident of monetary transmission?

Fairly confident, I should say. I heard the banks say transmission would take place but, probably, it might happen with a lag. We leave it at that.

article