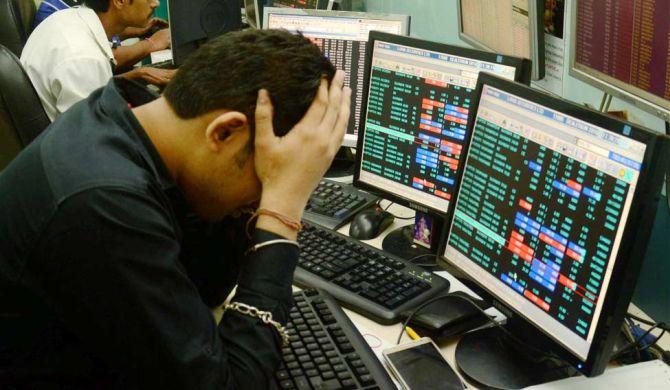

Stock markets took a beating on Monday with benchmark Sensex and Nifty tumbling over 1 per cent as escalating conflict in the Middle East and weak trends from global markets unnerved investors.

Extending losses to the second session, the 30-share BSE Sensex tanked 845.12 points or 1.14 per cent to settle at a more than two-week low of 73,399.78.

During the day, it plunged 929.74 points or 1.25 per cent to 73,315.16.

The NSE Nifty declined 246.90 points or 1.10 per cent to finish at 22,272.50.

Key indices had plunged by over 1 per cent in the previous session on Friday due to profit taking by investors at record high levels.

Sensex lost 1,638 points or 2.19 per cent while Nifty plunged 481 points or 2.13 per cent to slip below the 22,300 level in two straight sessions.

Foreign fund outflows and hotter-than-expected US inflation data also played spoilsport for the markets.

Analysts said the renewed conflict in the Middle East, proposed changes in the India-Mauritius tax treaty and the hotter-than-expected US inflation proved to be major drags.

From the Sensex basket, Wipro, ICICI Bank, Bajaj Finserv, Bajaj Finance, Tata Motors, Larsen & Toubro, Tech Mahindra and HDFC Bank were the major laggards.

Nestle, Maruti and Bharti Airtel were the gainers.

In Asian markets, Seoul, Tokyo and Hong Kong settled lower while Shanghai ended in the positive territory. European markets were trading on a mixed note. Wall Street ended significantly lower on Friday.

"Geopolitical tensions and higher-than-expected US inflation impacted investor sentiment and dragged the indices to a lower note.

“The major casualties were the mid- and small-cap indices due to their rich valuation and expectation of moderation in earnings growth in Q4FY24.

"On the other hand, the European market opened on a positive note while oil prices inched lower as market participants expected that the diplomatic efforts were likely to de-escalate tensions in the Middle East," said Vinod Nair, head of research, Geojit Financial Services.

Global oil benchmark Brent crude dipped 1.04 per cent to $89.51 a barrel.

Foreign institutional investors (FIIs) offloaded equities worth Rs 8,027 crore on Friday, according to exchange data.

"The escalating geopolitical tensions in West Asia prompted a decline in the 30-share BSE Sensex and the NSE Nifty.

“Market indices traded lower, influenced by the heightened tensions between Iran and Israel, leading to losses across major sectors.

“Notably, the broader small and midcap segments also saw declines," said Suman Bannerjee, CIO of hedge fund Hedonova.

Official data released on Monday showed that wholesale inflation rose marginally to 0.53 per cent in March compared to 0.20 per cent in the preceding month due to an increase in prices of vegetables, potato, onion and crude oil.

Retail inflation declined to a five-month low of 4.85 per cent in March, inching towards the Reserve Bank's target of 4 per cent, according to official data released on Friday.

India's industrial production growth accelerated to a four-month high of 5.7 per cent in February 2024, mainly due to the good performance of the mining sector, according to official data released on Friday.

The Income Tax Department on Friday said the amended India-Mauritius protocol on double taxation avoidance agreement (DTAA) is yet to be ratified and notified by the department.

India and Mauritius on March 7, 2024, signed an amendment to the DTAA and included a principal purpose test (PPT) in the pact which aims to curtail tax avoidance by ensuring that treaty benefits are granted only for transactions with a bona fide purpose.