With India’s imports exceeding exports, weak rupee does more harm than good.

Analysts, however, say that rupee depriciation is positive for export-oriented sectors such as IT services, pharmaceuticals, textiles and automobiles.

The Indian rupee, like its other emerging market peers, is giving jitters to equity investors and Corporate India.

Historically, stocks market returns were poor in years when the Indian currency depreciated against the dollar and vice-versa.

This is not surprising, given that India’s imports consistently exceed exports.

The rupee’s depreciation makes imports costlier, pushing up operating costs for companies and household budgets.

The former hit corporate earnings while the latter has a negative impact on consumer demand, affecting the overall demand for goods and services in the economy.

“As India consistently runs a trade deficit, the negative fallout of currency depreciation far outweighs the gains to exporters from a weaker rupee,” said Devendra Pant, chief economist, India Ratings.

Analysts, however, say that depreciation in the rupee is positive for export-oriented sectors such as information technology (IT) services, pharmaceuticals, textiles, automobiles and auto ancillaries.

“Currency depreciation will push up exporters’ revenue (in rupee terms) for a few quarters and provide some relief from the creeping rise in operating costs,” said Dhananjay Sinha, head of research, Emkay Global Financial Services.

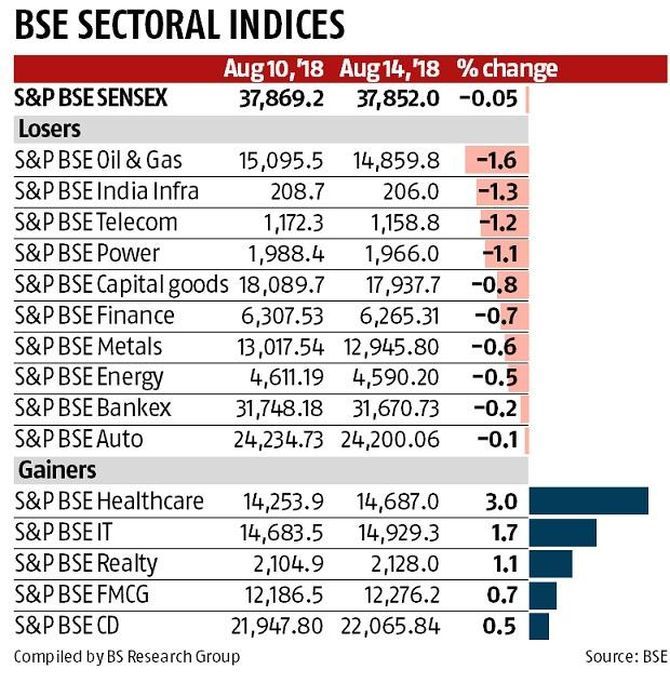

Not surprisingly, information technology and pharma stocks have been top performers during the current year so far and reacted positively to the recent fall in currency (see chart).

In pharma, for example, a weaker rupee helps large firms that are net exporters but is a negative for small and mid-sized companies that rely on imported bulk drugs from China.

Pankaj Patel, chairman of Cadila Healthcare, said prices of several intermediaries and bulk drugs had gone up.

“For export-oriented companies, a weak rupee is good news, while the same is not true for companies with a domestic market focus. Overall, the Indian pharma industry is a net exporter.”

India exported pharma products worth $17 billion in the last fiscal year and exports have grown by 18 per cent or so year-on-year in the first quarter of the current fiscal year.

However, India imports roughly 70 per cent of the active pharmaceutical ingredients (API) it needs.

Textile companies are looking at the relative depreciation in the rupee against competing currencies in the emerging markets.

Rahul Mehta, president, Clothing Manufacturers Association of India, said depreciation should help, but if all competing currencies depreciated in the same proportion, the gains would be neutralised.

“Dollar strengthening will benefit only if your own currency weakens while the competitor’s currency remains relatively strong.”

At the macro level, however, currency depreciation is negative for corporate India, given its negative impact on companies input cost and household budget.

India’s import basket is dominated by hydrocarbons with the country importing $132 billion worth of crude oil, natural gas and coal, accounting for 28 per cent of all merchandise imports in FY18.

The recent depreciation in the rupee will further raise energy import bill and makes fuel costlier for companies and individuals.

The energy cost for domestic manufacturers (companies excluding lenders, oil & gas, IT, pharma and metal) was at a 11-quarter high during the April-June 2018 quarter.

Companies’ expenses on power and fuel were equivalent to 9.53 per cent of net sales in the latest quarter against 8.45 per cent of net sales during January-March 2018, eating into companies operating margins.

Analysts are also worried about the rising trade protectionism that nullifies that the gains from currency depreciation.

“Trade barriers including import tariffs are rising across the globe that shrinks the overall export opportunity and blunts the price effect of currency depreciation.

"This make it tough for exporters to take full advantage of the recent fall in rupee,” says G Chokkalingam, founder & MD, Equinomics Research & Advisory Services.

Photograph: PTI Photo