The rupee is depreciating by the minute. In just the past few days it has slipped by over 4 per cent.

One significant factor that is increasing the demand for the dollar (which in turn has increased the value of the dollar and simultaneously depressed the value of the rupee) is the capital outflow caused by the exit of foreign institutional investor (FII) funds.

In this connection, Finance Minister Pranab Mukherjee observed that any intervention by the Reserve Bank of India would not effectively check the fall in the value of the rupee.

According to the finance minister, the demand for the dollar was triggered by the pullout by FII, triggered by global factors, from the Indian markets.

Rough estimates suggest that FIIs pulled out approximately $500 million since November 15, 2011 from India.

. . .

But who is actually pulling out from the Indian markets? While broadly categorizing the sellers as FIIs, one suspects that the Securities and Exchange Board of India cannot precisely answer that question. Neither can the RBI. Nor the Enforcement Directorate or, for that matter, the finance minister himself.

Why? The answer to the same is that the Indian stock markets have been peppered by a financial instrument called Participatory Notes.

It may be noted that as a subset of the policy on foreign direct investment, India allowed investments by foreign institutional investors (FIIs) directly into the stock markets, provided these FIIs register with Sebi and be subjected to its rules and regulations.

Participatory Notes (P-Notes) are derivative instruments issued by FIIs to foreign investors -- individuals or corporates -- who want exposure to Indian equities, but do not want to register with Sebi.

Thus, P-Notes are a contract between a foreign institution and a foreigner to invest into India. Needless to emphasize, the underlying securities of P-Notes are Indian stocks.

. . .

In contrast to the stringent Know Your Customer (KYC) norms laid out for resident Indians even for opening a bank account, the norms for P-Notes are relatively lax.

In fact, courts in India have held that there are virtually no KYC norms for P-Notes. That makes transactions relating to P-Notes incomprehensible.

The net result: Indian regulators do not know the names of such investors, or the origin or sources of such funds. Crucially, they can do precious little. No wonder, P-Notes are referred to also as Phantom Notes.

Indeterminate ownership

Given this background, the Union finance ministry had constituted a high-power committee, comprising senior officials and experts from the ministry as well as from Sebi and the Reserve Bank of India in 2005, to look into these issues.

The RBI, which was a part of this committee, was of the view that P-Notes should not be allowed. In a dissenting note to the expert group, it stated, "The Reserve Bank's stance has been that the issue of Participatory Notes should not be permitted. In this context, we would like to point out that the main concerns regarding issue of P-Notes are that the nature of the beneficial ownership or the identity of the investor will not be known, unlike in the case of FIIs registered with a financial regulator."

. . .

Further, the RBI apprehended that "trading of these P-Notes will lead to multi-layering, which will make it difficult to identify the ultimate holder of P-Notes. Both conceptually and in practice, restriction on suspicious flows enhance the reputation of markets and lead to healthy flows. We, therefore, reiterate that issuance of Participatory Notes should not be permitted."

Subsequently, the Tarapore Committee set up by the RBI in 2006 to recommend steps to usher in Capital Account Convertibility, reiterated its earlier views on banning P-Notes.

In this connection, this report observed, "In the case of Participatory Notes, the nature of the beneficial ownership or the identity is not known, unlike in the case of FIIs. The committee is, therefore, of the view that FIIs should be prohibited from investing fresh money raised through P-Notes. Existing P-Note holders may be provided an exit route and phased out completely within one year."

Yet P-Notes continue to dominate the Indian capital markets. But what is disturbing to note here is that despite repeated attempts by Sebi (as exemplified by several cases involving P-Notes), it has been unable to get the names of the ultimate beneficiaries of the P-Notes or determine their owners.

The net result is that even to this date, owners of P-Notes are suspected of playing ducks and drakes with the Indian capital markets.

. . .

What is appalling is that while there is capital inflow into the country on account of this dubious mechanism and its exit not only keeps the stock market on the boil, it also has the calculated effect of keeping the rupee volatile as much as keeping the macro-economy in a state of constant imbalance.

The crucial point to note here is that a mere exit of $500 million (when India has a forex reserve in excess of $300 billion!) is sufficient to dynamite the currency markets, cause a steep fall in the stock markets as it is being witnessed now, and possibly keep the money market on the boil in the coming days when interest rates could further harden.

Time to tackle the P-Notes monster

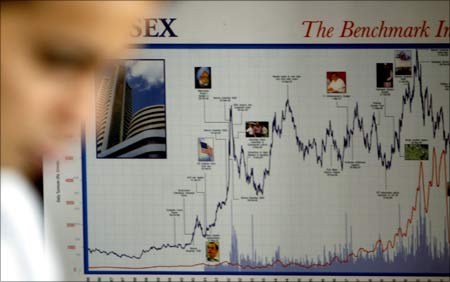

It may be recalled that all that is stated above is nothing unknown. P-Notes have been at the centre of any debate involving gyrations in the stock markets and their consequential impact on the national economy.

It may be recalled that Parliament was agitated over the extreme gyrations in the stock markets in 2001. Consequently, a Joint Parliamentary Committee was constituted to look into the matter.

One of the interesting findings of that JPC was with respect to P-Notes. According the JPC report, Sebi expressed suspicion that some of the Indian promoters have purchased shares of their own companies through P-Notes issued by sub-accounts of FIIs.

. . .

This mechanism enabled the holders to hide their identities and to transact in the Indian capital market. [Para 8.81 of the Report]

The crux of the argument against P-Notes is that these predominantly comprise round-tripping (which is used for tax evasion and money laundering) of the corrupt money of Indians, moved out first through the hawala route and laundered back into India, taking advantage of the tax-breaks provided by the Indo-Mauritius DTAA.

That was in 2001. A decade later not much has changed in our stock markets. As pointed out above, a mere $500 million FII-pullout is enough to dynamite our economy.

What is indeed hurting the ordinary Indian is that with every pullout of a dollar by the FIIs (possibly P-Notes), the rupee depreciates. And with the depreciation of the rupee, the fuel bill of an average Indian soars.

Assuming for a moment that these are legitimate investors, one can rationalise these developments as market-related ones.

. . .

However, what if such sales in the stock markets are effectuated by P-Note holders who are not favourably disposed to our national interest?

In the alternative they could well be some of our own who have parked their illegitimate wealth in the Indian market through the P-Note route.

What if the Chinese have parked a few billions in our markets out of their $3 trillion forex reserves using the P-Note route and attempt to pull out all of a sudden?

Crucially, in all these cases when the ownership of P-Notes is itself indeterminate, how can Sebi or RBI identify them, much less regulate them?

And all these make P-Notes a stock market escalator, or security risk or an economic disaster; probably all.

. . .

Naturally, the latest exit of a mere $500 million (0.16% of our forex reserves) and its impact on the Indian economy demonstrates the need to monitor the entry and exit of P-Notes.

With Sebi reluctant and the finance ministry unwilling to ban P-Notes, it interesting to note that P-Notes is one instrument that unites the usually warring political class!

Ideally, with the markets low and global confidence wavering, it is appropriate to get rid of the monkey on our back and take the bull by its horns.

It is time to neutralise the debilitating impact of P-Notes by banning fresh issue of P-Notes. As far as existing P-Notes are concerned, one way out would be to reopen the income-tax assessment of FIIs.

Under the extant law of the land any FII can be subjected to reassessment for assessment years beginning 2005-06. Under this process, the FII must be asked to provide the ownership details of all P-Notes issued by them and 'exited' Indian markets till date.

. . .

In case they fail to provide details of the ownership of P-Notes, the said amounts must be taxed as 'unexplained credit' in the hands of the FII.

It is pertinent to note that such details need be strategically sought only in cases of those P-Notes that have 'exited' the Indian markets, not otherwise. Those who stay invested may be allowed to do so.

While one is not sure whether such a move would inhibit further pullouts, the fact remains that this is an opportune moment to get at P-Notes!

Of course, we can tackle the morality issue later during better times.

Tackling P-Notes is a small yet effective step in curbing black money, money laundering, and restoring order into our capital markets. Else with each passing day, the Indian economy will be controlled by phantoms -- the ultimate owners of P-Notes!

The author is a Chennai-based chartered accountant. Comments can be sent to mrv@mrv.net.in