Mallya and Kingfisher Airlines owes Rs 7,800 crore (Rs 78 billion) to a consortium of 17 lenders led by State Bank, which had an exposure of over Rs 1,600 crore (Rs 16 billion) to the now defunct airline.

In a stern warning to willful defaulters like Vijay Mallya, Finance Minister Arun Jaitley said they should settle their dues honourably with the banks or else be ready to face ‘coercive action’ by lenders and investigative agencies.

"I don't want to make any comments on individual cases but I think it's a responsibility of large groups like his (Vijay Mallya's) to honourably settle their dues with the banks," he told PTI in an interview in New Delhi.

He further said that banks have certain collaterals of group companies of Vijay Mallya and will take legal action to recover dues that are in excess of Rs 9,000 crore (Rs 90 billion).

"Banks have some securities.

"Banks plus other agencies have also coercive methods available with them through legal enforcement. . .these are all being investigated by relevant agencies," he said.

Mallya, promoter of long-grounded Kingfisher Airlines, left India on March 2, presumably for London, days before the Supreme Court heard a plea of clutch of state-owned banks seeking recovery from his group firms.

Mallya and Kingfisher Airlines owed Rs 7,800 crore (Rs 78 billion) to a consortium of 17 lenders led by State Bank, which had an exposure of over Rs 1,600 crore (Rs 16 billion) to the now defunct airline.

Other banks that have exposure to the airline include Punjab National Bank and IDBI Bank (Rs 800 crore or Rs 8 billion each), Bank of India (Rs 650 crore or Rs 6.5 billion), Bank of Baroda (Rs 550 crore or Rs 5.5 billion), Central Bank of India (Rs 410 crore or Rs 4.1 billion).

UCO Bank has to recover Rs 320 crore (Rs 3.2 billion), Corporation Bank (Rs 310 crore or Rs 3.1 billion), State Bank of Mysore, (Rs 150 crore or Rs 1.5 billion), Indian Overseas Bank (Rs 140 crore or Rs 1.4 billion), Federal Bank (Rs 90 crore or Rs 900 million), Punjab & Sind Bank (Rs 60 crore or Rs 600 million) and Axis Bank (Rs 50 crore or Rs 500 million).

The Finance Minister said the government has been trying to address the problem of NPAs in sectors such as steel, textile, highways and infrastructure, which are on account of economic slowdown.

"I think the non-performing assets resolution process will now begin.

“The sectors which have caused distress. . . I have always said that there are two kinds of NPAs.

“One is because of economic environment, the losses in certain categories of industry. “Now those areas we are trying to address," he said.

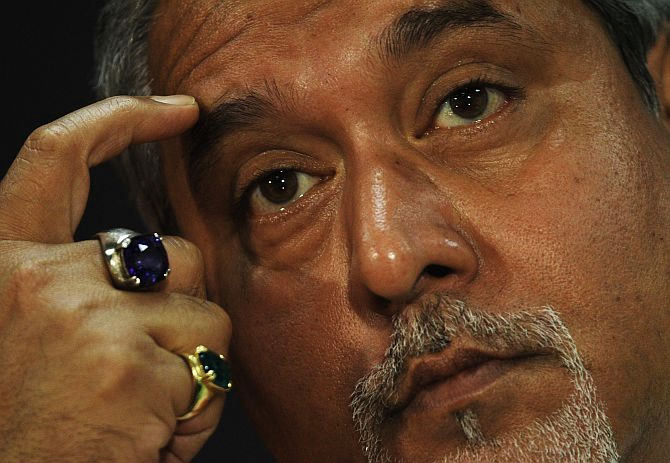

Image: Vijay Mallya left India the day after public sector banks moved the Debt Recovery Tribunal against him. Photograph: PTI