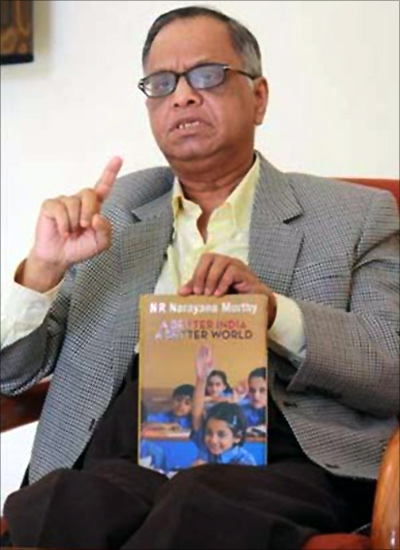

A year ago, when India’s second-largest information technology services company, Infosys, brought back iconic co-founder N R Narayana Murthy as executive chairman, about two years after his retirement, the decision was welcomed with much fanfare.

Despite a shrinking market share and declining profitability, Murthy’s return helped Infosys get a double thumbs-up from investors.

While the company’s shares rose around five per cent in the first trade after the announcement of Murthy’s return, they surged nearly 30 per cent over the next three months.

A year later, however, the sentiment is not as upbeat.

Despite the several initiatives Murthy is taking at the company, most experts believe he is unlikely to meet his target of bringing Infosys back to its old glory within three years of his return.

. . .

Compared with peers Tata Consultancy Services’ and Wipro’s, Infosys’ stock has been a weak performer in the past 12 months.

While the Infosys scrip rose around 29 per cent during the past year, shares of TCS and Wipro grew 44 per cent and 55 per cent, respectively.

Even as Infosys posted 11.5 per cent revenue growth in 2013-14, expanding at nearly double the pace in the previous year, its performance lagged behind peers’.

During the three quarters of 2013-14 that Murthy was at the helm of affairs (June 2013 to March 2014), Infosys’ revenue growth averaged 4.8 per cent, against 6.5 per cent for Tata Consultancy Services, 6.4 per cent for Wipro and 6.3 per cent for Cognizant.

Additionally, the company shared a forcast of seven-nine per cent revenue growth in 2014-15, way lower than Nasscom’s estimate of 13-15 per cent for the Indian IT services sector and rival Cognizant’s guidance of 16.5 per cent.

. . .

“Infosys is still not on track and many large customers are disappointed.

"They believe Murthy’s return has not brought the expected positive impulse,” says Peter Schumacher, founder of Germany-based Value Leadership Group.

“They see his three-pronged agenda as tactical cost-focused initiative that is skewed toward benefiting Infosys and has little added customer value.”

Hits & misses

Upon joining Infosys in his second innings, Murthy initiated a three-pronged strategy, which included focus on cost rationalisation (which he said would start yielding results in six-18 months), sales effectiveness (which would take nine-21 months to show results) and delivery effectiveness (benefits from which would be visible in 18-24 months).

Murthy also immediately brought back focus on revenue-accretive traditional business IT, the bread-and-butter for most large Indian IT services players.

Infosys had ignored this to a great extend over the past three years as it implemented its ambitious ‘Infosys 3.0’ strategy.

. . .

“You also have to take into account the time when Murthy was at the company’s helm of affairs.

"When he was the CEO, the market was evolving and the only thing you needed to do was improving your delivery,” says Sudin Apte, CEO & research director at Offshore Insights, an IT research firm.

“It was during Nandan Nilekani’s time that the company actually grew at a faster pace -- that was a time when the industry was evolving.

"Even now all the things that Murthy has done are old-style, especially the cost-cutting measures. Infosys started cutting sales and marketing expenses, too, as part of its selling, general & administrative expense).

What it does not realise is that S&M spent is investment for the future.”

The magnitude of problems was perhaps much larger than what Murthy had assessed.

In the months following his return, as Murthy started laying stress on meritocracy and initiated an organisational restructuring, Infosys saw exits of some of its top sales and delivery people.

Among others, the company saw resignations of board members Ashok Vemuri, V Balakrishnan and, more recently, B G Srinivas.

The three were once seen as top contenders to become the CEO of Infosys after incumbent S D Shibulal’s retirement by January next year. These exits, analysts believe, affected Infosys’ business.

. . .

The company also saw exits at the middle and junior levels which resulted in attrition rate rising to an all-time high of 18.1 per cent in January-March 2014.

While Murthy maintained most of the people who left the company were not contributing much, experts and analysts advised caution.

“We have always maintained that an individual person or personality cannot pull Infosys out of its current situation. Unfortunately, that is the only thing that has been hyped and focused at,” Apte says.

“The recent exits have hit employees’ morale.

"A look at the attrition numbers shows this.

"Uncertainty always makes employees nervous.

"Clients are more concerned about delivery and quality. Any delay in delivery will affect client confidence.

"And, with higher attrition, this becomes a concern.”

Another concern that continued to weigh on the minds of investors was the presence of Murthy’s son, Rohan, who had joined the company with him as his executive assistant.

Company observers continued to raise questions on Rohan Murty’s role and authority at Infosys, with several proxy advisory firms criticising the decision to bring him on board.

. . .

CEO crisis

As the top layer of leaders eroded and Shibulal announced his intention to hang up his boots by January, ahead of his scheduled superannuation in March 2015, immediate concerns about Infosys shifted from growth revival to finding an appropriate leader.

While many believe an obvious option was bringing in an effective outsider who could re-start Infosys’ engines and bring in some freshness, the fear for the company, known to give a fair chance to home-grown leaders, is exit of more leaders who could be eying an opportunity to perform.

“I still think it’s not too late. If a new leader is appointed soon and he is able to balance, Infosys can pull up,” Apte says.

“The biggest positive is that the company has been able to hold on to clients. None has so far divorced from the company. Infosys may not be growing as fast as a TCS or a Cognizant, but it still has clients.”

. . .

According to sources, the CEO search at Infosys has reached its final stage now.

The company has shortlisted a few insiders with the help of evaluation specialist Development Dimensions International and some outsiders with the assistance of multinational executive search firm Egon Zehnder.

Experts believe the company is likely to announce its next CEO within a few weeks.

“A lot hinges on this CEO selection; a wrong choice by the company can really turn investors away and lead everyone to lose hope of a revival,” says an analyst with a domestic brokerage house.

“The company should announce its next CEO within the next two weeks.

"I don’t think Murthy will delay the decision on this, as the tolerance level of investors and employees is very fragile at present.

"I think Murthy understands this.

"The market won’t accept a prolonged CEO search.”

. . .

Will he? Won’t he?

Experts believe Murthy needs to take some stronger decisions to meet the three-year target he has set for bringing Infosys back to industry-leading growth rates.

Most say the target might not be met if he continues with the performance he has shown in the past 12 months.

“With challenges like high attrition and a shift in client spending models, it doesn’t seem possible for Infosys to return to its earlier growth levels in the next two years,” says Manish Bahl, vice-president at Forrester Research.

“A lot will depend on Murthy’s next moves.

"If the company continues (with its revival plan) at the same pace, the target won’t be met. Murthy will have to take some bolder steps like acquisitions or de-centralisation of power.”

Value Leadership Group’s Schumacher also believes Murthy’s agenda is “too narrow and inward focused; it does not provide a compelling vision for the future”.

“As a company with the intent to lead the industry, Infosys must set goals that are broader and connect to the passions of its employees and customers,” Schumacher says.

Quoting from the letter that Murthy sent to Infosys employees asking them to “think big and act bolder”, Schumacher says, Murthy must change Infosys more fundamentally and “thinking bigger and acting more boldly may just be a starting point”.

. . .

LACKLUSTRE SECOND INNINGS?