A key demand is to reduce the dividend distribution tax on listed firms, reports Shrimi Choudhary.

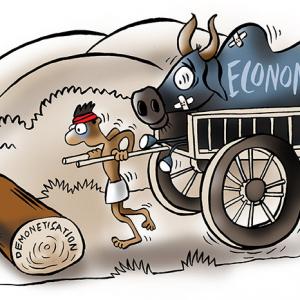

Illustration: Dominic Xavier/Rediff.com

Worried over Prime Minister Narendra Modi's remarks about increasing taxes on the securities markets, the broking community has urged the government not to increase the securities transaction tax (STT) and restore the rebates under long-term capital gains (LTCG).

Worried over Prime Minister Narendra Modi's remarks about increasing taxes on the securities markets, the broking community has urged the government not to increase the securities transaction tax (STT) and restore the rebates under long-term capital gains (LTCG).

In a proposal to the government ahead of the Union Budget, the BSE Brokers Forum has said that increase in the rate of STT and reduction in tax benefits would lead to a double whammy for capital market participants.

The suggestion comes in the wake of Modi's speech where he hinted that there is a need to increase the contribution of tax from those who make money from the markets.

Currently, LTCG on the sale of listed securities is exempt from taxes.

Meanwhile, short-term capital gains (STCG), profits on sale of shares held for less than 12 months, are taxed at a flat rate of 15%.

Besides these, all stock market transactions also attract STT in a range between 0.017% and 0.125%.

According to the BSE Brokers Forum, the rates of STT have gone up in recent times and so have the tax rates on STCG.

Also, the rebate under Section 80E for traders has been withdrawn.

"The concession under 80E should be re-introduced to avoid disparities between business income and long-term capital gains where STT is paid and collected by stock exchange," said Mehul Patel, member, BSE Brokers Forum.

"We have requested that such tax benefits should be restored and Commodity Transaction Tax (CTT) should be given similar treatment," Patel added.

Another key demand of trading members is to reduce the dividend distribution tax (DDT) on listed firms.

According to them, the current levy of DDT along with 10% tax levy on income of more than Rs 10 lakh (Rs 1 million) as dividend has led to the scenario of high incidence of tax on the same income stream, it said.

Besides, the BSE Brokers Forum also suggested modification in the Rajiv Gandhi Equity Saving Schemes (RGESS) under Section 80 CCG.

It has proposed that the scheme should be in line with Section 80CCF (infrastructure bonds) which provides additional limit of Rs 50,000 over and above Section 80C.

It also provides a lock-in period of three years and deduction for those investors who invest in public issues.

The BSE Brokers Forum has a view that this would encourage retail participation in public issues.

It also proposed to have centralised registration under the upcoming Goods and Services Tax regime, as multi-state wise registration and procedural issues would make the brokers' job cumbersome.

Another national trade body for capital market intermediaries, the Association of National Exchanges Members of India (ANMI), has also submitted its demand to the finance ministry where it had pitched for making Aadhaar card an identity proof document for investors to trade in stock exchanges.

"The CKYC System implemented by CERSAI is another hurdle in which all KYC compliant investor have to re-do the CKYC compliant whereas the template is incomplete and not suitable for stock market investor," said S K Rustagi, president, ANMI.

"It is further disturbed because only one agency has been granted a monopoly for creating a database as against multiple agencies for the KRA, which is a dangerous signal, keeping the national database with one agency," he added.

Among other steps proposed to expand and deepen the retail investor-base in the country, ANMI said there was need to give the broking business the status of industry.

These apart, it also sought clarification on the provision to write off bad debts by the brokers, as allowed to banks.