'You cannot have only one product or one market or one customer segment.'

While the Reserve Bank of India (RBI) allows small finance banks (SFBs) to apply to be universal banks after five years of their operation, none of these lenders have done so, despite most of them being eligible for it.

Participants at a panel discussion at the Business Standard BFSI Insight Summit 2023 say that SFBs need diverse product lines before they apply for universal bank licence, and should not lose sight of their focused area when they do so.

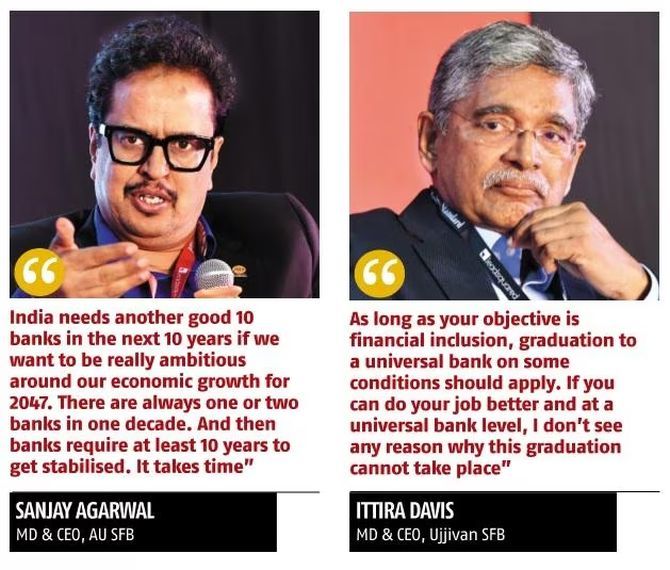

The discussion titled 'Can SFBs become universal banks' comprised heads of leading SFBs such as Sanjay Agarwal, managing director (MD) & chief executive officer (CEO), AU SFB; Ittira Davis, MD & CEO, Ujjivan SFB; Ajay Kanwal, MD & CEO, Jana SFB; and Inderjit Camotra, MD & CEO, Unity SFB.

Can small finance banks become universal banks?

Sanjay Agarwal: If you had asked me this question three years ago, I would have said you need a universal licence to really be a very powerful franchise or a very relevant franchise.

Now, after six-and-a-half years, I would say that SFB itself is very powerful in the sense that 10 SFBs got the licence in 2017.

As we all started our journey, two more licences were given to SFBs.

There is a clear-cut kind of narrative from everywhere that SFBs are very relevant.

SFBs are the platform where you can come and learn banking first.

In my opinion, SFBs now need to build all product ranges. You cannot have only one product or one market or one customer segment.

We have to have entire product ranges like we offer home loans, commercial banking, digital banking.

If you service the 360-degree customer requirement, then the customer won't judge you that you are an SFB or you are a universal bank.

It is more about your product, more about your delivery.

Universal is the need of the hour. But to get to the universal, you need to do some kind of focus on customers, build more products and services.

Mr Davis, should SFBs become universal banks?

Ittira Davis: That question would not have come unless the regulator had given us a roadmap for that.

There is a road map - complete five years, you are eligible to apply.

But my viewpoint is once you have space, spend some time growing, knowing your market.

As long as your objective is financial inclusion, graduation to a universal bank on some conditions should apply.

If you can do your job better and at a universal bank level, I don't see any reason why this graduation cannot take place.

I think the question is - should we make a move towards universal banks? If we meet all the conditions, I don't see why we should not, because the universal bank has certain advantages.

Mr Kanwal, what are your thoughts?

Ajay Kanwal: I do think that becoming a universal bank will certainly help us on the branding side and the liability side, much more than assets.

As long as you are true to your purpose and the universal bank helps us do that purpose better, I think we should convert to a universal bank and we should be allowed to do that.

From an employee perspective, it will also be a lot better if you are not named small because you are really doing a big job.

Our balance sheet size is pretty large. Lots of universal banks' balance sheet sizes will be smaller than ours.

Mr Camotra, do you think you have a roadmap to become a universal bank?

Inderjit Camotra: I agree with Sanjay that if you stay true to your cause, and become a good, robust, compliant, technologically driven bank, you will pass the mettle of the test of becoming any format of bank you want to.

Since we are so young - just two years into our journey - and the path to becoming a universal bank is at least five years, I will follow the lead set by my senior SFBs.

Universal bank licence is available on tap, still none of you have applied. What is the reason, are you waiting for certain clarifications from the regulator?

Agarwal: I don't think that the regulator needs to clarify anything.

Whenever I interact with them, they say that if you feel that you are good enough, you should just submit the application.

I again want to repeat that it is not about the platform. I think the SFB platform itself is so powerful.

In the end, the customer doesn't mind whether it is a universal bank or it is an SFB.

Customer minds about your services, your products, your approach, your brand.

In my opinion, India needs another good ten banks in the next ten years if we want to be really ambitious around our economic growth for 2047.

There are always one or two banks in one decade.

And then banks require at least ten years to get stabilised. It takes time.

Is there a fear of rejection in the sense that first you need to prove yourself that you are ready to take on the bigger banks, then you should apply?

Agarwal: It is not about fear of rejection. It may be a positioning where every institution might be taking a call on whether it is fit enough to service the expectations.

It is not a fear of rejection because a regulator will reject an SFB's (application for licence).

You are still a bank. You are a commercial scheduled commercial bank.

You are still on that whole list of banking. I don't think we can call it a fear of rejection.

But the regulators can advise you that you have not done a good enough job at SFB. They can advise that first do that job.

Do you think there is a need for clarifications from the RBI before SFBs make up their mind to apply for a universal banking licence?

Davis: The dialogue with RBI is something that we do continuously. So obviously that is something that we can talk to them about.

So far as Ujjivan is concerned, we have internally decided that we will wait for a while.

Mr Kanwal, what is your take?

Kanwal: Converting to a universal bank doesn't mean changing strategy. This means that I don't have to start doing corporate banking when I become a universal bank.

Is it really a disadvantage to use the word 'small' for you?

Camotra: At the moment, we are small finance banks and let us revel and enjoy that status.

Half of our lending is below Rs 2.5 million. So, all of us never have to scramble for priority sector assets.

As long as we manage our NPAs and our cost of production well, we are a very profitable set of banks.

Our ROE (return on equity) in most of our balance sheets is all in double digits.

Feature Presentation: Aslam Hunani/Rediff.com