As a small investor, the rules suggest that you must invest in stocks with a long term view of five to eight years and diversify portfolio with debt and gold.

Legendary investors, however, have their own style and timeline. While some prefer to hold investments for indefinite period other would sell at a good profit.

All of them, however, researched their companies well, didn’t believe in the market chatter and advise to stay invested for long term.

Let’s take a look at 15 top stock investors and the nugget of wisdom they have shared about investing.

Please click NEXT to continue reading…

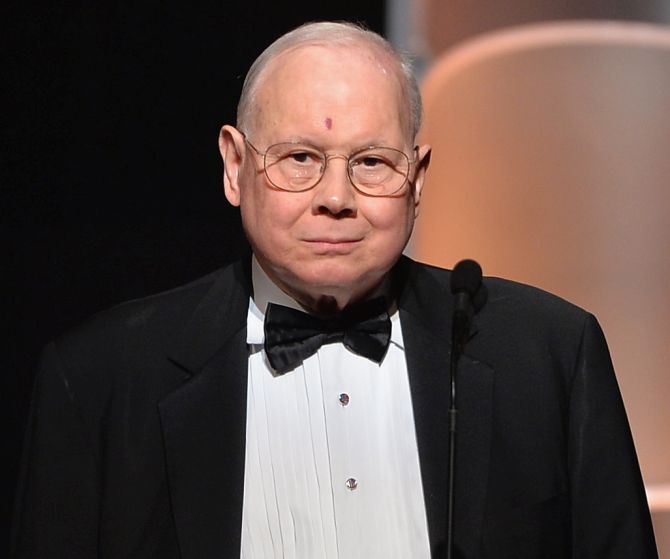

Jack (John) Bogle

Who is he: Founder and retired CEO of The Vanguard Group

Investment strategy: Invest in low cost index funds and hold them for long

Quote: “Over the long-term, the miracle of compounding returns is overwhelmed by the tyranny of compounding cost”

His idea was that investors should invest in mutual funds that charge the lowest possible fees, which is possible in an index fund. He showed how a 2 per cent annual fee can eat away into your returns.

This idea became so popular that The Vanguard Group is now the world's largest mutual fund family, with $2.6 trillion under management, according to Forbes.

Please click NEXT to continue reading…

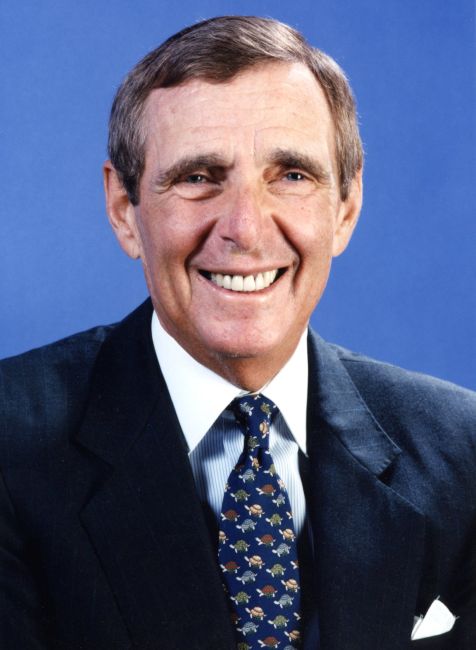

John Templeton

Who is he: A legendary investor and mutual fund pioneer

Investment strategy: He is a legendary stock investor who believed in buying at a low price and selling at a high

Quote: "If you buy the same securities everyone else is buying, you will have the same results as everyone else"

Templeton became a billionaire by pioneering the use of globally diversified mutual funds. His Templeton Growth Fund was among the first which invested in Japan in the middle of the 1960s and reap the benefit on the country’s astronomical economic rise.

Please click NEXT to continue reading…

Warren Buffett

Who is he: The most successful investor of our time, he is chairman and CEO of Berkshire Hathaway

Investment strategy: He is a value investor that buys stocks at a low price and holds them for a indefinite period

Quote: “Whether we’re talking about socks or stocks, I like buying quality merchandise when it is marked down”

He only invests in business that he understands and this made him stay away from dot com companies that went bust in the year 2000.

Please click NEXT to continue reading…

Peter Lynch

Who is he: He was the star manager of Fidelity Investments and author of several books on investment such as ‘Invest in what you know’ and ‘One Up On Wall Street’.

Investment strategy: Take your time to identify exceptional companies.

Quote: “Everyone has the brainpower to follow the stock market. If you made it through fifth grade math, you can do it”

Just like Warren Buffett, Lynch always stuck to companies that he can understand. He didn’t believe in following the herd and famously acknowledge that it’s futile to predict the economy and interest rates.

Please click NEXT to continue reading…

David Dreman

Who is he: He is a famous investor that has written books such as ‘Contrarian Investment Strategy: The Psychology of Stock Market Success’

Investment strategy: He believed in taking contrarian calls

Quote: "If you have good stocks and you really know them, you'll make money if you're patient over three years or more"

He buys stocks that have a low price-earnings ratios, low price-to-book value ratios and higher than average yield. He believed that this stock picking technique can outperform the markets always.

Please click NEXT to continue reading…

Philip Fisher

Who is he: He is an extraordinary stock investor who helped clients make better returns than markets through his firm Fisher & Co.

Investment strategy: In his book ‘Common Stocks and Uncommon Profits’, Fisher said that the best time to sell a stock was ‘almost never’.

Quote: “(When a) stock rises to, say, 50 or 60 or 70, per cent, the urge to sell and take a profit now that the stock is ‘high’ becomes irresistible to many people. Giving in to this urge can be very costly”

He believed that investors should invest in few great stocks rather than holding a portfolio of many. And, stay with them without bothering the new highs the stock makes. One of his followers is Warren Buffett.

Please click NEXT to continue reading…

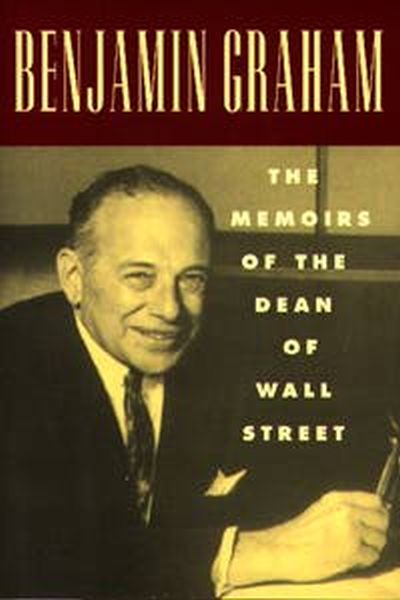

Benjamin Graham

Who is he: He was a professional investor that influenced mind of people such as Warren Buffett and Irving Kahn. He if often addressed as the father of value investing.

Investment strategy: He sought companies with strong balance sheets, with little debt, above-average profit margins, and ample cash flow, according to Investopedia. The website also add that it’s not possible to summarise his investment style to few words. Readers should refer to his books to gain further insights.

Quote: “If you are shopping for common stocks, choose them the way you would buy groceries, not the way you would buy perfume”

It wouldn’t be an exaggeration to say that modern value investing borrows many principles of Graham’s investment style such as analysing company, avoiding speculation, adjusting portfolio regularly, and keeping a margin-of-safety.

Please click NEXT to continue reading…

William (Bill) Gross

Who is he: Co-founder of Pacific Investment Management (PIMCO). The New York Times called him the nation's most prominent bond investor

Investment strategy: He believes in investing for long term, maintaining asset allocation and keeping investment costs low

Quote: "Finding the best person or the best organisation to invest your money is one of the most important financial decisions you'll ever make"

PIMCO has been the world's largest fixed-income management firm for many years. He believes that investors need to be disciple and should not give into fear and greed.

Please click NEXT to continue reading…

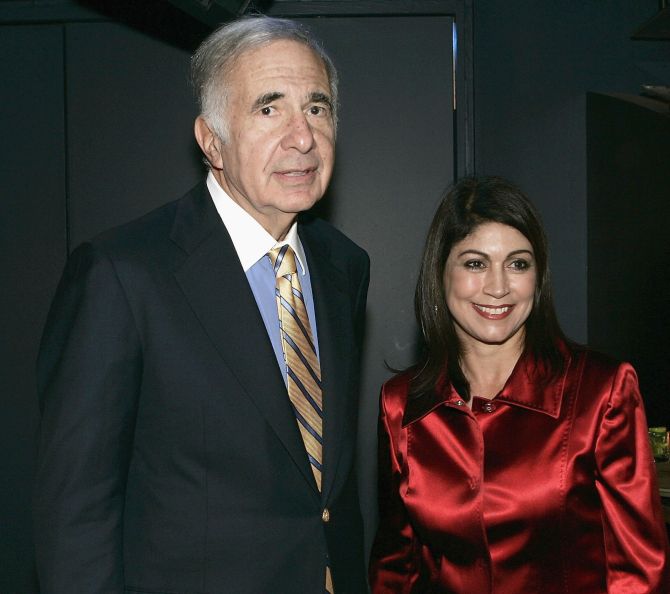

Carl Icahn

Who is he: He is the chairman of Icahn Enterprises, which holds stakes in multiple businesses. He is also an activist investors and was in the news for asking Apple to buyback its shares to boost stock price

Investment strategy: He targets companies that are poorly run and stock price is below the real value. He then starts buying into them and garner enough shares to get on their board.

Quote: “The cardinal rule is to have enough capital at the end of the day”

Most of the time when Icahn took on a company management, he won and shareholders benefitted tremendously. Many shareholders even call him Robin Hood.

Please click NEXT to continue reading…

Jesse L. Livermore

Who is he: A legendary investor, he was called as the Bear of Wall Street

Investment strategy: A speculator, he made buying decision based on the direction of the market and not just of a single stock

Quote: “Never buy a stock because it has had a big decline from its previous high”

He also never believed in insider information. He thought that if there was easy money lying around, no one would be forcing it into your pocket.

Please click NEXT to continue reading…

Bill Miller

Who is he: Investment wizard Miller is the former Chairman and Chief Investment Officer of the famous Legg Mason Capital Management

Investment strategy: He received accolades for his distinct style, which focused on a detailed understanding of businesses and their intrinsic value.

Quote: "I often remind our analysts that 100 per cent of the information you have about a company represents the past, and 100 per cent of a stock's valuation depends on the future."

Bill Miller is a self-described value investor, but his definition of value investing is somewhat disconcerting to some traditional value investors, according to Investopedia. Miller believes that any stock can be a value stock if it trades at a discount to its intrinsic value.

Please click NEXT to continue reading…

John Neff

Who is he: He is one of the best known mutual fund managers who have consistently managed to beat the benchmark

Investment strategy: He refers to his investing style as a low price-to-earnings (P/E) methodology, though others consider Neff a variation of the standard value investor, according to Wikipedia.

Quote: "Successful stocks don't tell you when to sell. When you feel like bragging, it's probably time to sell"

He used to buy stocks on bad news when the stock had taken a beating. To take exposure to a hot stock, which had expensive valuation, Neff would buy companies connected to it – for example, its main supplier of raw materials.

Please click NEXT to continue reading…

William J. O'Neil

Who is he: He wore many hats including founder of business newspaper Investor's Business Daily and of the stock brokerage firm William O'Neil & Co. Inc. He is also an author of several books on investing

Investment strategy: He is the inventor of the growth stock investing

Quote: "The whole secret to winning and losing in the stock market is to lose the least amount possible when you're not right."

He believed in holding on to the strong stocks and selling off the weak ones. His investment style is often called as CAN SLIM. This is a seven point checklist before investing in a growth stock. This strategy helps to discover leading stocks before they make major price advances.

Please click NEXT to continue reading…

Thomas Rowe Price, Jr.

Who is he: Founder of investment firm T. Rowe Price

Investment strategy: Price is best known for developing the growth stock style of investing, and is known as ‘the father of growth investing’

Quote: "No one can see ahead three years, let alone five or ten. Competition, new inventions - all kinds of things - can change the situation in twelve months"

He believed that investors can invest in high growth companies that can outgrow inflation and economy. At the same time, investor should diversify to reduce the risk. He, therefore, looked for companies that were present in niche areas where competition was not intense, labour cost was low and the government has not regulated the sector too much.

Please click NEXT to continue reading…

James D. Slater

Who is he: He donned many hats and started as a chartered accountant for Leyland Motors. Then he co-founded Slater Walker Securities and later started Galahad Gold. He has even authored several books that are considered as Bibles for investors

Investment strategy: He used price-earnings to growth ratio (PEG) to find companies that are small and had potential to grow big

Quote: "Most leading brokers cannot spare the time and money to research smaller stocks. You are therefore more likely to find a bargain in this relatively under-exploited area of the stock market"

His stock picking strategy is well-explained in his book The Zulu Principle.