Photographs: Reuters Sachin Mampatta and Rajesh Bhayani in Mumbai

Want to know where gold prices are headed?

It might make sense to track the stocks of gold mining companies.

In the recent past, these have served as good indicators, says CLSA’s Chief Equity Strategist Christopher Wood.

“The action in gold mining stocks is serving as a useful lead indicator for the price of bullion, with Newcrest Mining, for example, up 30 per cent year-to-date.

Gold mining stocks were certainly a lead indicator for the decline in gold prices last year,” Wood said in his periodic ‘Greed and Fear’ report, released earlier this month.

. . .

'Track gold miners' stocks to predict price trends'

Image: An employee makes gold studs at a jewellery workshop.Photographs: Dinuka Liyanawatte/Reuters

The report added those who had taken contrarian calls on gold would have been well rewarded.

“What is clear is anyone who wanted to construct a truly ‘contrarian’ portfolio, positioned the opposite to the consensus at the beginning of 2014, would have included a large weighting, in gold mining shares, as well as a large weighting in 30-year Treasury bonds,” it said.

An equal-weighted index comprising the top 15 gold mining companies in the world, compiled by the BS Research Bureau, showed in 2014, gold mining companies gained twice as much as gold prices.

. . .

'Track gold miners' stocks to predict price trends'

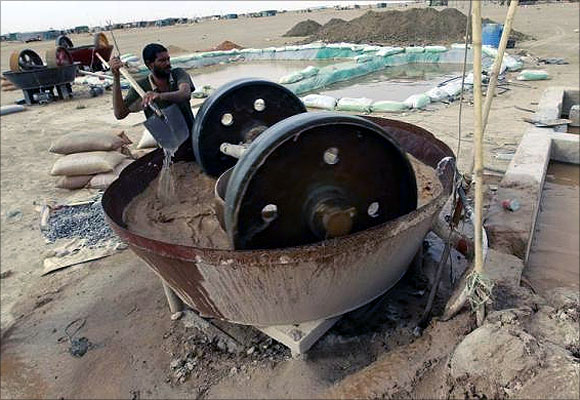

Image: A gold mine worker uses a gold crusher at a local mine in Al-Ibedia locality at River Nile State.Photographs: Mohamed Nureldin Abdallah/Reuters

The price of gold has risen 10.63 per cent this year -- from $1,205.65 an ounce at the beginning of the year to $1,333.9 on Monday.

During the same period, the index of gold mining companies rose 19.16 per cent.

When gold prices fell, gold mining companies also fell more than the commodity.

The index of gold mining companies fell 8.19 per cent in the last quarter of 2013, compared with a 6.37 per cent fall in gold prices.

William Tankard, research director (precious metals mining) at Thomson Reuters GFMS, said a change in the price of the underlying commodity a mining company produced would have a leveraged effect on earnings.

. . .

'Track gold miners' stocks to predict price trends'

Image: A goldsmith arranges gold bangles at a jewellery shop.Photographs: Murad Sezer/Reuters

At times, this could affect a company’s share price.

“That the dollar gold price has stabilised and, in recent weeks, shown improvement (strong improvement in many emerging markets’ local price terms) has had a positive impact on investor attitude towards major and mid-tier mining companies,” he said.

Cost-cuts and price stability also aided outlook for these companies, Tankard added.

“These improvements have broadly coincided with evidence producers are getting to grips with cost-containment initiatives implemented since the middle of last year -- head office costs, exploration and capex budgets are being cut and operating costs are being reined in where possible and, in many cases, production is increasing.

. . .

'Track gold miners' stocks to predict price trends'

Image: A pawn shop worker sorts through gold jewellery at Easy Money Pawn shop in Bangkok.Photographs: Athit Perawongmetha/Reuters

Coupled with this, many producers took heavy asset impairments in late 2013 and 2014. “The fact that prices have apparently stabilised will also give some investors confidence the worst of these asset write-downs may now be behind us,” he said.

Cameron Alexander, manager (precious metals demand), Asia, GFMS, said, “In the first quarter, we envisage room for price improvement when those accumulated shorts on comex unwind, pushing gold up to a high of $1,327/oz.

“However, we expect that rally to reverse to a mid-year average low of about $1,180/oz in the second and third quarters, as monetary stimulus unwinds further.”

article