Photographs: Rediff Archives Fundsupermart.com

Have you ever dreamt of owning a part of Infosys or Reliance Industries? With stocks you can.

Stocks are basically 'shares' of a company. It is ownership in the most literal sense: you get a piece of every desk, filing cabinet, contract and sale in the company. Better yet, you own a slice of every rupee of profit that comes through the door. The more shares you buy, the bigger your stake in the company.

Stocks are the means by which companies obtain additional financing for their businesses -- by selling off parts of their company to investors. The price of a stock can vary tremendously, from less than a rupee of a share, to a few thousand rupees a share!

.

Disclaimer: This article is for information purpose only. This article and information do not constitute a distribution, an endorsement, an investment advice, an offer to buy or sell or the solicitation of an offer to buy or sell any securities/schemes or any other financial products /investment products mentioned in this article or an attempt to influence the opinion or behavior of the investors /recipients.

Any use of the information /any investment and investment related decisions of the investors/recipients are at their sole discretion and risk. Any advice herein is made on a general basis and does not take into account the specific investment objectives of the specific person or group of persons. Opinions expressed herein are subject to change without notice.

How is the price of a stock determined?

It's all about the company's earnings (profits). Suppose you own a company which makes Rs 1,000 in profits every year. How much would you be willing to sell the entire company for? Say you ask for Rs 10,000. Would anyone buy it?

To a potential buyer, he will assess his situation with this question, "How much return can I get if I invested my money somewhere else?"

If he buys your company at Rs 10,000, he is essentially investing in a vehicle that can generate 10 per cent returns a year. If he can't find that kind of return somewhere else, he will pay your Rs 10,000 asking price. If he can, then he won't. You might have to lower your asking price.

Another factor that enters into the consideration is earnings growth.

Your company may be making Rs 1,000 today, but it may make Rs 2,000 next year. For a 10 per cent return, an investor might be willing to pay you around Rs 15,000 for your company. He may only make 6.6 per cent this year, but he makes 13.3 per cent next year, and possibly more the year after.

So his Rs 15,000 now can still be considered well invested as he would meet his investment objective.

You can sell your company for Rs 5,000 more. This is the reason why the shares of some companies are going through the roof even though they are not earning much money. Many people are projecting that their future earnings will be good, so they are willing to invest in these companies now.

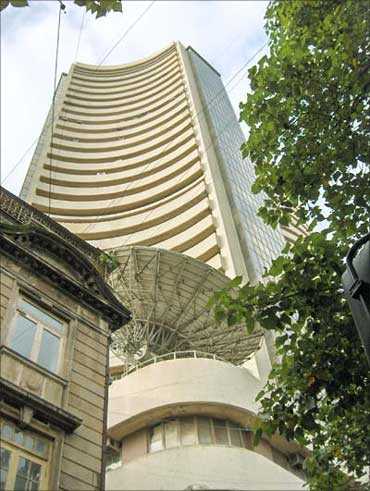

What are stock markets?

Stock markets are places where companies can offer their shares for sale. They do this through an initial public offer or IPO. If a company sells Rs 10 lakh of its shares at Rs 10 each, then it is able to raise Rs 1 crore for itself.

Companies raise money for a variety of reasons. Mostly, it is to expand its business or to pay down debt.

Potential investors who look at a company's IPO will ask the same two questions outlined above. What is the company's earnings potential, and whether there are other investments which might give them a better return. If they decide that the company's earnings potential is good, and can offer a better rate of return, they will invest in it.

That is why many companies who offer IPOs usually price their stocks at attractive levels.

After the IPO, the thousands or millions of investors who have bought the stocks can go back to the stock market and sell the stocks to other investors, so 'trading' of the stocks begin. A stock market is simply the clearing house for these 'trades'.

What causes volatility in stock prices?

Factors that affect a stock's price can be separated into 'macro' factors and 'micro' factors.

'Macro' factors are factors that affect the whole economy. Higher interest rates, inflation, national productivity levels, politics and such can have important effects on a company's earnings potential and so affect its share price.

'Micro' factors are factors that affect the company itself. Management change, prices and availability of raw materials, productivity of workers and such affect that individual company's earnings performance.

Fund managers and stock investors have to study both macro and micro reasons to try and ascertain the profitability of a company, and determine the 'fair price' of the shares.

What causes volatility in the prices is that there are often different opinions about where a company's earnings are headed. In a day when more people think that a company's earnings are headed down, there will be more sellers and prices will head down. Of course, the reverse happens as well.

Dividends

Price increase, or capital appreciation, is not the only way you can make money on stocks.

Many companies also pay yearly dividends. These are cash payments that represent a portion of profits. However, it is entirely up to the companies whether to pay out dividends or not. They are not obligated to.

But some companies have policies to pay regular dividends; they will return a portion of their earnings to reward their investors.

Diversify your risks

While history shows that the prices of stocks of good companies will rise in the long run, there are no guarantees -- especially when it comes to individual stocks. Companies do go bankrupt. When that happens, the share price drops to zero (remember Enron?) and you lose all your money.

The best way to avoid this heartache is to diversify your investments by owning a variety of stocks. That way, the collapse of a single company wouldn't give you a minor stroke.

You can either choose to hold a range of different stocks and monitor each one, or simply buy into an equity mutual fund, which is a diversified collection of stocks, and let a professional fund manager manage your money.

These fund managers spend all their time studying companies and their earnings potentials and chances are that they will do better at stock picking and make more money for you.

What you can be assured is that, there is definitely less stress, as you won't need to watch prices everyday!

Basics of investing in mutual funds

This is our reason for being! We believe that mutual funds are the best investment instruments for you.

What are mutual funds?

In the previous sections you read about stocks and bonds. Mutual funds are simply portfolios of stocks, bonds, and other investment instruments.

The value of each portfolio is the sum of the value of the investments (stocks, bonds) which they hold. You own a portion of the portfolio when you purchase a 'unit' of it. That's it!

Why mutual funds?

Let us count the ways:

1. They are already well-diversified: Mutual funds spread the risks involved in investing because they buy into a good variety of stocks and bonds.

2. Less stress: They are managed by professional fund managers.

3. You can invest all over the world. If you invest in stocks, you can only invest in the stocks of your own country. But mutual funds can invest in various business sectors. This way, you have a lot more opportunities.

Think pharmaceutical sector might boom? Or technology sector? Or infrastructure sector? Mutual fund picks out the best companies in these sectors for you. We have a range of global funds too.

4. You only need a small amount of investment to start with. Investments start mostly at Rs 1,000 and Rs 5,000. You can even arrange to have your bank account SIP(ed) (Systematic Investment Plan), so that you automatically acquire a certain amount of units every month. Stocks will cost you a bomb for just one lot. With a mutual fund, a small sum buys you into a well-diversified portfolio.

Why mutual funds?

5. Redemption is immediate. If you own stocks, you might not be able to sell them off at the price you want because there are not enough buyers in the market. But with mutual funds, the issuer is bound by their agreement to buy it back from you at the day's prevailing price no matter how large the number of units you hold.

6. It is relatively safe. If you are concerned about volatility, you can choose a fixed income mutual fund that can give pretty stable returns. Generally, over the medium to long term, these still perform better than your fixed deposits.

7. Most important of all, you can reap tremendous returns. Over the long term, mutual fund investment can reap very handsome returns. Some good mutual funds have returned more than 200 per cent in a year. That means that an investment of Rs 1,000 at the beginning of the year would turn into Rs 3,000 at the end of it!

Many have given about 10 per cent -- 15 per cent average annualised returns every year.

Comment

article