Home, auto and other loans are set to become costlier with the Reserve Bank on Tuesday hiking key short-term rates to contain inflation, while giving relief to small savers by increasing the savings bank rate to 4 per cent from 3.5 per cent now.

The signal was given by the RBI in its annual policy review meeting for 2011-12, where it hiked the repo rate (the rate at which banks borrow from the RBI) by 50 basis points to 7.25 per cent, the ninth increase since March, 2010.

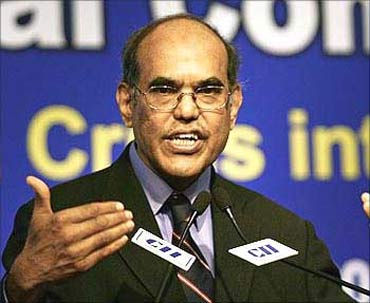

RBI Governor D Subbarao made it clear that containing inflation would take precedence over growth, which has been pegged at a lower level of 8 per cent for 2011-12 as against the government's projection of 9 per cent.

. . .

Home, auto loans to become costlier as RBI raises key rates

Image: RBI Governor D Subbarao.The move to hike the rates has been necessitated as the RBI feels inflation would remain at an 'elevated level' of 9 per cent in the first half of the current financial year before moderating to 6 per cent by March, 2012.

Subbarao's hawkish stance was supported by Finance Minister Pranab Mukherjee, who said, "This (hike in rates) was necessary to contain inflation. Inflationary pressure in the economy is still very high."

Planning Commission Deputy Chairman Montek Singh Ahluwalia also endorsed the RBI stance and welcomed the hike in both the lending rate as well as the savings rate.

"Personally, I am very glad that the RBI has given a clear signal going beyond the usual 25 basis points (revision)," he added.

. . .

Home, auto loans to become costlier as RBI raises key rates

The RBI chief said over the long run, high inflation is inimical to growth, as it harms investment by creating uncertainty.

"Current elevated rates of inflation pose significant risks to future growth. Bringing them down, therefore, even at the cost of some growth in the short run, should take precedence," he added.

Most bankers felt there was no option but to increase interest rates as the cost of borrowing funds has also gone up, with the RBI hiking the short-term lending rates.

. . .

Home, auto loans to become costlier as RBI raises key rates

However, the industry is disappointed. "This is certainly a very hawkish monetary stand, which would make the investment environment even more difficult. . . We are afraid that with growth slowing down, employment targets will not be achieved and this could generate greater social pressures," Federation of Indian Chambers of Commerce and Industry director general Rajiv Kumar said.

The RBI, however, kept the cash reserve ratio (the portion of cash banks are required to keep with the RBI) at 6 per cent, ensuring sufficient liquidity in the system.

The central bank also introduced a new mechanism -- Marginal Standing Facility -- under which banks would be permitted to borrow short-term funds (overnight) up to 1 per

cent of their deposits at 8.25 per cent.

. . .

RBI hikes policy rates by 0.50%; what it means

The following are the highlights of the RBI Monetary Policy Statement:

- Short term lending rate (repo) hiked by 50 bps to 7.25 pc

- Repo rate to be only effective policy rate to better signal monetary policy stance from now on

- Reverse repo to be fixed 100 bps lower than the repo rate

- Short-term borrowing rate (reverse repo) up by 50 bps to 6.25 pc

- Cash reserve ratio and bank rate left unchanged at 6 pc each

- Interest rates on savings bank deposits hiked to 4 pc from 3.5 pc

. . .

RBI hikes policy rates by 0.50%; what it means

- Economic growth projected lower at 8 pc for FY'12

- WPI inflation projection lowered to 6 pc

- Objective is to contain inflation by curbing demand-side pressures

- Favours aligning of fuel prices with international crude prices to avert widening of fiscal deficit

- Banks to get a new overnight borrowing window under Marginal Standing Facility at 8.25 pc

- Likelihood of oil prices moderating significantly is low

- Malegam Committee recommendations on MFI sector broadly accepted

- Bank loan to MFIs on or after April 1, 2011, will be treated as priority sector loans

article