'We are bullish on sectors such as consumption, IT and pharma, and some engineering, procurement and construction companies that have corrected sharply.'

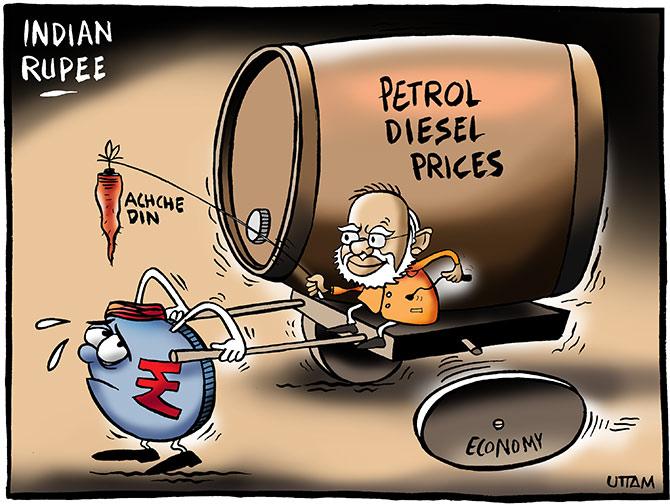

Illustration: Uttam Ghosh/rediff.com

Even as rising crude oil prices, trade war fears and a sliding rupee cast a shadow on market sentiment, Nischal Maheshwari, bottom, left, chief executive officer for institutional equities and advisory at Centrum Broking, tells Puneet Wadhwa that in the next one year, the outcome of the 2019 general election is a bigger challenge for the market.

Political uncertainty or change of the guard, if any, will stay for at least the next five years, he says, whereas lack of earnings growth would have a shorter impact. Edited excerpts:

How vulnerable are the Indian markets to macro headwinds?

India has historically always outperformed other emerging markets (EMs) and continues to trade at a premium.

Given the current macroeconomic environment, I believe that this outperformance will continue.

The primary reason being India's strong domestic consumption story.

Currently, there is stability in the long-term investment environment, and I expect, capital inflows in equities to continue.

Rising oil prices, volatility in the rupee/dollar rates could leave the markets volatile, albeit in short term.

Are the markets prepared for a slippage in fiscal deficit numbers?

On the basis of our interactions with diverse stakeholders, I think we are definitely seeing an improvement in the economy.

Our GDP (gross domestic product) growth numbers have demonstrated outperformance backed by strong growth in construction, manufacturing and public services.

That said, we may face challenges on the fiscal deficit front, owing to high oil prices and a falling rupee.

That said, we may face challenges on the fiscal deficit front, owing to high oil prices and a falling rupee.

The market, however, seems to have already taken this fiscal deficit slippage into its stride as the 10-year yield is over 8 per cent; hence there may not be a significant slippage in the next few quarters.

What's your view on foreign flows?

Foreign institutional investors (FIIs) have been turning net sellers world over and I think this trend may continue.

The performance of most markets, with the exception of the US, has been mediocre. It will be challenging to continue attracting foreign flows.

What about India?

India may face headwinds in the short-to-medium term. Foreign institutional investors (FIIs) could divert their investment to safe-haven assets amid trade war worries and a falling rupee.

Investors are watchful and if they see any widening of the fiscal deficit, they are tempted to withdraw as it is indicative of a rise in inflationary pressure.

However, India Inc’s strong performance in the June quarter backed by leading stocks posting double-digit growth, is giving a positive guidance in for the coming quarters.

A favourable monsoon, too, has reduced growth concerns.

Earnings growth or political uncertainty, which is a bigger threat?

I think the outcome of the next year's general election is a bigger challenge.

Political uncertainty or change of guard, if any, will stay for at least the next five years, whereas lack of profit growth would have a shorter impact.

Is it a good time to buy mid- and small-cap stocks given their relative underperformance this year?

Though we feel that small- and mid-caps have bottomed out, we advise caution and suggest that one can invest in mid-caps very selectively.

We are bullish on sectors such as consumption, information technology (IT) and pharma, and some engineering, procurement and construction (EPC) companies that have corrected sharply.

On the EPC front, if you look at the construction side, all the EPC companies have record order books. This is largely due to the government putting out multiple orders.

Pure play EPC companies are asset light. They have cleaned up their books, their working capital cycles are coming down.

They have a challenge as far as interest rates are concerned, but given that they are increasing their turnover, the operating leverage will start playing in.

But IT and pharma have already seen a good run. Your thoughts.

Well, a falling rupee is positive for sectors such as IT and pharma.

IT has got a long way to go over the next three years, as we are seeing demand pick-up after a gap of almost eight-nine years.

Consumption sectors (FMCG and durables), too, will do well owing to a good monsoon and the upcoming festive season.

FMCG has always been expensive and it will continue to remain expensive.

I do not think they are going to get cheaper any time soon, given that there has been good, strong demand and we have got a reasonable rainfall.

The next few quarters will be good for the sector.