Photographs: Keith Bedford/Getty Images

Business Standard presents expert views on what changes can help improve the prospects of various asset classes.

Needed: Higher tax slab rates: Vikas Vasal

First, the tax slab rates need revision. The basic income threshold of Rs 2 lakh, above which the tax liability gets triggered, is quite low and should be revised to Rs 3 lakh.

Similarly, other slab rates should also be revised to leave more money in the hands of the households.

Second, increase the annual tax deduction of Rs 1 lakh to Rs 3 lakh. This popular deduction of Rs 1 lakh for various investments/expenses, like PF, PPF, and insurance premium, etc has not kept pace with the rising inflation.

It is pertinent to note that this deduction helps people in taking investment decisions and encourages them to save for their long-term requirements.

Third, deduction for interest on housing loan for a self-occupied house property currently capped at Rs 1.5 lakh should be revised in line with the rising housing costs and interest rates.

Besides, being a good investment, a house also provides emotional and psychological comfort to a family. Therefore, this deduction should be doubled.

Fourth, various other deductions/exemptions like benefit for medical expense reimbursement of Rs 15,000 per year, conveyance allowance of Rs 800 a month. have outlived their utility.

These benefits should either be enhanced substantially in line with the current economic reality or scrapped altogether and instead clubbed in the form of a standard deduction / allowance to make it a more meaningful benefit.

Fifth, widen the tax base. Currently, only a very small percentage of the population of our country pays income tax and files tax returns. The government should take steps to widen the tax net and thereby reduce the effective tax rate for all the individuals.

Vikas Vasal

Partner-Tax, KPMG

…

Money matters: 5 key areas that Modi can bring big changes

Photographs: Reuters

Real estate prices to see movement: Sanjay Dutt

Prices in real estate would see movement after the new government comes to power.

Developed areas with presence of sufficient physical and social infrastructure, where prices have remained stagnant over the past few quarters, would be the first to witness price increases.

Some correction can be expected in peripheral sub-markets that are oversupplied. The actual change would be more dependent on the local supply-demand dynamics of sub-markets in each city and the policy implementation or changes made by each state.

Developers should get faster approvals, which results in faster completion of projects and lower cost of construction, the benefits of which should be passed to the end-users. This will create more supply and home buyers will get more options to choose from, stabilising home prices.

The prices in real estate cannot be sustained for longer periods without the participation of end-users, as investors need to finally offload their units to realise gains.

Improving of investor sentiment to attract large-scale investments is imperative in boosting the growth of the real estate sector.

Specific to the latter is fast-track implementation of pending Bills such as the SEBI (Real Estate Investment Trusts) Regulations, 2013, and Real Estate (Regulation and Development) Bill, 2013. And, further relaxing the investment norms for foreign direct investment in the sector will create a positive environment.

Also, providing it the status of an 'industry' would be a big step. These would go a long way in providing necessary access to cheaper funding for the sector and help in bringing down the overall costs.

Which, in turn would make real estate assets, especially housing, cheaper for the masses.

Sanjay Dutt

Managing Director- South Asia, Cushman & Wakefield

…

Money matters: 5 key areas that Modi can bring big changes

Photographs: Reuters

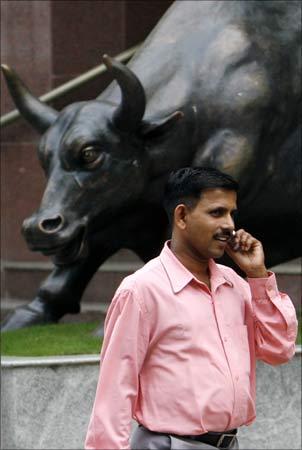

Equity investors will view India favourably: Nilesh Shah

Retail investor is hugely underinvested in equities. Equities have outperformed gold, real estate and fixed income in the past year. It is likely that outperformance will continue in the medium term.

Global investors will view India favourably as its investment is likely to pick up, growth rate is likely to improve, currency is likely to appreciate (albeit for short term) and interest rates are likely to come down.

Within the peer groups China is suffering from credit bubble, Brazil is having weak macros and Russia is pariah due to Ukraine crisis. Equity market will now run on both the legs of FII as well as domestic flows.

In the medium term, value style is likely to outperform growth style, small and mid-caps are likely to outperform large caps, cyclical, engineering and infrastructure sector is likely to outperform market.

PSUs and PSU banks are likely to outperform due to cheap valuations and growth revival. Consumer staple, IT and healthcare sector is likely to underperform the market.

The market is unlikely to have a unidirectional move. However now it is a 'buy on dip' market.

For retail investor it will be appropriate to enter via mutual funds on a systematic investment basis. There will be many opportunities in the primary market as well over medium term.

Sensex has made a top once every eight years. In 1992, 2000 and 2008, Sensex made a top. May be the new top will be in 2016. Hopefully reader will be participating in this.

Nilesh Shah

Managing Director & CEO, Axis Direct

…

Money matters: 5 key areas that Modi can bring big changes

Photographs: Reuters

Lock into long-term fixed income assets: Ajay Bagga

As Milton Friedman said, "Inflation is taxation without legislation." Indian savers were the worst hit, with negative real returns .Investors, hence, moved to real assets to protect their real returns and the share of savings going into financial assets fell.

RBI wisely moved to protect savers with sharp rate increases that have brought back investors into financial assets. We expect rates in India to stay elevated for the next six to 12 months, given the challenges facing both the new government and RBI.

The fiscal deficit, threat of a poor monsoon and poor revenue inflows will not give the government much flexibility in the near term.

Investors should use this opportunity to lock into long-term fixed income assets. New products like REITs (real estate investment trusts) will also be introduced as these get approved and can be invested in.

We recommend investors to lock into short-term debt mutual funds, fixed maturity plans and tax-free bonds of strong public sector units. In terms of tenure, we would recommend staying at the shorter end, in short-term debt funds, and to avoid exposure to long-term income and gilt funds as the inflationary headwinds are still strong.

There is an old saying, "The bond market is smarter than the stock market." As the Indian stock markets have rallied more than 25 per cent from September 2013, the retail investor has steadfastly stayed away and even sold into the rally.

At present, we think stocks have run away in bullish sentiment, while the interest rate curve and bond yields are more conservatively measured in their reaction.

Ajay Bagga

Market Expert

…

Money matters: 5 key areas that Modi can bring big changes

Photographs: Reuters

New govt to have no effect on gold prices: Kishore Narne

The new government at the Centre will not make any difference to domestic gold prices, since factors like an improvement in the current account deficit and reduction in import duty have already been factored in.

The Reserve Bank of India (RBI) had indicated it would relax gold import rules in the next two to three months. There will be further pressure on gold prices from a stronger rupee, in the wake of a stable government.

So, investors wishing to make lump sum investments in physical gold should wait till prices come down. Gold prices could fall to Rs 24,000-24,5000 (per 10g) by December, from the current Rs 29,250.

The question is when the new government will reduce the import duty and by how much. For the new government, this will not be a priority area. So, use this opportunity to hedge any investments you already hold.

Hence, it is not a good time to make fresh investments in physical gold. However, investors who already have gold holdings can use this opportunity to reduce the inventory or hedge their positions using futures.

Investors must remember that any upside in gold prices are likely to be limited. Internationally, too, gold prices are likely to remain under pressure.

The US is expected to start reversing interest rates in mid-2015. Coupled with the drying of excess liquidity, that will put pressure on gold prices.

Kishore Narne is Associate Director & Head - Commodity & Currency, Motilal Oswal Commodity Broker.

(The views are personal and do not represent those of the organization)

article