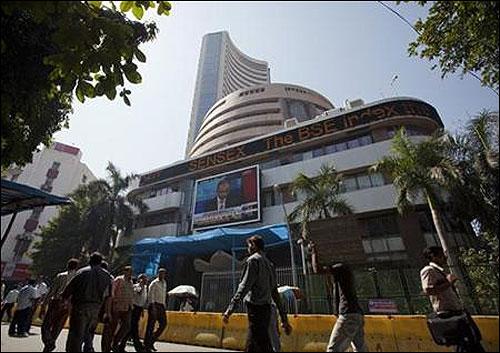

Photographs: Reuters Tulemino Antao in Mumbai

Benchmark share indices surged on Monday to record their highest single-day gains since October 18 after US Fed plans to continue the stimulus measures raised hopes of further foreign inflows and bold economic reforms unveiled by China boosted investor sentiment.

The 30-share Sensex ended up 451 points at 20,851 and the 50-share Nifty ended up 133 points to close at 6,189.

As per today's closing levels the Sensex regained nearly 650 points of the 1000 points loss last week while the Nifty recovered nearly 200 points of the 330 point fall last week.

On October 18, the Sensex had gained 2.3% or 467 points and the Nifty had jumped 143 points or 2.4%.

The India rupee continued to strengthen on Monday due to dollar sale by banks. The bullish sentiments in equity market also helped the rupee.

The Indian rupee was trading at Rs 62.46 to the US dollar against the previous close of 63.11.

Shares in Hong Kong and mainland China surged on Monday after bold economic reforms unveiled by China over the weekend.

The Chinese government while relaxing its one-child policy with a view to boost urban population also said that it would further liberalise the financial sector.

Hong Kong and Shanghai COmposite ended up nearly 3% each while Nikkie ended flat with negative bias and Straits Times ended 0.1% up.

However, European shares were trading mixed after recouping some of their early losses.

The CAC-40 was up 0.4%, DAX was up 0.1% and FTSE-100 was down 0.1.

All the sectoral indices on the BSE ended with gains.

The BSE Capital Goods index was the top gainer among the sectoral indices on the BSE, up 3.2% followed by Bankex, FMCG, Realty, Oil and Gas among others.

Index heavyweights ITC ended up 3.6% contributing the most to Sensex gains along with Reliance Industries which ended up 2.7%. ITC edged up after unwinding of short positions in its November futures, dealers said.

Bank shares firmed up ahead of the outcome of the RBI's Rs 8,000 crore bond purchase through open market operations today. Bank Nifty gained the most in percentage terms since October 29 and ended up 3.1% at 11,142.

SBI, HDFC, HDFC Bank and ICICI Bank ended up 2.6-4.1% each.

Other Sensex gainers include, L&T, Infosys, Hindustan Unilever, ONGC, Tata Motors and TCS among others.

Among other shares, Cox and Kings ended 2% up at Rs 101, extending its Thursday’s nearly 8% rally, after reporting a 79% year-on-year (yoy) jump in consolidated net profit at Rs 264 crore for the quarter ended September 30, 2013 (Q2).

Mastek lost 7.6% to end at Rs 141 in otherwise firm market on BSE after the IT software products maker said the company’s revenue of the North American business may be impact due to a major customer is reprioritizing its multi-vendor transformation program.

SKS Microfinance has soared 15% to end at Rs 183 ahead of Sequoia Capital's stake sale plan to a fund managed by WestBridge Capital on or after November 20.

Shares of Financial Technologies (India) surged 20% and Multi Commodity Exchange of India (MCX) has surged 18% on back of heavy volumes on the Bombay Stock Exchange (BSE).

Ramco Systems ended in 20% upper circuit at Rs 130 on BSE after IT consulting and software firm said it will concentrate on the US market over the next two years to promote its human resource management software.

Elder Pharmaceuticals gained 4.4% to end at Rs 307 on reports that French drug maker Sanofi SA is close to acquiring the Mumbai-based pharmaceuticals company.

In the broader market, the BSE Mid-cap and Small-cap indices ended up 1% each.

Market breadth was positive with 1,401 gainers and 1,059 losers on the BSE.

article