Markets ended near the day's high on buying interest visible in banks, realty and auto shares.

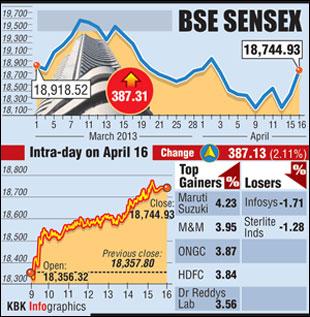

The Sensex, after opening at 18,356, touched a high of 18,771. The index finally ended at 18,745 up 387 points or 2%. Equities rose as steep drop this week in gold and oil prices will ease concerns of high current account and fiscal deficit.

The index finally ended at 18,745 up 387 points or 2%. Equities rose as steep drop this week in gold and oil prices will ease concerns of high current account and fiscal deficit.

The Nifty rose 121 points to end at 5,689 on continued optimism after the government announced a better-than-expected WPI inflation data on Monday.

Foreign institutional investors (FIIs) sold shares worth a net Rs 418.37 crore on Monday as per provisional data from the stock exchanges.

"The FIIs have brought in around $38 billion in the last 15 months.

"To me, that itself is a risk. So, if they decide to book even partial profits say $4-5 billion, ahead of the general elections, which I feel will happen only around January-February 2014, the markets may see a sharp fall," said G Chokkalingam, executive director (ED) and chief investment officer (CIO), Centrum Wealth Management.

Meanwhile, Japan's Nikkei average fell for a third day in a row on Tuesday, shedding 0.4 percent with the mood soured by concerns over stumbling global growth, but renewed weakness in the yen enabled the market to pare some of its early steep losses.

The Nikkei ended 54.22 points lower at 13,221.44. The benchmark dropped as much as 2 percent to a one-week low of 13,004.46 in the morning session but moved back into positive territory several times in the afternoon.

Back home, Wholesale Price Index-based inflation hit a 40-month low of 5.96 per cent in March, compared with 6.84 per cent in February, much lower than the Reserve Bank of India (RBI)'s projection of 6.8%.

Investors are now hoping that the central bank would ease monetary policy more aggressively next month to boost growth into the Asia’s third-biggest economy. There is an 80% probability that the Reserve Bank will cut repo rate by 0.25% in its monetary policy review on May 3,

There is an 80% probability that the Reserve Bank will cut repo rate by 0.25% in its monetary policy review on May 3,

Gold image via Shutterstock Gold futures prices today dipped below Rs 26,000-level to trade at a 15-month low of Rs 25,270 per 10 grams as participants indulged in creating short positions after the metal had its biggest one-day drop since 1983 in global markets.

Gold prices, which had been plummeting since last week, fell by another Rs 364, or 1.41%, to trade at a 15-month low of Rs 25,270 per 10 grams for delivery in June at the Multi Commodity Exchange. It clocked a turnover of 93 lots.

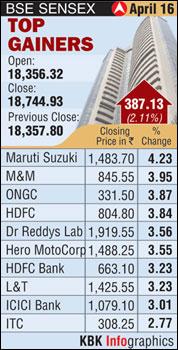

Banking and financial shares like HDFC, HDFC Bank, ICICI Bank and SBI surged between 2-4% on expectations that the RBI will start cutting interest rates in the coming month to support the slowing economy.

The BSE bankex surged 3% to 13,589.

Realty, auto and power indices were up around 2.5% each. However, on the losing side, IT index was down 0.5% at 5,986.

Infosys continued its fall from last Friday post its dismal guidance.

The stock was down 1.7% at Rs 2,294.

Other IT shares were weak as well with Wipro and TCS trading unchanged this afternoon.

Rupee extended gains to 54.26, its strongest since April 2 and up from its Monday's close of 54.6250/6350, tracking gains in domestic shares as slumping commodity and gold prices are reducing the pressure on the country's record current account deficit.

Maruti was the top Sensex gainer - up 4.2% at Rs 1,484. Mahindra & Mahindra and Hero MotoCorp added 3-4% each.

ONGC, Larsen & Toubro and Tata Power advanced 2-3% each. Market heavyweight Reliance added 1.4% at Rs 805 ahead of its financial results which is set to come out later today.

However, Sterlite Industries dipped 1.3% at Rs 85, extending its previous day’s 2.6% fall, in otherwise firm market on reports that the National Green Tribunal has directed the Tamil Nadu Pollution Control Board (TNPCB) to provide the emission data of all units in industrial estate.

BSE market breadth was negative.

Out of 2509 shares traded, around 1,337 shares advanced while 1,023 shares declined.