Aslam Hunani presents some of the frequently asked questions about Health Insurance in India.

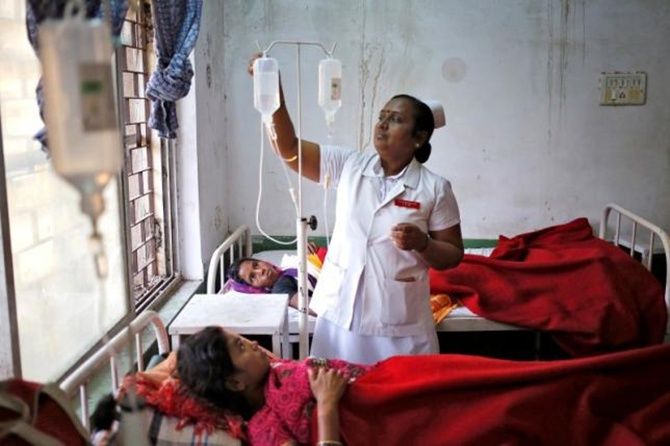

Photograph: Anindito Mukherjee/Reuters

What is Health Insurance?

Health insurance is an insurance product that covers medical expenses incurred by an individual.

It is an agreement between the insurer and the individual or group of people in which the insurer agrees to provide sufficient health coverage at a premium to the individual or group of people.

Why is Health Insurance important?

With the cost of medical expenses and hospitalisation skyrocketing, it has become important to get covered under Health Hnsurance.

It helps in meeting the sudden expenses of emergency hospitalisation of self or any member of the family.

It protects from sudden, unexpected costs of hospitalisation or other covered health events like critical illnesses, which otherwise may dent the household savings even leading to indebtedness.

Medical emergency can strike anyone without prior warning and with healthcare becoming increasingly expensive, it is very important to opt for medical coverage and buy policies which will cover the entire family too.

Sometimes high treatment expenses may be beyond the reach of many, so opting for Health Insurance is the best thing to do.

What are the different forms of Health Insurance available in India?

Basic Health Insurance is available for hospitalisation in India.

Due to liberalisation the insurance sector opened for private players and with increase in competition in the sector, a variety of products have been launched which offers range of services for individuals, families, group of people and senior citizens.

Health Insurance works in two ways in India: One is the cashless facility and the other is the reimbursement facility.

In the cashless facility, the entire bill is taken care of by the insurer at the time of hospitalisation while in the reimbursed facility, the medical bills are to be taken care of by the individual first and the money is later reimbursed to the policy holder by the insurer after proper submission of bills and other documents.

What is cashless facility?

This facility is only available at the network hospitals mentioned in the list provided by your insurance company.

Insurance companies tie up with hospitals in different parts of the country and form a network of such hospitals which offer cashless hospitalisation benefits to the policy holder.

In case of emergency hospitalisation or planned hospitalisation, the policy holder has to approach one of the network hospitals.

At the time of hospitalisation, the policy holder is required to fill up pre-authorisation form for availing this facility and this form is submitted to the Third Party Administrator (TPA) as appointed by the insurance provider.

Once the TPA approves the form, the patient becomes eligible for availing the cashless facility.

Cashless facility cannot be availed at hospitals which are not part of the network of hospitals.

What kind of Health Insurance plans are available?

Health Insurance plans are available from a meagre Rs 5,000 to Rs 50 lakh (Rs 5 million) or more in certain critical illness plans in India.

On an average most providers offer health coverage plans between Rs 1 lakh to Rs 5 lakh as the sum insured.

The individual can buy plans for self or for the entire family which is termed 'Family Floater plan' wherein all the family members can avail mediclaim to the extent of sum insured.

The premium for a 'Family Floater plan' is high compared to individual plans.

Most insurance companies offer health insurance policies for the duration of one year, but there are policies which are issued for more than a year too. There are some plans which extend for a longer duration.

What is a 'Family Floater' insurance policy?

A family plan is one single policy that covers all the members of a particular family. It takes care of the family members' hospitalisation expenses.

The policy has one single sum insured, and one single premium is paid for the policy.

The advantage of having a 'Family Floater' policy is that all members of the family are covered and there is no need to buy individual policies for each member of the family and there is no need to pay different amount of premiums for different policies.

A 'Family Floater plan' takes care of all the medical expenses during sudden illness, surgeries and accidents.

What does a health policy cover?

A health policy covers pre- and post-hospitalisation expenses.

In addition to hospitalisation, some specific policies offer number of additional benefits like maternity and newborn coverage, day care procedures for specific procedures, pre- and post-hospitalisation care, and other benefits.

A critical illness plan provides a fixed amount to the insured in case of diagnosis of a specified illness or on undergoing a specified procedure.

What are the tax benefits for Health Insurance?

There are various benefits provided to the policy holder under Section 80D of the Income Tax Act.

This section of the Income Tax Act is different from Section 80C which is applicable to life insurance wherein other forms of investments/expenditure also qualify for the deduction.

If a taxpayer buys a Health Insurance policy, then under Section 80D deduction is available up to Rs 25,000 for insurance of self, spouse and dependent children.

If the individual or spouse happens to be more than 60 years of old, the deduction available is Rs 30,000.

Additional deduction for insurance of parents (either or both parents) available is up to the extent of Rs 25,000 if they are less than 60 year old and Rs 30,000 if they are more than 60 year old.

For super senior citizens (more than 80 years old) who are uninsured, medical expenditure incurred up to Rs 30,000 shall be allowed as a deduction under Section 80D.

Therefore, the maximum deduction available under this section is to the extent of Rs 60,000.

What factors affect the Health Insurance premium?

Age plays a major role that determines the premium of the policy.

The older you are, the higher will be the premium because you are more prone to illnesses when you are old.

Previous medical history is another major factor that determines the premium.

If no prior medical history exists, the premium will automatically be lower.

Claim-free years can also be a factor in determining the cost of the premium as it might benefit you with certain discounts.

What does the policy not cover?

It is very important to read the policy document before purchasing any type of health insurance policy from an agent of the insurance provider.

It helps understand what is not covered in the policy being bought. Some policies don't cover pre-existing diseases.

There are policies which exclude certain diseases from the first year of coverage and impose a waiting period. Hence, it is very important to understand policy terms and conitions.

There can be some other exclusion like purchase of spectacles, contact lenses, hearing aids, dental treatment or dental surgery unless hospitalisation is required.

The other things which may be excluded are use of intoxicating drugs/alcohol, AIDS, expenses for diagnosis, x-ray or laboratory tests not consistent with the disease requiring hospitalisation, treatment relating to pregnancy or child birth including caesarean section, naturopathy treatment.

What is a pre-existing condition in Health Insurance?

it is possible a person suffers from an ailment before a policy is bought.

Pre-existing condition is broadly defined as a condition or a disease which existed before the Health Insurance policy is bought.

Most Health Insurance providers do not cover pre-existing conditions for a period of 4 years from purchase of the first policy.

Can the policy expire if it is not renewed on time?

There is a grace period of 15 days available to pay the premium from the date of expiry of the policy.

However, coverage would not be available for the period for which no premium is received by the insurance company.

The policy will become nonexistent if the premium is not paid within the specified grace period.

Can a policy be transferred from one insurance provider to another provider without losing the benefits?

Yes! The Insurance Regulatory and Development Authority, the regulatory body looking after the insurance sector in India, has issued a circular which directs insurance companies to allow transfer from one insurance company to another and from one plan to another, without making the insured lose the renewal credits for pre-existing conditions, enjoyed in the previous policy.

However, this credit will be limited to the Sum Insured (including Bonus) under the previous policy.

What is the term 'Waiting Period"' for claims under a policy?

When you opt for a new policy, there will be a waiting period of 30 days from the date of inception of the policy.

Any type of hospitalisation -- whether planned or emergency -- will not be covered by the insurance provider during the span of this waiting period.

However, this is not applicable for any emergency hospitalisation occurring due to an accident.

This waiting period will not be applicable for subsequent policies under renewal.

What happens to the policy coverage after a claim is filed?

If the policy is insured for a sum of Rs 100,000 from January to December and if you file a claim for Rs 50,000 in the month of June, and after the claim is settled, the policy coverage will be reduced to Rs 50,000 for the period from June to December.

This means that whatever claim you have received, that amount will be deducted from the sum insured for the remaining period of the policy.

What is the maximum number of claims allowed over a year?

A policy holder can claim any number of claims under a policy, within a year.

But the claim amount cannot exceed the maximum amount for which the policy has been insured.