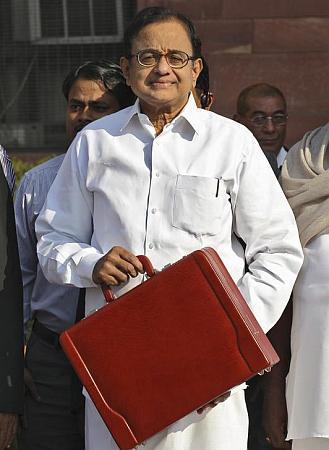

The much-debated additional tax for super-rich found favour with the government as Finance Minister P Chidambaram on Thursday proposed a 10 per cent surcharge for a year on income above Rs 1 crore.

The proposal will cover 42,800 individuals and entities. "When I need to raise resources, who can I go to except those who are well placed in society. Only 42,800 persons in the whole country who admitted to a taxable income of exceeding Rs 1 crore per year.

"I propose to impose a surcharge of 10 per cent on persons whose taxable income exceeds Rs 1 crore per year," he said while unveiling Budget proposals for 2013-14.

Meanwhile, there is no change in the tax slabs or rates. There will be a Rs 2000 credit for those earning up to Rs 5 lakh per annum.

The proposal to tax the super-rich was mooted by Prime Minister's Economic Advisory Council Chairman C Rangarajan and found echo in Wipro Chairman Azim Premji.

"I believe there is a little bit of spirit of Azim Premji in every affluent taxpayers and I am confident when I ask relatively affluent taxpayers to bear a small burden for one year they will do so cheerfully," he said, adding the tax proposal will be only for one year.

He further said, "fiscal consolidation cannot be effected only by cutting expenditure. Where ever possible, revenues must also be augmented."

The surcharge will apply to individuals, HUFs, firms and entities with similar tax status, he added. on Thursday proposed no revision in tax slabs or rates.