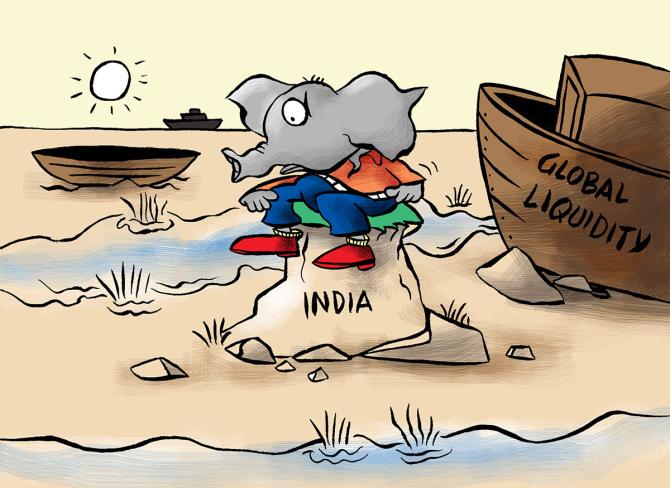

Foreign Portfolio Investors (FPIs) selling spree continued as they dumped Indian equity worth over Rs 5,800 crore this month so far on rising interest rates and geopolitical tensions in the Middle East.

This came after such investors withdrew Rs 24,548 crore in October and Rs 14,767 crore in September, data with the depositories showed.

Before the outflow, FPIs were incessantly buying Indian equities in the last six months from March to August and brought in Rs 1.74 lakh crore during the period.

Going forward, this selling trend is unlikely to continue as the US Federal Reserve signalled a dovish stance in its meeting last week, experts said.

According to the data with the depositories, FPIs sold shares to the tune of Rs 5,805 crore during November 1-10.

The FPI selling trend which started in September continued in October and is showing no signs of reversing in November even though the intensity of selling has come down this month.

This could be largely attributed to the growing geo-political tensions due to the conflict between Israel and Hamas, alongside a notable rise in US Treasury bond yields, Himanshu Srivastava, associate director - manager research, Morningstar Investment Adviser India, said.

In the current scenario, experts believe that there could be an enhanced focus on safe-haven assets such as gold and US dollars.

On the other hand, the debt market attracted Rs 6,053 crore in the period under review after receiving Rs 6,381 crore in October, data showed.

This approach may represent a tactical move by foreign investors to allocate funds to Indian debt in the short term, with the intention of redirecting capital into the equity markets when conditions become more favourable, Morningstar's Srivastava said.

The inclusion of Indian G-Sec in the JP Morgan Government Bond Index Emerging Markets has spurred foreign fund participation in the Indian bond markets.

With this, the total investment by FPIs in equity has reached Rs 90,161 crore and Rs 41,554 crore in the debt market so far this year.

In terms of sectors, FPIs continue selling in financials despite their impressive Q2 results and bright prospects.

In this time of uncertainty, FPIs are looking for the safety of the risk-free US bond yields where the 10-year is yielding around 4.64 per cent, V K Vijayakumar, chief investment strategist at Geojit Financial Services, said.

The sustained selling by FPIs in financials has made the valuations of banking stocks attractive.

"In the run-up to the General elections, a rally in the stock market is likely as happened during the last five general elections.

"Leading banking stocks have the potential to outperform in the imminent rally," he added.